best legal advice for divorce property division

Defining Marital Property: The Fundamentals

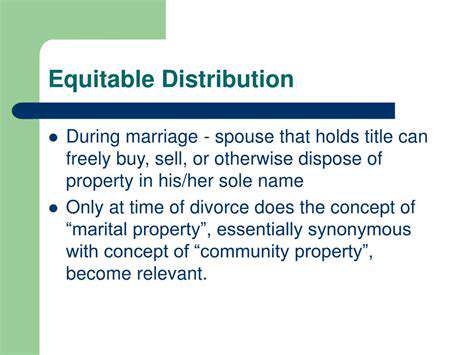

Understanding the concept of marital property is crucial for couples navigating the complexities of divorce or separation. Marital property encompasses all assets and debts acquired by either spouse during the marriage. This includes everything from real estate and bank accounts to vehicles, investments, and even personal belongings. It's important to remember that this definition often differs from separate property, which belongs solely to one spouse.

This fundamental understanding lays the groundwork for equitable distribution in many jurisdictions. The goal is to fairly divide the marital estate between the parties involved, ensuring a just outcome for both. However, the specifics of what constitutes marital property and how it's divided can vary significantly based on the jurisdiction's laws and the unique circumstances of the case. This is why seeking legal counsel is vital when dealing with such matters.

Separate Property: Assets Owned Before or Acquired During Marriage

Separate property, in contrast to marital property, consists of assets a spouse owned prior to the marriage or received during the marriage as a gift or inheritance. This includes property acquired before the marriage, and any gifts or inheritances received by one spouse during the marriage.

Understanding the distinction between separate and marital property is essential for a fair division of assets in a divorce. This ensures that assets acquired through individual efforts or gifts are not considered part of the marital estate. A thorough understanding of these concepts is crucial to ensure legal rights are protected.

Community Property States: A Shared Approach

In community property states, marital property is typically defined as all assets and debts acquired during the marriage, regardless of which spouse's name is on the title or account. This means that any income earned during the marriage, as well as any property purchased with that income, is generally considered community property.

This shared ownership approach reflects a cooperative effort during the marriage, and ensures a relatively straightforward division of assets in a divorce. This is in contrast to other jurisdictions that may have different approaches to defining marital property.

Tracing Assets: Determining Ownership

Tracing the origin of assets can be vital in determining their classification as marital or separate property. This process involves examining financial records, receipts, and other documentation to establish how an asset was acquired.

Careful examination of financial records, including bank statements, investment records, and tax returns, is often necessary to establish clear ownership and determine the extent of marital property. Tracing assets is a crucial aspect of property division in divorce proceedings, aiming to ensure fairness and accuracy.

The Impact of Pre-nuptial Agreements: Protecting Individual Assets

Pre-nuptial agreements, or prenuptial agreements, are legal contracts entered into by couples before marriage. These agreements often outline how assets will be treated in the event of a divorce or separation. They can define separate property and how marital property will be divided.

Pre-nuptial agreements can offer significant protection for individual assets, especially for high-net-worth individuals. They can safeguard assets acquired before the marriage and ensure that expectations are clearly defined from the outset. It's wise to seek legal counsel to ensure the agreement is legally sound.

Addressing Complex Assets: Real Estate, Businesses, and Retirement Accounts

Understanding the Nuances of Real Estate Investments

Real estate investments, while often perceived as straightforward, possess a complex web of factors that influence their value and potential returns. These factors range from local market conditions and zoning regulations to the intricacies of property management and tenant relations. Analyzing these intricacies is crucial for making informed decisions, minimizing risks, and maximizing potential profits.

Understanding the specific characteristics of different types of real estate properties—residential, commercial, or industrial—is paramount. Each type presents unique challenges and opportunities, requiring a tailored approach to investment strategies and risk assessment.

Market Analysis: Key Drivers and Trends

Real estate markets are dynamic entities, constantly evolving based on a multitude of factors. Economic trends, demographic shifts, and government policies all play a significant role in shaping market behavior. Thorough market research is essential for identifying emerging opportunities and mitigating potential risks.

Understanding local market trends, including population growth, employment rates, and interest rate fluctuations, is crucial for successful real estate investment decisions. Failure to adequately consider these factors can lead to significant financial losses.

Property Valuation and Assessment

Accurate property valuation is a cornerstone of any successful real estate investment strategy. Appraisal methods, such as comparative market analysis and income capitalization, help determine a property's fair market value. This process allows investors to assess the potential return on investment, compare different investment opportunities, and make informed decisions.

Legal and Regulatory Considerations

Navigating the legal and regulatory landscape surrounding real estate investments is critical. Understanding zoning regulations, building codes, and environmental restrictions is vital to avoid costly legal issues and ensure compliance. Failure to adhere to these regulations can lead to significant penalties and delays in development projects.

Furthermore, legal structures and contracts, such as leases and purchase agreements, must be carefully reviewed by qualified professionals to protect the interests of investors and ensure smooth transactions.

Financing Strategies for Real Estate

Securing appropriate financing is a critical aspect of real estate investment. Understanding various financing options, including mortgages, loans, and equity financing, is essential for managing cash flow and maximizing returns. Different financing options have varying terms and conditions, and investors must carefully analyze these to optimize their investment strategies.

Effective financial planning and management are key to navigating the financial complexities of real estate investments.

Risk Management and Mitigation Strategies

Real estate investments, like any other investment, are inherently subject to a range of risks. Market fluctuations, economic downturns, and unforeseen circumstances can all impact the value and profitability of a property. Understanding and mitigating these risks through careful due diligence and diversified investment strategies is crucial for long-term success.

Contingency planning and risk assessment are essential components of a robust real estate investment strategy. Identifying potential challenges and developing proactive solutions can help minimize the impact of unforeseen events.

Due Diligence and Property Inspection

Thorough due diligence and property inspections are essential for identifying potential issues and mitigating risks associated with real estate investments. This process involves a comprehensive evaluation of the property's condition, environmental factors, and legal compliance. Understanding the property's history, potential maintenance needs, and any latent defects is critical.

Professional inspections, appraisals, and legal reviews provide critical information for making informed decisions and avoiding costly surprises down the road. This careful due diligence process is vital for protecting the investment and ensuring long-term profitability.

Read more about best legal advice for divorce property division

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases