Divorce Financial Planning and Mental Health

Understanding the Emotional Impact of Divorce

Divorce is often described as one of the most stressful life events, second only to the death of a loved one. Research indicates that individuals going through a divorce experience a range of emotions including grief, anxiety, and anger. A survey by the American Psychological Association found that 70% of individuals suffered from moderate to high levels of emotional distress during and after divorce proceedings.

It's crucial to recognize that these emotional responses are valid. They arise from the displacement of long-held life plans, financial uncertainty, and changes in familial responsibilities. Seeking professional mental health support can make a significant difference, as trained counselors can help individuals navigate this turbulent emotional landscape more effectively.

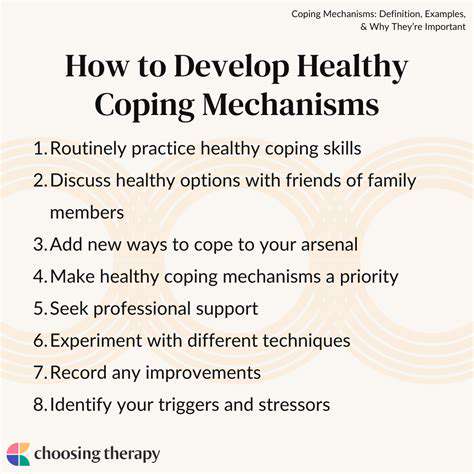

Effective Coping Strategies

When facing the multifaceted stressors of divorce, adopting Effective Coping Strategies can be beneficial. One approach is mindfulness, which promotes awareness of the present moment and can help reduce anxiety. According to a study published in the Journal of Marital and Family Therapy, practicing mindfulness can lessen emotional reactivity and enhance emotional regulation, a critical factor during such a tumultuous period.

Engaging in physical activities, such as regular exercise or yoga, is another strategy proven to boost mental health. Physical activity releases endorphins, the body's natural stress relievers. Aim for at least 30 minutes of moderate exercise several times a week to foster a sense of accomplishment and well-being.

The Importance of Social Support

No one should navigate divorce alone. Relying on friends and family for support can be essential during this difficult period. Close relationships often serve as a buffer against stress, allowing individuals to express their feelings freely and receive emotional comfort. According to research from the University of California, having a robust support system can reduce the risk of developing anxiety and depression, which are common during and after divorce.

Seeking Professional Help

While self-care strategies play a vital role, there are instances when professional guidance becomes necessary. Therapy can provide personalized strategies to cope with the emotional fallout of divorce. Cognitive-behavioral therapy (CBT) has been shown to be particularly effective, targeting negative thought patterns that can exacerbate feelings of hopelessness and despair.

Many divorcees report that group therapy sessions have also been beneficial. These settings allow individuals to connect with others undergoing similar experiences, fostering a sense of community and shared understanding. If you're feeling overwhelmed, don't hesitate to reach out to a mental health professional or join a support group dedicated to individuals navigating divorce. Remember, seeking help is a sign of strength, not weakness.

The Importance of Post-Divorce Financial Review

Understanding Post-Divorce Financial Challenges

Divorce can drastically alter your financial landscape. After the finalization of a divorce, individuals may face new financial obligations, including alimony, child support, and the division of assets. The reality is that many find themselves unprepared for this sudden change.

According to a study by the National Endowment for Financial Education, roughly 44% of divorcees reported feeling financially unprepared for life after separation. This lack of preparedness can lead to difficulties in budgeting, saving for retirement, and managing day-to-day expenses. Understanding these challenges is the first step toward effective financial management.

Assessing Your Current Financial Situation

A comprehensive Post-Divorce Financial Review begins with a clear assessment of your current situation. This includes compiling a list of assets and liabilities, examining income sources, and understanding expenses. Evaluating these factors helps set a foundation for future financial planning.

It's essential to gather all necessary documentation such as bank statements, credit card bills, and investment records to gain a complete picture. This process not only clarifies your financial state but also helps identify areas needing immediate attention. Tools like financial spreadsheets or dedicated apps can simplify this task.

Revisiting Your Financial Goals

Post-divorce life is an excellent opportunity to revisit and redefine your financial goals. Whether it’s saving for a house, funding your children's education, or planning for retirement, clear and achievable goals can guide your decision-making process. Setting timelines can also help prioritize these objectives and create a sense of direction.

Consider consulting a financial advisor to tailor an investment strategy that aligns with your new goals. This professional input can be invaluable, especially in navigating the complexities that arise after divorce. Additionally, regularly revisiting and adjusting these goals ensures they remain relevant as your circumstances change.

Creating a Sustainable Budget

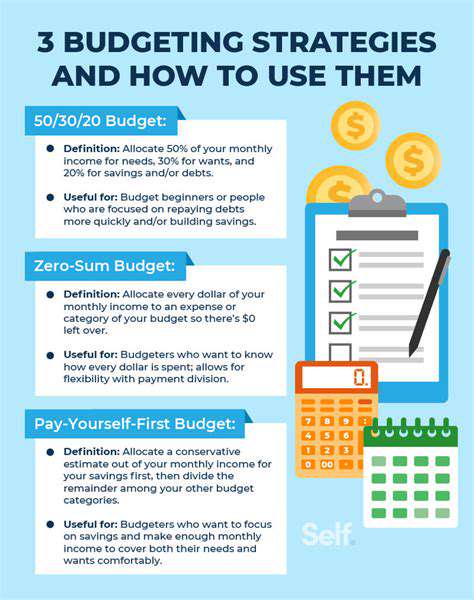

Following a divorce, many individuals find themselves needing to establish a new budget. Creating a Sustainable Budget requires careful analysis of income and expenses to determine an appropriate spending plan that accommodates your financial reality. Start by listing all sources of income, including salaries, alimony, and any side jobs.

Next, outline monthly expenses while differentiating between needs and wants. Consider adopting the 50/30/20 rule as a budgeting guideline, allocating 50% of income to necessities, 30% to discretionary expenses, and 20% to savings and debt repayment. This balanced approach can enhance financial stability and aid long-term planning.

Managing Debt Post-Divorce

Divorce often brings about a shift in debt responsibility. It is critical to understand which debts remain yours and how these will impact your financial health. This includes jointly held debts that may still require attention, even after the divorce is finalized. Ignoring these obligations can lead to adverse credit outcomes and financial strain.

Take proactive steps to establish a plan for managing existing debt. Consider consolidating high-interest debt into lower-rate loans, or negotiating with creditors to establish more manageable repayment terms. Furthermore, prioritizing payments on debts that could impact credit scores is essential to maintaining financial stability moving forward.

The Role of Professional Guidance

Professional guidance can play a pivotal role during this transitional phase. Whether consulting a financial advisor, a tax professional, or a divorce financial planner, accessing expert advice tailored to your specific circumstances can provide significant benefits. These professionals offer insight into tax implications following a divorce and can help strategize asset management.

Many individuals benefit from therapy or counseling as well, as financial stress often correlates with emotional well-being. Taking the initiative to seek help can empower you to regain control over your financial situation and foster resilience in the face of change.

Read more about Divorce Financial Planning and Mental Health

Hot Recommendations

- divorce legal consultation near me

- co parenting success after divorce

- preventing divorce cold violence methods

- co parenting advice for divorce families

- building resilience after divorce

- how to move forward confidently after divorce

- divorce recovery tips for single parents

- how to rebuild trust after divorce

- best divorce settlement resources online

- post divorce self improvement guide