how to move forward confidently after divorce

Understanding Your Current Financial Landscape

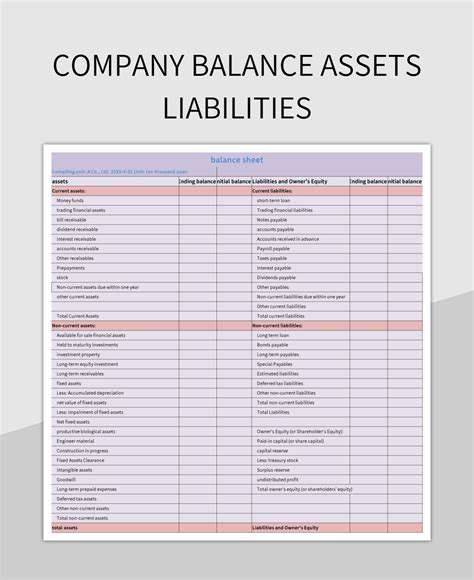

Assessing your current financial situation is crucial for establishing a solid foundation for future growth. This involves a comprehensive review of your income sources, expenses, assets, and debts. A detailed budget, outlining all income and expenditure, is essential for pinpointing areas where adjustments can be made. Identifying areas where you can reduce expenses and increase savings is a key first step towards rebuilding your financial health and setting yourself up for a more secure future.

Defining Your Financial Goals

Clearly defining your financial goals is paramount to creating a roadmap for success. Whether it's saving for a down payment on a house, paying off debt, or building an emergency fund, having specific, measurable, achievable, relevant, and time-bound (SMART) goals provides direction and motivation. Consider short-term goals, like paying off a credit card, alongside long-term goals, such as retirement planning. A well-defined set of goals allows you to prioritize your financial actions and stay focused on your desired outcomes.

Creating a Realistic Budget

A realistic budget is not just a list of numbers; it's a reflection of your financial lifestyle and priorities. It should consider all sources of income, including salary, investments, and any other income streams. Carefully categorize your expenses, differentiating between needs and wants. Consider using budgeting apps or spreadsheets to track your spending and identify areas where you can cut back or find ways to increase your income.

Managing and Eliminating Debt

Debt can be a significant obstacle to financial well-being. A crucial step in rebuilding your financial foundation is developing a strategy to manage and eliminate debt. Prioritize high-interest debts and explore options like debt consolidation or balance transfers to lower your monthly payments. Understanding different debt repayment strategies, such as the snowball or avalanche methods, can help you formulate a plan that aligns with your financial goals and capabilities.

Building an Emergency Fund

An emergency fund is a safety net for unexpected expenses, providing peace of mind and preventing financial hardship during unforeseen circumstances. Aim to build a fund that covers three to six months of living expenses. This fund should be easily accessible and kept separate from your regular savings. Consistent contributions, even small amounts, can significantly grow your emergency fund over time, providing a critical buffer against financial shocks.

Investing for the Future

Investing plays a vital role in building long-term wealth and achieving financial security. Explore different investment options, such as stocks, bonds, and mutual funds, to diversify your portfolio and potentially increase your returns. Understanding the risks and rewards associated with different investment vehicles is crucial for making informed decisions. Seek professional advice when necessary to create a personalized investment strategy that aligns with your risk tolerance and long-term goals.

Seeking Professional Guidance

Don't hesitate to seek professional guidance from financial advisors or counselors. Their expertise can provide valuable insights and support in navigating complex financial situations. A financial advisor can help you develop a personalized financial plan, assess your risk tolerance, and make informed investment decisions. Seeking professional guidance can be an invaluable asset in achieving your financial goals and building a secure future.

Embracing New Opportunities: Stepping into a Future of Possibilities

Identifying Your Aspiration

To effectively move forward, you first need to clearly define your aspirations. What excites you? What kind of future do you envision for yourself? This introspection is crucial, as it shapes the path you choose. It's not enough to simply react to circumstances; you must actively create a future that aligns with your values and goals. This initial step lays the foundation for all subsequent decisions.

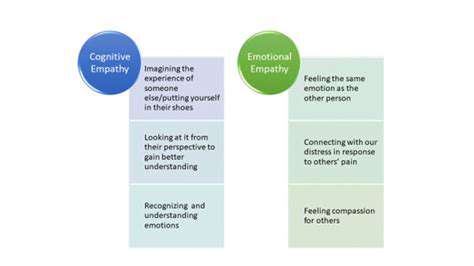

Consider your strengths, weaknesses, and interests. What are you naturally good at? What tasks do you find challenging but rewarding? Understanding these aspects will guide you toward opportunities that leverage your talents and allow you to develop new skills. This self-assessment will provide a clearer perspective on your potential and the type of environment that would best support your growth.

Assessing Current Circumstances

A realistic evaluation of your current situation is essential for planning your next steps. This includes acknowledging your current resources, both tangible and intangible. What financial, social, and emotional support systems are available to you? Are there any constraints or limitations that might hinder your progress? Understanding these factors will help you develop a plan that is both ambitious and achievable.

Don't shy away from difficult truths. Honest self-reflection is key. Accepting where you are currently positioned allows you to strategically plan for advancement without unrealistic expectations. This assessment provides a crucial baseline for measuring your progress and adjusting your approach as needed.

Developing a Strategic Plan

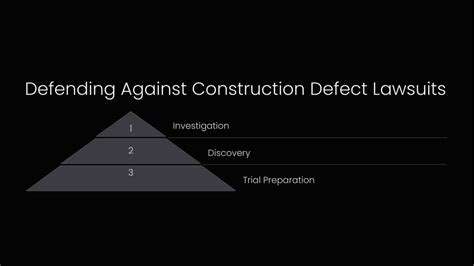

Once you've identified your aspirations and assessed your current circumstances, it's time to develop a comprehensive plan. This should outline the specific steps you need to take to achieve your goals. Break down large objectives into smaller, manageable tasks. This approach allows for better tracking of progress and provides a sense of accomplishment as you check off each milestone.

Consider potential roadblocks and develop contingency plans. Anticipating challenges and having backup strategies is crucial for maintaining momentum. This proactive approach ensures that you're prepared for any unexpected obstacles that may arise during your journey.

Seeking Mentorship and Support

Don't be afraid to seek guidance from others. Mentors, advisors, and supportive colleagues can provide invaluable insights and support. Learning from the experiences of others can significantly accelerate your progress. Actively seek out these relationships and leverage their expertise to navigate challenges and make informed decisions.

Building a network of supportive individuals is crucial for your journey. Connect with like-minded individuals who share your aspirations. A strong support system can provide encouragement, motivation, and a sounding board for your ideas.

Embracing Continuous Learning

The world is constantly evolving, and staying updated with new trends and knowledge is essential for success. Embrace lifelong learning by dedicating time to acquiring new skills and information. This commitment to continuous growth will ensure that you remain adaptable and competitive in the ever-changing landscape.

Explore opportunities for professional development, whether through workshops, courses, or online resources. This proactive approach to learning will equip you with the tools and knowledge necessary to thrive in your chosen field and adapt to future challenges. This ongoing commitment to learning will serve you well throughout your career.

Overcoming Obstacles and Maintaining Motivation

Expect setbacks. Obstacles are inevitable in any pursuit. Developing resilience is key for navigating these challenges. Learn from your mistakes, adjust your approach, and keep moving forward. Maintaining a positive mindset is essential for staying motivated and achieving your goals.

Celebrate your achievements, no matter how small. Recognizing and appreciating your progress will reinforce your motivation and keep you focused on your aspirations. Maintaining a growth mindset, embracing challenges, and acknowledging achievements will help you stay motivated throughout the process.

Read more about how to move forward confidently after divorce

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases