managing divorce legal expenses effectively

Assessing Your Financial Situation Before Proceeding

Understanding Your Income

When evaluating your finances, the first critical step is gaining a clear grasp of your income. This encompasses not just your primary paycheck but also secondary revenue streams like dividends, side gigs, or property rentals. Maintaining meticulous records of all earnings is absolutely vital for painting an accurate picture of your fiscal health. Be brutally honest about how reliable each income source is. Periodic reviews of your earnings allow you to tweak your budget to match your actual financial landscape.

Sorting your income into categories reveals your money's origins. This organizational approach enables smarter budgeting and expense prioritization, forming the bedrock of a solid financial game plan. Knowing exactly what's coming in is non-negotiable for building economic stability.

Evaluating Your Expenses

Scrutinizing your spending carries equal weight to income analysis. This means tracking every dollar that leaves your wallet - from housing costs to coffee runs. Comprehensive expense tracking shines a light on potential overspending and reveals opportunities for savings. Such detailed monitoring provides crystal-clear visibility into your cash flow patterns.

Separate fixed obligations (like car payments) from variable costs (like entertainment). Recognizing this distinction is fundamental to budget mastery. The more precisely you categorize, the better you can control your financial destiny.

Analyzing Your Assets

Your assets represent your financial firepower - everything from stock portfolios to jewelry collections. A rigorous assessment of what you own, including its value and liquidity, gives you complete financial clarity. This comprehensive review helps you understand your true net worth and plan strategically for the future.

Different assets have different cash conversion timelines. While savings accounts offer instant access, selling property takes time. This liquidity awareness is crucial when planning for emergencies or major purchases.

Evaluating Your Liabilities

Debts and financial obligations form the counterbalance to your assets. Precisely quantifying what you owe, and to whom, is the cornerstone of effective debt management. This clear-eyed assessment reveals your actual financial burdens and determines your capacity for additional credit.

Organizing debts by type (short-term credit cards vs long-term mortgages) enables smarter repayment strategies. This systematic approach helps minimize debt's drag on your overall financial health.

Debt Management Strategies

Conquering debt requires battle-tested tactics like the snowball or avalanche methods. Mastering these approaches is transformative, reducing financial anxiety while building lasting security. These techniques can potentially save thousands in interest over time.

Crafting a realistic payback schedule demands careful consideration of your income, living costs, and loan terms. The right plan balances aggressive repayment with sustainable living.

Creating a Budget

A budget acts as your financial GPS, mapping income against outflows. This indispensable tool forms the foundation of fiscal responsibility, empowering smarter money decisions. Remember - budgets are living documents requiring regular updates as circumstances change.

Detailed budgeting illuminates spending patterns, revealing opportunities for improvement. It's the first step toward true financial control and freedom.

Financial Goals and Planning

Clear financial targets - whether saving for a home or retirement - provide crucial direction. Well-defined, measurable objectives create motivation and pave the path to prosperity. These can range from short-term vacation funds to decades-long investment plans.

Developing a step-by-step achievement roadmap keeps you accountable. Regular progress checks ensure you stay on course toward your financial aspirations.

Negotiating and Settling with Your Spouse

Understanding the Negotiation Process

Negotiation skills prove invaluable across life's spectrum, from personal relationships to business deals. Successful discussions require mutual understanding and creative problem-solving. The art lies in balancing assertiveness with empathy to reach equitable solutions.

Thorough preparation separates effective negotiators from the rest. This means clarifying your objectives, knowing your walk-away point, and researching the other party's position. Such groundwork builds confidence and positions you for success.

Identifying Your Goals and Interests

Entering negotiations without clear priorities is like sailing without a compass. Define exactly what matters most before discussions begin. This focus prevents distraction by minor issues and keeps you aligned with core objectives.

Anticipate various potential outcomes and their implications. Scenario planning prepares you to pivot gracefully during actual negotiations.

Understanding the Other Party's Perspective

Truly effective negotiation requires stepping into the other person's shoes. Active listening and genuine curiosity about their needs often reveal unexpected common ground. This empathetic approach frequently unlocks creative solutions satisfying both parties.

Developing a Negotiation Strategy

Approaching negotiations without a plan is recipe for disappointment. Your strategy should outline primary objectives, fallback positions, and potential concessions. Anticipating challenges and preparing responses keeps you composed under pressure.

Flexibility within your framework allows adaptation to new information while maintaining strategic direction.

Strategies for Effective Communication

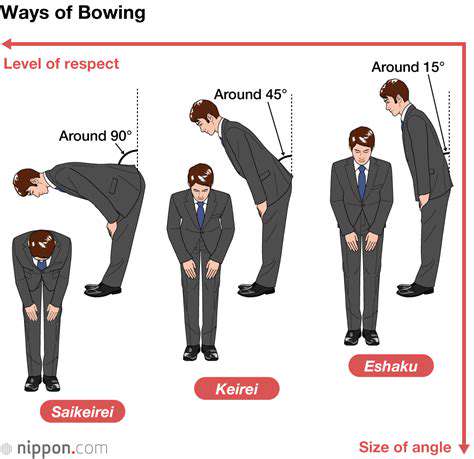

Clear expression and attentive listening form the bedrock of successful negotiation. Pay equal attention to spoken words and body language cues. Respectful dialogue builds trust and fosters collaborative problem-solving, essential for reaching mutually satisfactory agreements.

Addressing Potential Conflicts

Disagreements are negotiation inevitabilities. The skill lies in transforming conflict into creative tension that drives better solutions. Focus on interests rather than positions to find innovative compromises.

Maintaining professionalism prevents personalization of disputes. Keeping discussions factual and solution-focused preserves relationships.

Ensuring a Fair Settlement

Equitable agreements consider all parties' core needs. This often requires creative thinking and willingness to compromise on less critical items. Transparency and fairness during negotiations lay groundwork for positive future interactions.

The most durable settlements balance immediate needs with long-term relationship preservation.

Seeking Expert Advice Throughout the Process

Understanding Your Financial Landscape

Divorce financial planning begins with comprehensive assessment of all assets, debts, and income sources. Gather documentation including tax returns, bank statements, and loan agreements. Complete transparency with your legal team ensures they can advocate effectively for your interests.

Inaccurate financial disclosures risk court penalties and procedural delays. Honesty with your attorneys about your complete financial picture enables them to develop the strongest possible strategy.

Estimating Legal Costs and Fees

Divorce expenses vary widely based on case complexity and resolution method. Early discussions about fee structures (hourly vs flat rates) prevent unpleasant surprises. Understanding billing practices helps you allocate resources effectively throughout proceedings.

Many attorneys offer payment plans - don't hesitate to discuss financial concerns openly. A good legal team will work with you to make quality representation accessible.

Exploring Alternative Dispute Resolution Options

Courtroom battles often represent the costliest divorce path. Mediation and collaborative law frequently deliver satisfactory resolutions at lower emotional and financial cost. These approaches emphasize cooperative problem-solving over adversarial positioning.

Your attorney can assess whether alternative methods suit your specific circumstances. The right approach balances cost considerations with outcome quality.

Budgeting for Unexpected Expenses

Divorce proceedings often include unforeseen costs - from additional appraisals to emergency motions. Building a 10-15% contingency into your legal budget provides crucial flexibility. Regular financial check-ins with your attorney help catch potential overages early.

Seeking Professional Financial Advice

A specialized financial advisor brings invaluable expertise to divorce planning. They can identify tax implications, recommend asset protection strategies, and help rebuild post-divorce finances. This professional guidance often pays for itself through smarter financial decisions.

Look for advisors with specific divorce financial analysis experience. Their specialized knowledge can make substantial differences in long-term outcomes.

Read more about managing divorce legal expenses effectively

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases