Asset Division Tips for Divorce Cases

Negotiation and Mediation Strategies for Asset Division

Understanding the Importance of Negotiation

Skillful negotiation during asset division can transform a contentious separation into a collaborative process. Partners who articulate their concerns clearly while remaining open to compromise often achieve more satisfactory outcomes. Rather than viewing assets as mere financial items, recognizing their emotional significance helps create solutions that respect both parties' needs. Unlike courtroom battles that drain resources, this approach preserves relationships and reduces stress.

The negotiation table becomes a space for uncovering shared priorities. When ex-partners listen actively to each other's valuation perspectives, surprising areas of agreement often emerge. This mutual understanding forms the foundation for crafting personalized arrangements that standard legal judgments cannot provide.

Mediation as a Constructive Alternative

Professional mediation introduces an impartial perspective that can break deadlocks. The mediator's expertise in conflict resolution helps reframe disputes as shared problems to solve rather than battles to win. This process frequently reveals innovative solutions that satisfy both parties' core needs without requiring concessions.

The private nature of mediation sessions encourages honest discussion of sensitive matters. For co-parents or business partners maintaining post-divorce relationships, this confidentiality proves invaluable. Without courtroom formalities, participants can explore unconventional arrangements that better reflect their unique circumstances.

Identifying and Valuing Assets

A meticulous asset inventory forms the bedrock of fair division. Beyond obvious items like homes and vehicles, overlooking digital assets, loyalty points, or collectibles can create significant inequities. Professional appraisals become particularly crucial for items with subjective value, such as artwork or family heirlooms.

Market conditions dramatically affect asset valuations. A residential property's worth might fluctuate based on neighborhood developments, while investment portfolios require analysis of current market trends. Tax implications and liquidity factors should also inform valuation discussions to prevent future financial surprises.

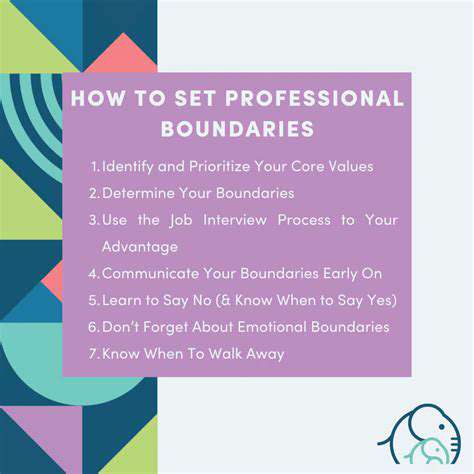

Developing a Strategy for Negotiation

Successful negotiators enter discussions with clear priorities and fallback positions. Creating a hierarchy of needs - separating must-haves from negotiable items - provides crucial flexibility during talks. Anticipating the other party's likely concerns allows for preparing reasoned counterproposals in advance.

Long-term consequences often outweigh immediate gains in divorce settlements. Keeping retirement security and future earning potential in perspective prevents shortsighted decisions. Scenario planning for various negotiation outcomes helps maintain objectivity when emotions run high.

Addressing Complex Assets

Business interests and investment portfolios demand specialized valuation approaches. Engaging forensic accountants can uncover hidden value or liabilities that affect equitable distribution. For family businesses, solutions might involve gradual buyouts or creative equity arrangements that preserve the enterprise while fairly compensating both parties.

Future management plans require detailed documentation. Whether dividing ownership or establishing operating agreements, clearly defining roles and decision-making processes prevents conflicts. Contingency plans for business valuation changes or partner disagreements provide necessary safeguards.

Understanding Legal Considerations

Jurisdictional variations in marital property laws significantly impact division outcomes. An attorney's guidance proves indispensable for navigating community property versus equitable distribution states. Legal professionals can also identify often-overlooked considerations like hidden assets or premarital property claims that might resurface years later.

Proper documentation protects against future disputes. From notarized agreements to court filings, ensuring all decisions meet legal requirements prevents challenges to the settlement's validity. Attorneys also advise on post-divorce asset protection strategies and necessary insurance safeguards.

Read more about Asset Division Tips for Divorce Cases

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

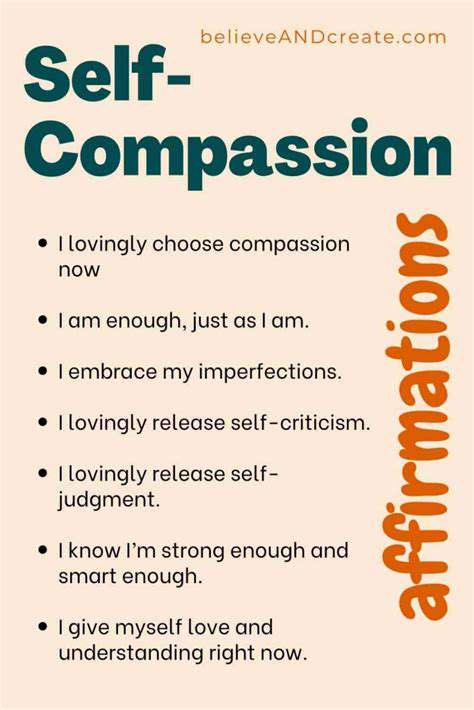

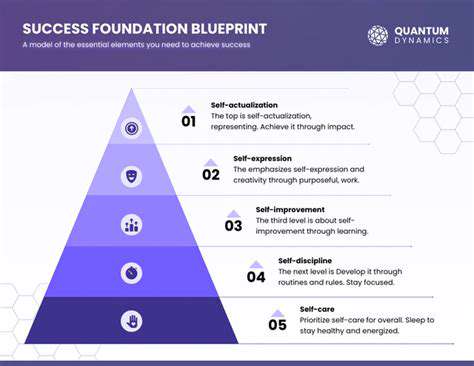

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases