divorce financial planning for long term security

Building a Secure Financial Future: Insurance and Risk Management

Understanding Your Financial Risks in Divorce

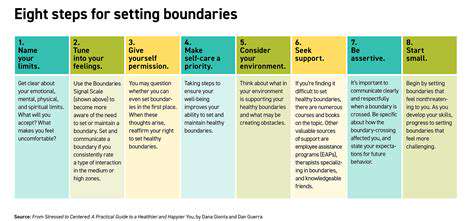

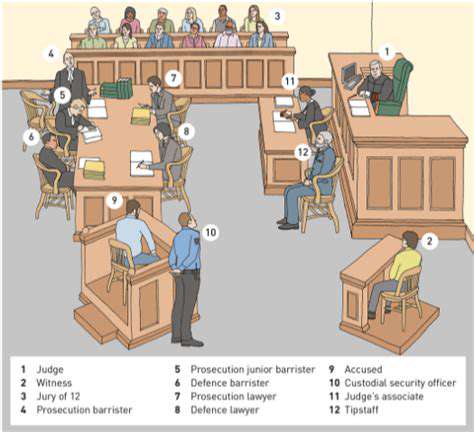

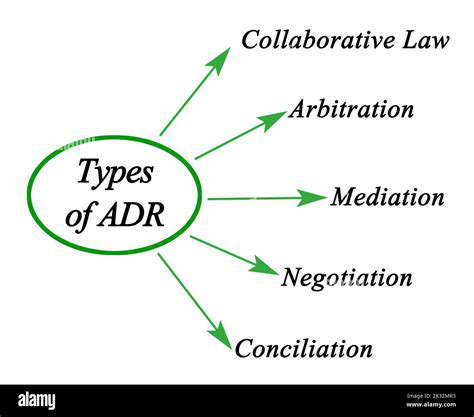

Navigating a divorce can be incredibly stressful, and often the financial implications are a significant source of anxiety. Divorce proceedings frequently involve the division of assets, debts, and ongoing financial obligations. Understanding the potential financial risks associated with divorce, such as the loss of a significant portion of your income, the need to rebuild your financial foundation, and the potential for increased debt, is crucial for developing a solid strategy to protect your future financial well-being and mitigate the impact of the legal process.

Thorough financial planning and proactive risk assessment are essential steps in managing these challenges effectively. This involves carefully evaluating your current financial situation, including income, expenses, assets, and debts, and anticipating potential changes that might arise during and after the divorce process. This preparation allows you to develop a strong financial foundation for the future.

The Role of Insurance in Protecting Your Assets

Insurance policies play a critical role in safeguarding your financial future during and after divorce. Reviewing existing insurance policies, such as health insurance, life insurance, auto insurance, and homeowners insurance, is crucial to ensure they adequately protect your interests. This includes evaluating coverage amounts, policy terms, and potential gaps in protection that may arise from divorce proceedings. Understanding how these policies will function in the future, and how they may need adjusting due to changes in your circumstances is critical.

Proper insurance coverage helps mitigate potential financial losses arising from unforeseen events such as accidents, illnesses, or property damage, thus ensuring a stable financial future post-divorce. The right insurance policies can provide a safety net and help you weather the financial storms that divorce can bring.

Developing a Post-Divorce Budget

Creating a realistic and detailed budget is essential for managing your finances effectively after divorce. This involves meticulously tracking all income sources, including alimony, child support, and any new employment. Accurately accounting for all expenses, including housing, utilities, food, transportation, and childcare, is equally important. A comprehensive budget will help you understand your financial situation clearly and allow you to make informed decisions.

Establishing a post-divorce budget is about more than just managing expenses. It's about planning for the future. This detailed plan will allow you to anticipate and address potential financial challenges in the years ahead and ensure that your financial goals are attainable.

Retirement Planning After Divorce

Retirement planning is an area often overlooked during divorce proceedings but is crucial for a secure future. Dividing retirement accounts and understanding the implications of these divisions on your retirement savings is vital. It's essential to consult with a financial advisor to determine the best strategies for managing your retirement funds and assets, whether they be pensions, 401(k)s, or IRAs.

Asset Protection Strategies

Protecting your assets during and after divorce is a vital aspect of financial planning. Strategies for asset protection can involve transferring assets to a trust, or taking steps to shield assets from potential legal claims. Understanding different asset protection strategies can help you safeguard your financial well-being and reduce the risk of losing valuable possessions in the divorce process.

Managing Debt and Credit During Divorce

Divorce can sometimes lead to an increase in debt. Managing existing debt and establishing sound credit practices are essential aspects of financial recovery. This involves understanding and resolving any outstanding debts and determining strategies for managing future financial obligations. Understanding and utilizing credit responsibly is crucial for building a secure financial future, and this is particularly important in the context of divorce proceedings. This includes avoiding unnecessary debt and establishing or maintaining good credit ratings.

Read more about divorce financial planning for long term security

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases