Divorce Preparation Tips for Women

Catalog

Build a reliable circle of support through personal connections and community involvement.

Take control of your financial situation with thorough planning and expert guidance.

Arm yourself with legal knowledge to safeguard your interests during proceedings.

Make personal well-being a non-negotiable priority throughout the process.

Develop personalized strategies to manage fluctuating emotions effectively.

1. Build Your Support Network

1. Identify Your Core Support Team

- Pinpoint friends and relatives who consistently show up for you emotionally

- Explore professional support options like counseling services

- Connect with local divorce support groups for shared experiences

Discovering your true support system acts like an emotional safety net during divorce chaos. Those friends who've stuck by you through thick and thin become priceless anchors. Their steady presence helps stabilize the emotional turbulence that often accompanies major life changes.

Mental health specialists bring more than just a listening ear - they offer concrete tools for managing the psychological whirlwind. Investing in professional guidance isn't weakness; it's strategic self-preservation during this vulnerable phase.

2. Cultivate Community Connections

Building local support networks provides tangible assistance with daily challenges. Identify neighbors who can help with school runs or grocery shopping during particularly rough weeks. These practical lifelines become especially crucial when dealing with legal appointments or childcare logistics.

Local hobby groups serve dual purposes - they distract from stress while rebuilding social confidence. Whether it's pottery workshops or hiking clubs, shared activities create natural bonding opportunities that combat isolation.

3. Leverage Digital Support Systems

Online communities offer 24/7 access to global perspectives on divorce recovery. Anonymous forums allow raw emotional expression without judgment, while specialized groups provide targeted advice for issues like co-parenting or asset division.

Reputable websites act as virtual legal clinics, offering free resources about rights and procedures. Knowledge truly becomes power when navigating complex divorce negotiations. Many law firms now host live Q&A sessions, bringing expert advice directly to your screen.

2. Financial Preparedness Strategies

Current Financial Assessment

Start by creating a financial snapshot - gather every bank statement, loan document, and credit card bill. This reality check forms the foundation for all future planning. Many are shocked to discover hidden accounts or debts during this process.

Separate marital assets from personal property with forensic precision. Jewelry from your grandmother? The cabin purchased before marriage? Document everything with dates and paper trails.

Post-Divorce Budget Blueprint

Crafting a survival budget requires brutal honesty. Factor in potential lifestyle changes - maybe private school becomes public, or weekly spa visits turn monthly. Always include a contingency fund for unexpected expenses like car repairs or medical bills.

Expert Financial Guidance

A divorce-savvy financial planner becomes your monetary bodyguard. They'll explain how splitting retirement accounts affects future plans, or whether keeping the house makes financial sense long-term. Their projections help avoid costly emotional decisions.

Legal Financial Responsibilities

State laws dramatically impact financial outcomes. Community property states split assets 50/50, while equitable distribution states consider various factors. Misunderstanding these differences can lead to disastrous financial consequences.

Credit Protection Tactics

Freeze joint credit lines immediately to prevent surprise debts. Start building individual credit history with secured cards if necessary. Regular credit monitoring becomes essential - one missed payment on a joint account can haunt you for years.

Long-Term Financial Vision

Rebuild financial confidence by setting achievable milestones. Maybe it's saving $500 monthly or increasing retirement contributions by 2%. Celebrate each small victory - these wins create momentum for bigger financial goals.

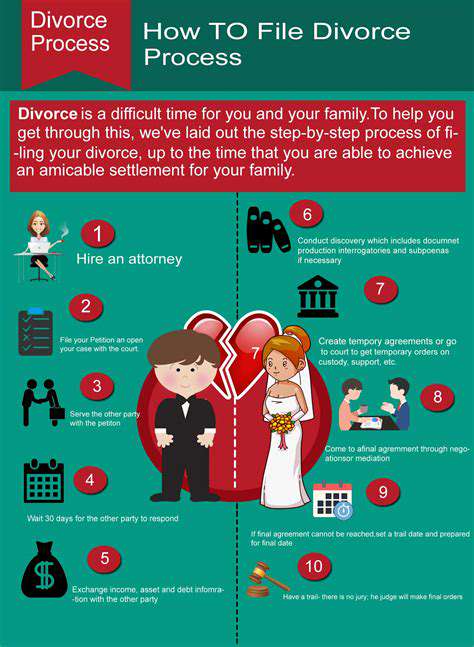

3. Legal Rights Awareness

State-Specific Legal Literacy

Your zip code dramatically impacts divorce outcomes. Some states mandate separation periods, others allow immediate filings. Local law libraries often offer free access to legal databases - use them to research your specific rights.

Court websites frequently post instructional videos explaining procedures. Many bar associations host free clinics where attorneys answer basic questions - perfect for initial orientation.

Proactive Legal Protection

Create a divorce binder with tabs for financial records, communication logs, and custody notes. This organized approach strengthens your position during negotiations. Always communicate through documented channels - sudden forgetfulness about agreements is common.

If children are involved, start a parenting journal tracking caregiving responsibilities. This evidence can be crucial for custody determinations. Consider consulting a child specialist to advocate for your kids' best interests.

4. Non-Negotiable Self-Care

Holistic Wellness Approach

Divorce stress manifests physically through insomnia or appetite changes. Combat this with scheduled recharge blocks - 20-minute power naps or lunchtime walks. Nutritional adjustments help too; omega-3 rich foods fight depression while complex carbs stabilize mood swings.

Customized Care Routines

Develop morning and evening rituals that anchor your day. Maybe it's lemon water and stretching upon waking, followed by gratitude journaling before bed. These small acts create stability amidst the chaos.

Therapeutic Interventions

Alternative therapies like EMDR or art therapy can process trauma that talk therapy can't reach. Many insurance plans now cover acupuncture - excellent for stress relief. Always verify credentials when trying new modalities.

5. Emotional Management Toolkit

Emotional Pattern Recognition

Track mood swings in a dedicated journal. Note triggers like specific dates or interactions. Over time, patterns emerge allowing proactive management. Color-coding entries (blue for sadness, red for anger) creates visual progress tracking.

Resilience-Building Exercises

Practice emotional fire drills - mentally rehearse stressful scenarios with calm responses. Gradually increase exposure to triggering situations, building tolerance like muscle memory.

Future-Focused Planning

Create a life after divorce vision board. Include career goals, travel plans, and personal growth objectives. This forward focus prevents stagnation in past disappointments.

Read more about Divorce Preparation Tips for Women

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases