Divorce Preparation Tips for Men

Understanding Your Income

Taking stock of your earnings is the foundation of financial awareness. Beyond just your paycheck, consider all revenue streams—dividends from investments, gig economy work, or rental income. Maintaining meticulous records of every dollar earned paints the most accurate portrait of your financial situation. Recognizing which income sources are steady versus variable helps you prepare for lean months and capitalize on windfalls.

Organizing income by type creates clarity for budgeting. For instance, separating a biweekly salary from sporadic consulting fees allows for smarter cash flow management. This level of financial mindfulness builds resilience against economic uncertainties.

Evaluating Your Spending

Scrutinizing where your money goes reveals crucial spending patterns. Track everything from mortgage payments to coffee runs—no expense is too small to document. Grouping expenditures by category highlights potential budget leaks. Over time, these spending snapshots expose habits that might otherwise go unnoticed.

Whether using apps or old-fashioned spreadsheets, consistent expense tracking illuminates financial behaviors. Spotting unnecessary subscriptions or impulse purchases creates opportunities to redirect funds toward meaningful financial goals. This disciplined approach transforms spending from passive to purposeful.

Taking Stock of What You Own

Your net worth extends beyond bank balances—it's the sum total of everything you possess. From retirement accounts to family heirlooms, each asset contributes to your financial foundation. Cataloging your possessions with current valuations provides tangible evidence of your economic position. Understanding which assets could be quickly converted to cash during emergencies adds another layer of financial preparedness.

Different assets serve different purposes—some generate income while others appreciate over time. Recognizing these distinctions helps shape smarter investment strategies. Regular asset evaluations ensure your financial plans remain grounded in reality.

Navigating What You Owe

Debt represents both obligation and opportunity in personal finance. Mapping out all liabilities—from student loans to credit card balances—clarifies your true financial picture. Tackling high-interest obligations first can dramatically reduce long-term financial strain. Creating a structured repayment approach turns overwhelming debt into manageable milestones.

Monitoring debt-to-income ratios prevents overextension. Strategies like refinancing or targeted payoff methods can accelerate your journey to financial freedom. Viewing debt management as an ongoing process rather than a crisis fosters healthier money habits.

Building a Roadmap for Your Money

Financial clarity culminates in creating actionable plans. A living budget adapts to life's changes while keeping priorities in focus. Revisiting your financial blueprint quarterly ensures it evolves with your circumstances. This dynamic approach prevents budgets from becoming irrelevant or restrictive.

Comprehensive planning bridges today's decisions with tomorrow's aspirations. Whether saving for a home or planning retirement, specific targets with clear timelines transform wishes into achievable objectives. Consistent execution of these plans builds financial confidence and capability over time.

Safeguarding What Matters: Legal and Financial Protection

Fortifying Your Financial Future

Modern financial landscapes demand proactive defense strategies. Protecting wealth—whether liquid assets or tangible property—requires both vigilance and knowledge. Identifying vulnerabilities allows for targeted protective measures. A robust financial safety net doesn't happen by accident—it's built through deliberate planning and action.

Staying informed about financial risks and maintaining adaptable strategies creates stability in uncertain times. Thoughtful preparation turns potential crises into manageable situations.

Knowing What Your Assets Are Worth

Accurate valuations form the bedrock of asset protection. Regular appraisals of investments and property ensure financial decisions are data-driven. This practice becomes particularly important during major life events or economic shifts. Updated valuations also prevent unpleasant surprises during tax season or estate settlements.

Maintaining a living inventory of possessions—complete with purchase details and current worth—simplifies insurance claims and financial planning. This habit transforms abstract net worth into concrete understanding.

Spreading Risk Through Smart Investing

Putting all financial eggs in one basket invites unnecessary risk. Allocating resources across different investment types cushions against market volatility. This balanced approach allows participation in growth sectors while maintaining stability through conservative holdings.

Diversification acts as financial shock absorption—when one investment stumbles, others maintain equilibrium. Regular portfolio reviews ensure your risk distribution aligns with current goals and market conditions.

Securing Physical Assets

Tangible property requires tangible protection. From home security systems to proper storage for valuables, physical safeguards prevent loss and damage. Assessing neighborhood crime trends and natural disaster risks informs appropriate protective measures. Insurance serves as the final backstop when prevention falls short.

Documenting Your Financial Journey

Paper trails prevent headaches. Organized records of transactions, appraisals, and legal documents streamline everything from tax preparation to loan applications. When disputes arise, thorough documentation often makes the difference between quick resolution and prolonged conflict. Digital backups with physical copies create redundancy against loss.

Establishing a consistent filing system—whether cloud-based or traditional—ensures important information remains accessible when needed most.

Planning for Life's Transitions

Thoughtful estate planning gifts peace of mind to both you and your heirs. Clear directives prevent family conflicts and ensure your wishes are honored. A properly structured estate plan can minimize tax burdens while maximizing benefit to loved ones. Regular updates account for life changes like marriages, births, or acquisitions.

Professional guidance navigates complex inheritance laws and creates legally binding arrangements. Viewing estate planning as an ongoing process—not a one-time event—keeps protections current.

Read more about Divorce Preparation Tips for Men

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

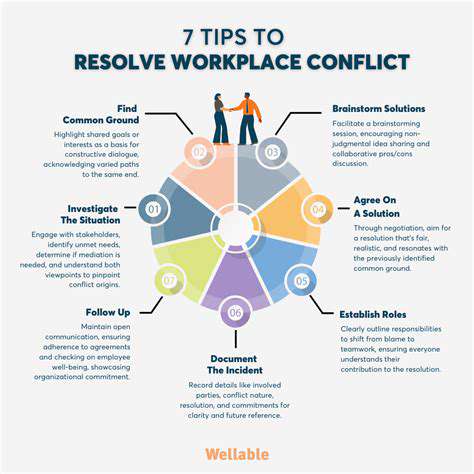

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases