How to Start Anew After Divorce

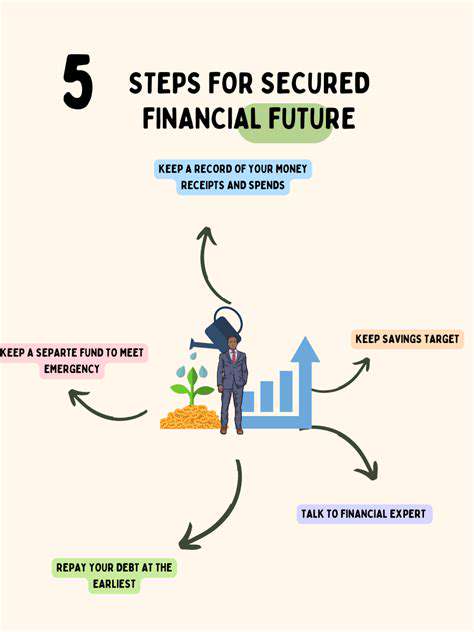

Assessing Your Current Financial Situation

Taking stock of where you stand financially is the first critical step toward building a stable future. Start by listing all income sources, tracking monthly expenses, and evaluating debts. Creating a comprehensive budget helps pinpoint spending leaks and reallocate funds toward important goals. Knowing your exact financial position allows for smarter, more confident decisions moving forward.

Don't forget to assess both assets (investments, savings) and liabilities (loans, credit cards). Maintaining accurate records transforms chaotic finances into an organized system you can actually work with.

Developing a Realistic Budget

A practical budget acts like a GPS for your money - it shows where every dollar should go. Separate expenses into fixed (rent, utilities) and variable (entertainment, dining) categories while setting aside money for future objectives. The secret to budget success lies in balancing necessities with personal priorities.

Life's unpredictable, so build some flexibility into your budget. Regularly revisiting and adjusting your plan ensures it remains useful as circumstances change.

Cutting Back Strategically

Finding ways to spend less isn't about deprivation - it's about creating financial breathing room. Audit recurring subscriptions, dining habits, and impulse purchases to identify savings opportunities. Redirecting even small amounts from discretionary spending can significantly impact debt reduction and savings growth.

Often, we don't notice how small, frequent expenses add up until we examine them closely. Try tracking every purchase for a month to reveal surprising patterns.

Managing Debt Effectively

Debt doesn't have to be overwhelming with the right approach. Options like negotiating lower rates, debt consolidation, or the avalanche method (targeting high-interest debts first) can create a clear path forward. A structured repayment plan turns an intimidating mountain into manageable steps.

Recognizing the true cost of different debts helps prioritize which to tackle first. When in doubt, professional guidance can provide customized solutions.

Establishing Financial Safety Nets

An emergency fund serves as your financial shock absorber. Start small if needed, but aim to eventually cover 3-6 months of essential living costs. This cash reserve means unexpected events don't have to derail your entire financial plan.

Treat emergency savings as non-negotiable, just like paying rent. Automating contributions makes building this cushion effortless over time.

Growing Your Wealth

Investing isn't just for the wealthy - it's how regular people build lasting security. Whether through retirement accounts, index funds, or other vehicles, consistent investing leverages compound growth. Align investment choices with both your goals and comfort with risk.

The most successful investors focus on steady contributions rather than trying to time the market. Patience and discipline outweigh financial genius in the long run.

Getting Expert Guidance

A good financial advisor does more than manage money - they provide clarity and confidence. They can spot opportunities you might miss and help navigate complex decisions. Professional advice often pays for itself by helping avoid costly mistakes.

The right advisor becomes a partner in creating financial strategies tailored specifically to your life situation. Don't hesitate to interview several to find the best fit.

Reconnecting with Yourself and Your Support System

The Power of Self-Discovery

Major life changes create opportunities for reinvention. Use this transition to reflect on what truly matters to you - not who you were in a relationship, but who you want to become. This isn't about erasing the past, but rather learning from it while designing your next chapter. Authentic self-knowledge becomes the compass for all future decisions.

Reconnecting with old passions or discovering new ones helps rebuild identity beyond relationship roles. What activities make you lose track of time? What causes spark your enthusiasm? These clues point toward post-divorce fulfillment.

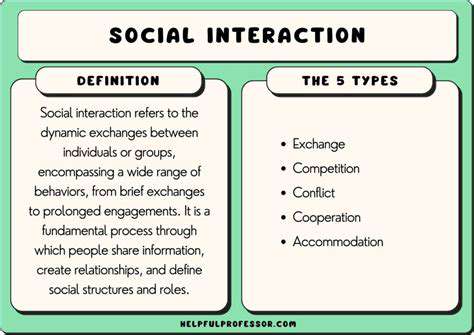

Building Meaningful Connections

Relationships naturally shift after major life events. Some connections fade while others deepen. Be proactive in nurturing relationships that energize you and seeking new ones through shared interests. Quality connections provide the emotional scaffolding for rebuilding your life.

Consider joining groups related to hobbies, volunteering, or personal growth. Shared experiences create bonds more meaningful than surface-level socializing. Remember that building community takes time - be patient with the process.

Your support network will evolve organically. Stay open to connections in unexpected places, and don't underestimate the value of casual acquaintances who might become important allies.

Embracing the Future with Hope and Optimism

The Innovation Imperative

Technological progress accelerates at an incredible pace, as highlighted in this resource about emotional healing. Staying curious and adaptable ensures we benefit from advancements rather than being overwhelmed by them. The most successful individuals and organizations maintain a learning mindset amid constant change.

We must balance enthusiasm for new technologies with thoughtful consideration of their broader impacts. Developing digital literacy becomes as fundamental as traditional education in today's world.

The Science of Hope

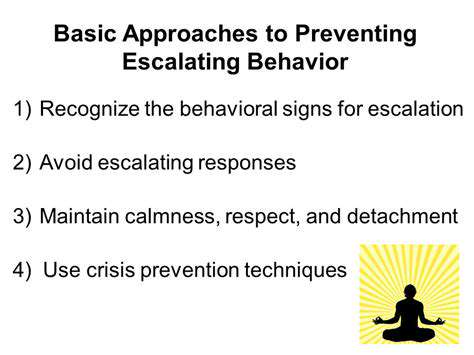

Hope isn't just wishful thinking - it's a psychological resource that fuels perseverance. Studies show hopeful people set better goals, develop more strategies, and demonstrate greater resilience. This mental stance transforms challenges into opportunities for growth rather than reasons for despair.

Practice futurecasting - vividly imagining positive outcomes. When communities share hopeful visions, they generate collective energy for making those visions real. Optimism, grounded in realistic assessment, becomes a self-fulfilling prophecy.

Collaboration as Competitive Advantage

Complex problems demand diverse perspectives. The most innovative solutions emerge when people with different expertise and backgrounds work together authentically. Modern challenges require breaking down silos between disciplines and sectors.

Effective collaboration combines clear communication with mutual respect. It's not about consensus, but rather synthesizing the best ideas from all participants. Teams that embrace cognitive diversity consistently outperform homogeneous groups.

Read more about How to Start Anew After Divorce

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases