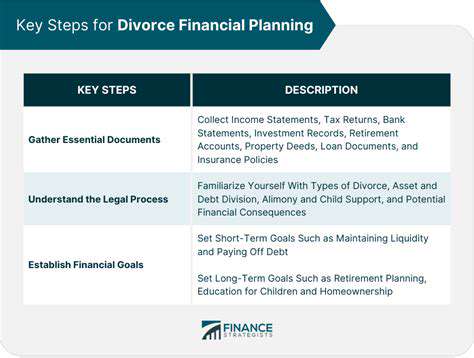

how to prepare financially for divorce

Assessing Your Current Financial Situation

Understanding Your Income and Expenses

A crucial first step in assessing your financial situation for divorce is a thorough understanding of your current income and expenses. This involves meticulously listing all sources of income, including salary, bonuses, investments, and any other regular or occasional income streams. Be precise and include all applicable deductions or taxes. Likewise, carefully document all your monthly expenses, from housing and utilities to groceries, transportation, and entertainment. Categorizing these expenses will help you identify areas where you might be able to cut back or consolidate in the future.

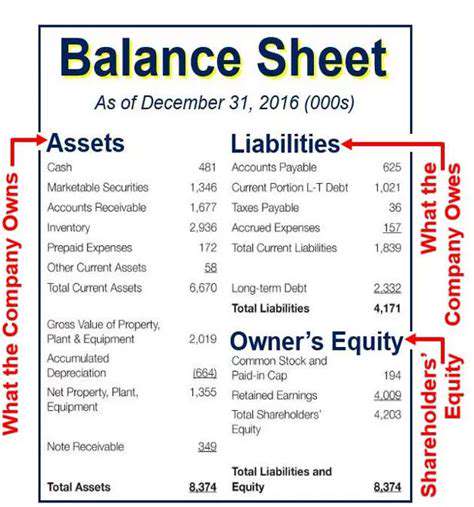

Evaluating Your Assets and Liabilities

Beyond income and expenses, you need to inventory your assets and liabilities. Assets include everything you own, such as your home, vehicles, bank accounts, investments, retirement funds, and personal belongings. Liabilities encompass any debts you owe, including mortgages, loans, credit card balances, and outstanding bills. Accurate documentation of these items is essential for a fair and equitable division of property during the divorce process. Detailed records will provide a clear picture of your overall financial position.

Analyzing Your Retirement Savings

Your retirement savings play a significant role in your long-term financial security. Understanding the value of your retirement accounts, including 401(k)s, IRAs, and pensions, is critical. Determining the current balance, potential withdrawal strategies, and any associated fees or penalties is important. This analysis will help you understand the impact of a divorce on your future financial well-being and potentially inform decisions regarding preserving and protecting these accounts.

Assessing Your Debt Burden

Evaluating the extent of your debt is vital. This includes not only high-interest debt like credit cards but also student loans, personal loans, and any other outstanding obligations. Understanding the interest rates, minimum payments, and potential penalties associated with each debt is crucial. This analysis will help you determine the impact of debt on your financial stability and guide strategies for managing or reducing debt during and after the divorce.

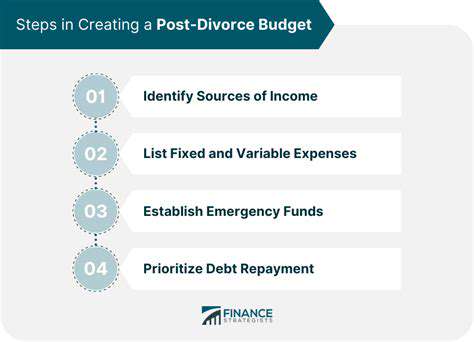

Considering Future Financial Needs

Divorce often necessitates a reassessment of your future financial needs. Factor in potential changes in living arrangements, childcare costs, and the need to establish a separate household budget. Considering these factors will help you formulate realistic financial goals and plans. It is important to consider both your short-term and long-term needs in light of the divorce. This proactive approach will help you prepare for the financial adjustments that lie ahead.

Evaluating Your Assets and Liabilities

Understanding Asset Valuation

Accurately assessing the value of your assets is crucial for a comprehensive financial picture. This involves considering various factors, including market conditions, current demand, and potential future growth. Proper valuation allows you to make informed decisions about investment strategies and overall financial health. A thorough evaluation helps in establishing a realistic financial position.

Different asset types require different valuation methods. Tangible assets like real estate and vehicles can be appraised by professionals, while intangible assets like intellectual property might need specialized valuation techniques. Taking the time to understand these diverse methods is essential to ensure a fair and accurate representation of your assets.

Categorizing Your Assets

Organizing your assets into distinct categories is vital for effective management. This allows you to track performance, anticipate potential risks, and tailor strategies for maximizing returns. Categorization enables a more strategic approach, helping you optimize your portfolio and allocate resources effectively.

Examples of asset categories include cash, investments, real estate, and personal property. Careful categorization helps you to understand your overall financial standing and identify potential areas for improvement.

Assessing Liabilities

Liabilities represent your financial obligations. Understanding the nature and extent of your liabilities is as important as understanding your assets. This includes debts like mortgages, loans, and credit card balances. A clear picture of your liabilities is essential for informed financial planning.

Analyzing your liabilities helps you understand your financial burden and potential for future debt accumulation. A thorough assessment of these obligations is key to developing a sound financial strategy.

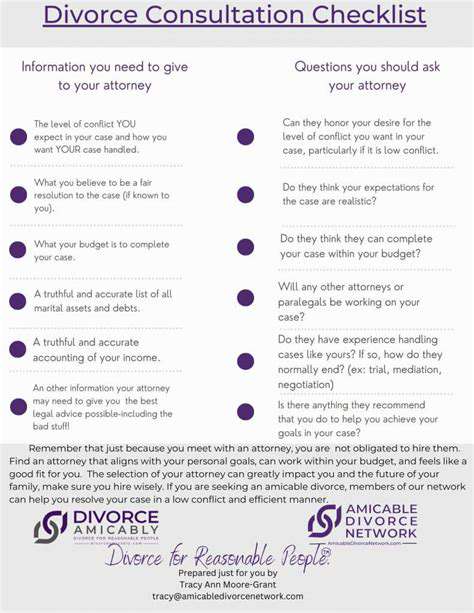

Developing a Financial Strategy

Once you've evaluated your assets and liabilities, you can develop a comprehensive financial strategy. This involves setting realistic goals, creating a budget, and identifying potential risks. A well-defined strategy allows you to effectively manage your finances and work towards your financial objectives. This is an important step in establishing long-term financial security.

Your strategy should incorporate steps for debt reduction, savings accumulation, and potential investment opportunities. A well-thought-out plan guides you towards achieving your financial goals.

Monitoring and Adjusting Your Plan

Your financial situation is constantly evolving. Regular monitoring and adjustments to your financial strategy are crucial to maintain stability and success. This involves tracking your progress, adapting to changing market conditions, and adjusting your approach as needed. Consistent monitoring ensures that your strategy remains relevant and effective over time.

This could involve re-evaluating your asset portfolio, adjusting your spending habits, or seeking professional advice when necessary. Flexibility and adaptability are essential for long-term financial well-being.

Read more about how to prepare financially for divorce

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases