how to manage divorce financial challenges effectively

Understanding Your Income Sources

When evaluating your financial health, the initial task involves carefully monitoring every revenue stream. Beyond your primary paycheck, consider freelance gigs, investment returns, and occasional windfalls. Documenting these inflows with precision creates the bedrock for intelligent financial planning. By maintaining thorough records, you'll spot inconsistencies and opportunities to enhance your earning potential. This granular examination forms the cornerstone of any robust monetary strategy.

Organizing income by priority helps optimize fund allocation. Essential earnings that cover fixed costs like housing should be distinguished from discretionary income for savings or leisure. This classification process exposes financial weak points, particularly overdependence on a single source. Recognizing these vulnerabilities early enables the construction of a more flexible and durable economic framework.

Analyzing Your Expenses

Scrutinizing outflows demands equal attention to income analysis. Maintain a rigorous log of all expenditures - from housing costs to coffee purchases. This forensic approach illuminates spending patterns, revealing where adjustments could yield significant savings. Periodic reviews of these records help eliminate unnecessary costs and refine consumption habits.

Categorizing expenses (housing, food, transportation) highlights budget imbalances. You might uncover excessive restaurant spending that could be redirected toward home cooking. Such insights empower smarter spending decisions aligned with your financial aspirations.

Evaluating Your Existing Debt

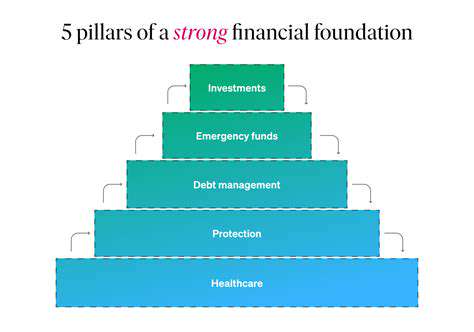

Modern financial life often includes various debts requiring careful management. Catalog all obligations - credit cards, loans, mortgages - noting interest rates and minimum payments. Calculating total interest costs paints the true picture of your debt burden, motivating more effective repayment strategies.

High-interest debts particularly erode financial health. Prioritizing these for accelerated repayment minimizes long-term costs, freeing resources for other goals. This strategic approach to debt management builds lasting economic stability.

Assessing Your Savings and Investments

A thorough financial review must examine reserve funds and investment vehicles. Evaluate all accounts (checking, savings, brokerage) considering risk profiles and projected returns. This assessment reveals security gaps in your financial position.

Investment diversification merits special attention. Proper asset allocation across different classes, matched to your risk tolerance, forms the foundation of sound wealth-building. Regular portfolio reviews ensure alignment with evolving financial objectives.

Identifying Your Financial Goals

Clear financial targets - from debt elimination to retirement planning - create purpose for monetary decisions. Articulating these ambitions ensures daily financial choices support long-term aspirations.

Ranking goals by urgency and importance enables effective resource distribution. Periodic progress reviews maintain motivation and course-correct when needed. This goal-oriented approach transforms abstract desires into achievable milestones.

Developing a Realistic Budget Post-Divorce

Understanding Your Income and Expenses

Post-divorce budgeting begins with meticulous financial tracking. Document all revenue sources, including secondary income streams. Precise income mapping forms the foundation for sustainable budgeting. Equally vital is expenditure tracking across all categories, from essentials to discretionary spending.

Detailed spending records expose patterns and potential excesses. This awareness enables informed decisions about resource allocation, ensuring funds support true priorities rather than habitual expenditures.

Setting Realistic Financial Goals

Effective budgeting requires defined objectives, whether eliminating debt or saving for major purchases. Clear targets provide direction and motivation for financial discipline. Without such markers, budgeting becomes an empty exercise rather than a strategic tool.

Align budget categories with prioritized goals. Debt reduction might command larger allocations, while other areas receive less. This intentional distribution creates visible progress toward financial aspirations. Remember to revisit and adjust targets as circumstances evolve.

Realistic timelines prevent frustration and abandonment of financial plans. Gradual, sustainable progress outperforms aggressive but short-lived efforts every time.

Creating and Implementing Your Budget

With income/expense clarity and defined goals, construct a budget reflecting actual financial behavior and aspirations. Allocate specific amounts to each spending category based on documented patterns rather than idealized scenarios.

Budget implementation requires regular performance reviews against projections. This ongoing refinement process ensures continued relevance and effectiveness of your financial plan. Scheduled check-ins maintain accountability while allowing necessary adjustments.

The most elegant budget fails without consistent execution. View your budget as a living document that evolves with your financial journey, not a rigid set of restrictions.

Managing Debt and Credit During Divorce Proceedings

Understanding the Impact of Divorce on Debt

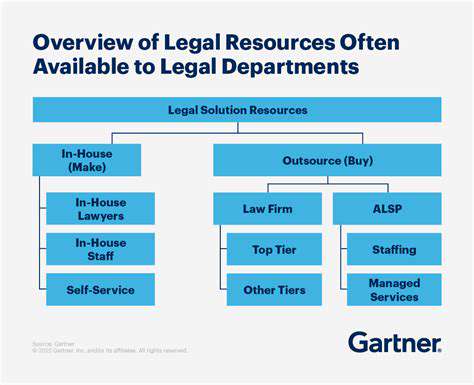

Divorce reshapes financial obligations, merging existing debts with new expenses. Catalog all liabilities - mortgages, credit cards, personal loans - and understand how they'll be addressed legally. Professional financial guidance during this transition safeguards long-term economic health.

Emotional stress often distorts financial judgment. However, neglecting debt issues risks credit damage and future hardship. Clear comprehension of debt division processes enables smoother financial transitions.

Strategies for Managing Existing Credit Accounts

Maintain impeccable records of all credit instruments during divorce. These documents prove invaluable for equitable debt allocation. Regular statement reviews and creditor communications can uncover adjustment opportunities to ease financial pressure.

Debt consolidation might offer relief through lower interest rates or simplified payments. Consult financial experts to evaluate if this strategy aligns with your specific situation and long-term objectives.

Planning for Future Financial Obligations

Divorce introduces new financial responsibilities - child support, alimony, property settlements. Proactive planning ensures these don't overwhelm your budget. Detailed financial projections and professional advice help navigate these changes successfully.

Beyond immediate concerns, consider long-term credit rebuilding and wealth accumulation strategies. A comprehensive financial plan addresses both present challenges and future security, creating stability in uncertain times.

True financial awareness begins with understanding how emotions influence monetary decisions. This self-knowledge transforms reactive spending into purposeful financial behavior. The process demands uncomfortable honesty about financial habits and priorities.

Navigating the Division of Assets and Liabilities in Divorce Settlements

Understanding the Basics of Asset Division

Asset division requires identifying all marital property, distinguishing it from pre-marital assets, and determining current values. Professional appraisals ensure accurate valuations for complex assets like real estate or businesses. This foundational work enables fair distribution negotiations.

Legal frameworks vary by jurisdiction - some mandate equal division, others equitable distribution based on multiple factors. Understanding these parameters is essential for informed decision-making during settlement discussions.

Identifying and Valuing Marital Assets

Comprehensive asset identification includes financial accounts, real property, vehicles, and retirement funds. Thorough documentation supports accurate valuation, often requiring professional assessments for precise market valuations.

Business interests and unique assets frequently need expert valuation to ensure equitable distribution. This meticulous approach prevents future disputes over asset values.

Addressing Liabilities and Debts

Debt division parallels asset distribution in divorce settlements. Catalog all obligations - credit cards, loans, mortgages - with equal thoroughness. Typically, liabilities are apportioned similarly to assets, ensuring balanced financial responsibility.

Debt allocation negotiations can become complex. Clear agreements about responsibility for specific debts prevent future confusion and protect both parties' credit standing.

Strategies for Negotiation and Settlement

Successful negotiations require open communication and compromise. Mediation often helps parties reach mutually acceptable solutions, while legal counsel ensures agreements comply with relevant laws.

Understanding legal parameters and potential consequences of various settlement options is crucial. Well-structured agreements minimize future conflicts and facilitate smoother post-divorce transitions.

Read more about how to manage divorce financial challenges effectively

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases