Divorce Financial Planning for Entrepreneurs

Table of contents

Business valuation methods are crucial for fair divorce settlements.

Engaging professional valuators minimizes bias and enhances negotiation outcomes.

Hidden assets complicate business valuations during divorce proceedings.

Business valuation impacts financial settlements and long-term stability.

Legal guidelines are essential for accurate business evaluations.

Ownership structure affects asset division in divorce negotiations.

Valuation challenges often require professional assistance for accurate outcomes.

Entrepreneurs should proactively prepare financial data for negotiations.

Protecting business interests involves legal agreements and clear documentation.

Post-divorce financial plans must reassess new needs and goals.

Formal business valuations aid negotiations on asset division.

Updating legal documents is vital after divorce to avoid complications.

Tax implications can significantly affect financial outcomes post-divorce.

Seeking professional guidance for tax planning is highly advisable.

Entrepreneurs face unique financial challenges during divorce proceedings.

Professional valuation services ensure accurate business assessments in divorce.

Understanding tax implications helps in strategic financial planning.

Negotiating balanced settlements is key for entrepreneurs with complex assets.

Long-term financial outlooks must adapt after divorce to new realities.

Assessing Business Valuation in Divorce Proceedings

Understanding Business Valuation Methods

In divorce proceedings, Understanding the different methods of business valuation is crucial for achieving a fair settlement. This can include the income approach, market approach, and asset-based approach. Each method has its own merits and downsides, making it essential for entrepreneurs to choose the right one based on the specific nature of their business.

The income approach assesses the potential earnings of a business, discounting future cash flows to their present value. On the other hand, the market approach looks at comparable businesses to determine a fair market value. Finally, the asset-based approach evaluates the company's total assets minus its liabilities. By knowing these methods, business owners can make informed decisions about the valuation process.

Engaging Professional Valuers

Hiring a seasoned professional valuator can be a game-changer in divorce cases involving a business. These experts bring objectivity and specialized knowledge, reducing the chances of bias that may arise during personal proceedings. They can also provide a detailed valuation report, which is important for legal documentation.

In addition, professional valuators often have valuable insights that can help in negotiations. They can articulate the value of not just physical assets, but also intangible assets such as goodwill. Having a credible report from a recognized expert can substantially bolster your position in settlement discussions.

Addressing Hidden Assets

- Hidden assets can significantly impact business valuation.

- Common tactics include offshore accounts or unreported income.

- Insisting on transparency can lead to a more equitable settlement.

During divorce proceedings, uncovering hidden assets is key to achieving a fair valuation. Many entrepreneurs may unintentionally hide or overlook certain assets, leading to discrepancies in the total assessed value. Assets such as intellectual property, brand equity, or secret accounts may not initially come to light.

By conducting a thorough investigation, individuals can ensure that all assets are counted, thus protecting their interests. This may involve forensic accounting, which can identify inconsistencies in financial records that hint at undisclosed earnings.

Financial Implications of Business Valuation

The valuation of a business directly affects the financial settlement in a divorce. A higher valuation typically leads to a larger share of the marital assets, which can be quite impactful in terms of cash flow and long-term financial stability. Entrepreneurs must be prepared for these implications when discussing settlement negotiations.

Moreover, understanding the financial implications can aid in effective planning for both parties post-divorce. If one spouse retains the business, they must consider future operational costs and profitability, potentially affecting alimony or child support obligations. Hence, it's vital to grasp how business valuation interlinks with broader financial responsibilities.

Legal Considerations in Business Valuation

Legal issues surrounding business valuation can be complicated, given the potential for disputes. The courts have set forth various guidelines that must be adhered to during the valuation process. Additionally, state-specific laws may influence how a business is evaluated and divided.

It is essential for business owners to work closely with their legal teams to ensure compliance with these legal frameworks. Staying informed about the applicable laws can significantly affect the outcome of the proceedings. Proper legal guidance can prevent costly mistakes that may arise during business valuation in divorce circumstances.

Understanding the Impact of Ownership Structure

Different Ownership Structures Explained

Ownership structures can significantly affect an entrepreneur's financial stability, especially during a divorce. When considering ownership scenarios, it's essential to understand how each structure influences asset division. Common ownership structures include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each of these forms has distinct legal implications that can directly impact an entrepreneur's financial plan in the event of a divorce.

In a sole proprietorship, for example, all assets are typically considered personal, which may subject the business to the same division rules as marital property. On the other hand, partnerships require careful evaluation of partnership agreements to determine the value of personal versus shared interests. Understanding these nuances enables entrepreneurs to effectively navigate the complexities surrounding how their business interests are treated in divorce proceedings.

Valuation Challenges of Business Ownership

Determining the value of a business during a divorce can present numerous challenges, often requiring professional assistance. The valuation process is complex due to the varied methodologies available and the subjective nature of business worth. Entrepreneurs must be prepared for potential discrepancies in evaluations, often necessitating compromise or the use of a mediator to establish an equitable outcome.

- Common valuation methods include asset-based, earning value, and market-based approaches.

- Each method can yield vastly different valuations, affecting financial settlements.

- Engaging a qualified business appraiser is advisable for an accurate assessment.

It is crucial for entrepreneurs to proactively gather financial data and documentation related to their business, which will be invaluable during negotiations. Proper preparation can alleviate misunderstandings and streamline the process, fostering clearer communication between both parties.

Impact of Business Ownership on Divorce Settlements

The ownership structure of a business not only influences the valuation but also plays a role in determining the overall divorce settlement. Entrepreneurs may find that their personal stake in the business can affect the negotiation process, particularly if the business is the primary income source for the family. In divorce scenarios where one spouse has a significant share in the business, it can complicate matters regarding alimony and child support agreements. Considering these factors, entrepreneurs should seek tailored legal advice to navigate these financial implications effectively.

For example, a spouse who has contributed to the business—whether through direct involvement or indirectly supporting the entrepreneur—might argue for a larger share. This highlights the importance of transparent communication about each spouse's contributions, both financial and non-financial. Ultimately, the impact of business ownership structures necessitates thorough consideration during financial planning for divorce.

Strategies for Protecting Business Interests

To mitigate risks associated with divorce, entrepreneurs can implement several strategies to protect their business interests. Establishing a prenuptial or postnuptial agreement can delineate the ownership and financial responsibilities clearly. These legal documents can safeguard the business from claims and ensure each party understands their rights before any complications arise. It’s prudent to work closely with attorneys familiar with both family law and business considerations to draft effective agreements.

- Operating as an LLC can provide limited liability protection and impact ownership distribution.

- Documenting operational roles and contributions can clarify valuations and expectations during a divorce.

- Maintaining separate business finances is crucial for protecting assets and simplifying financial reviews.

Moreover, continuously updating legal agreements and operational structures in response to personal circumstances can fortify an entrepreneur’s position. Regular consultations with a financial advisor can further refine strategies to preserve business assets amid personal transitions.

Creating a Comprehensive Financial Plan Post-Divorce

Understanding Financial Needs After Divorce

Post-divorce life represents a shift not just emotionally, but financially as well. It's crucial for individuals, especially entrepreneurs, to reassess their financial needs, which may have changed dramatically. Creating an inventory of expenses, from housing to insurance, helps identify new essentials and potential savings. Such thoroughness ensures you're not caught off guard when your regular expenses suddenly take center stage.

Additionally, evaluating the financial implications of shared assets and liabilities is essential. For entrepreneurs, distinguishing between personal and business finances becomes even more critical. This will not only help in prioritizing personal expenses but might also provide clarity on how business operations may need adjustments moving forward.

Reassessing Business Assets

Divorce often necessitates a review of business assets, especially for entrepreneurs who may have mixed personal and business finances. Consider conducting a formal business valuation to establish an accurate picture of the enterprise’s worth. This valuation is not just a legal necessity, but it can also serve as a focal point for negotiations related to asset division.

Moreover, it's prudent to consult with a financial advisor or a business appraiser. These experts can help with both evaluating the business's current market position and projecting future revenue streams, which can be vital during property settlements. This proactive step can result in more favorable outcomes during negotiations.

Setting New Financial Goals

Establishing financial goals post-divorce is more than just a wish list; it's a roadmap for future stability. Entrepreneurs should set short-term and long-term objectives that directly address their new financial reality. For example, creating a budget focused on recovery and growth can help in realigning business strategies to new consumer needs or market demands.

Incorporating regular financial reviews into your routine is also advisable. These check-ins can help ensure that you stay on track with your goals and adapt to changing circumstances. Remember, flexibility can be your best asset in an unpredictable market environment.

Updating Legal and Financial Documents

Divorce often requires a complete overhaul of legal and financial documents, including wills, trusts, and business contracts. Outdated documents can lead to unnecessary complications, especially regarding asset distribution or custody arrangements for children. Therefore, it's essential to update beneficiaries on your insurance policies and retirement accounts to reflect your current circumstances.

Seeking Professional Guidance

Navigating the financial complications of a divorce can be daunting, particularly for entrepreneurs managing both personal and business interests. Engaging professionals, such as financial planners, accountants, and attorneys, can provide invaluable support. These experts can not only help you interpret financial documents but can also offer advice tailored specifically to entrepreneurs.

Don't forget to take advantage of any resources that your local small business association or entrepreneurial networks might offer. These platforms frequently provide workshops or courses on managing finances effectively post-divorce, which can enhance your understanding and preparedness in your new financial journey.

Navigating Tax Implications Related to Divorce

Understanding Tax Deductions and Credits Post-Divorce

Post-divorce life often alters your eligibility for various Tax Deductions and Credits. For instance, alimony payments may be deductible for the payer, while the recipient must include them as income. Understanding how these payments affect your taxable income is crucial for financial planning. Keep records of alimony agreements and payment receipts, as they are essential for substantiating claims during tax filing.

Similarly, if you have dependent children, you may be entitled to claim child tax credits or deductions. However, the custodial parent typically receives these benefits unless otherwise negotiated. Review your divorce decree to clarify who holds the tax benefits related to children; it can significantly impact your tax filing strategy and refunds.

The Division of Assets and Its Tax Consequences

When dividing marital assets, entrepreneurs should consider how taxes will affect their overall financial standing. For instance, liquidating a business or selling a portion of your company to settle divorce terms can incur capital gains taxes. It’s advisable to consult with a tax professional to explore options for asset division that minimize your tax liability.

Additionally, certain assets, such as retirement accounts, may come with different tax implications. If you transfer a portion of a retirement account as part of the divorce settlement, a Qualified Domestic Relations Order (QDRO) is often required to avoid unnecessary taxes and penalties. Ensure clarity on such matters in your financial planning process.

Filing Status Changes After Divorce

Your tax filing status will change once your divorce is finalized, which directly impacts your tax obligations. For the year of separation, if you were legally married for at least half the year, you might qualify for married filing jointly. After the divorce is finalized, however, you’ll have to choose between single or head of household status, which has different implications for your tax rates and eligibility for deductions.

Impact of Divorce on Business Income and Deductions

For entrepreneurs, a divorce can also lead to changes in how business income is taxed. If you're operating as a sole proprietorship, your business income is reported on your personal tax return, which means your tax liability might increase if your income remains unchanged but your filing status has shifted. It's essential to reevaluate your business structure post-divorce for tax efficiency.

Moreover, consider potential deductions that may now be influenced by your marital status. If you previously co-managed a business, transition into sole ownership post-divorce may open up new avenues for deductions that better align with your current financial landscape.

Regularly consult with tax and financial advisors to ensure your business operations align with the best tax strategies following your divorce, and customize your financial plans accordingly.

Seeking Professional Guidance for Tax Planning

Given the complexities associated with tax implications of divorce, seeking Professional Guidance is highly advised. Tax advisors or certified public accountants (CPAs) with experience in divorce-related financial issues can provide invaluable insights into your unique tax situation. They can help you anticipate potential pitfalls and take advantage of available tax deductions related to your divorce.

It's also beneficial to engage legal counsel familiar with tax laws and divorce to ensure your settlement is structured efficiently. Proactive communication with these professionals can help you make informed decisions that shape your financial future positively, minimizing unexpected tax burdens during and post-divorce.

Seeking Professional Guidance for Complex Scenarios

Understanding the Unique Financial Challenges of Entrepreneurs

Entrepreneurs often face distinct financial hurdles during a divorce, primarily due to the intricacies of business ownership. Unlike salaried employees, business owners must contend with valuations of their companies, which can fluctuate widely. It’s crucial to accurately assess the value of any business assets amidst a divorce to ensure a fair distribution.

According to a study by the American Academy of Matrimonial Lawyers, nearly 70% of divorce cases involve complex assets like businesses. Failing to address these complexities can significantly impact an entrepreneur's financial stability in the long run. The right valuation can influence settlement discussions and future decisions regarding the business.

The Importance of Professional Valuation Services

Engaging a professional valuation expert is often a necessary step for business owners navigating divorce. These professionals utilize various methods to assess a company’s worth, factoring in cash flows, market conditions, and future earnings potential. This technical expertise is essential for accurately portraying the business’s value in legal proceedings.

Moreover, professional valuators provide credible testimony in court if negotiations escalate. This support can substantially strengthen a case when dealing with complex financial structures like S-Corps or LLCs, ensuring that the entrepreneur walks away with a division that truly reflects the business's value.

Tax Implications and Financial Planning During Divorce

When entrepreneurs divorce, understanding the tax ramifications is vital. Certain asset divisions can incur significant tax liabilities that may not be immediately apparent. For instance, liquidating business assets to split proceeds can lead to capital gains taxes, diminishing the overall value received from the divorce settlement.

Consulting with a financial planner who specializes in divorce can help identify these tax implications early in the process. A tailored financial plan can leverage tax-efficient strategies, helping entrepreneurs retain as much of their wealth as possible while ensuring compliance with legal requirements during asset division.

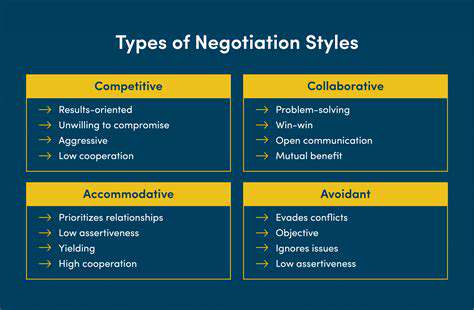

Strategies for a Balanced Financial Settlement

When negotiating a divorce settlement, strategizing is key, particularly for entrepreneurs with multiple income streams. It may be advisable to propose structured settlements that include cash payments and business equity, allowing for better cash flow management post-divorce.

Additionally, considering alternative dispute resolution methods, such as mediation, can facilitate smoother negotiations. This approach can help maintain business relationships that are often crucial for an entrepreneur, thus ensuring a less contentious process and potentially preserving the business’s operational integrity.

Long-Term Financial Outlook Post-Divorce

Post-divorce, entrepreneurs may need to recalibrate their long-term financial outlook. This includes not only adjusting personal budgets but also re-evaluating business strategies. After a divorce, it's common for individuals to experience changes in lifestyle expenses that must be accounted for in their financial plans.

Establishing a solid foundation for future financial stability typically involves setting new investment goals, perhaps diversifying income streams, and reassessing personal financial priorities. Seeking ongoing guidance from financial advisors can help entrepreneurs navigate these changes while working to rebuild their wealth in a post-divorce landscape.

Read more about Divorce Financial Planning for Entrepreneurs

Hot Recommendations

- divorce self recovery tips for quick healing

- best divorce preparation advice for couples

- how to support your ex for kids’ sake

- how to negotiate divorce custody agreements

- divorce financial planning for long term security

- how to manage co parenting conflicts post divorce

- best co parenting plans for divorced families

- best divorce settlement negotiation strategies

- best co parenting communication strategies

- best strategies for managing divorce conflict