how to manage co parenting conflicts post divorce

Maintaining a Positive Co-Parenting Relationship

Understanding the Importance of a Positive Co-Parenting Relationship

Maintaining a positive co-parenting relationship, even amidst conflict, is crucial for the well-being of children. A harmonious co-parenting dynamic fosters a stable and supportive environment where children can thrive. When parents can communicate effectively and work together, children experience less stress and anxiety, and are better equipped to navigate the complexities of life. This positive environment promotes emotional security and allows children to develop healthy relationships with both parents, ultimately contributing to their overall emotional and psychological development.

It's essential to acknowledge that a positive co-parenting relationship isn't always easy, especially after a separation or divorce. However, the effort to maintain a respectful and cooperative relationship is invaluable to the child's well-being. Focusing on the best interests of the child, rather than personal grievances, can significantly contribute to a healthier co-parenting dynamic. Ultimately, a positive co-parenting relationship minimizes the negative impact of conflict and allows children to flourish.

Effective Communication Strategies for Co-Parents

Open and honest communication is paramount in co-parenting. This includes actively listening to the other parent's perspective, even when differing opinions exist. Regular, scheduled communication, whether through phone calls, text messages, or email, can help maintain a consistent flow of information regarding the child's needs and activities. Using I statements to express feelings and needs, rather than making accusations, is a crucial element of effective communication. This approach fosters a more collaborative atmosphere and minimizes misunderstandings.

Establishing clear and consistent boundaries is also vital. This involves agreeing on rules and routines for the child's daily life, such as school schedules, extracurricular activities, and bedtime routines. Creating a shared understanding of expectations for each parent can reduce ambiguity and prevent potential conflicts. Understanding each other's strengths and weaknesses as parents will help build a more collaborative dynamic.

Addressing and Resolving Conflicts Constructively

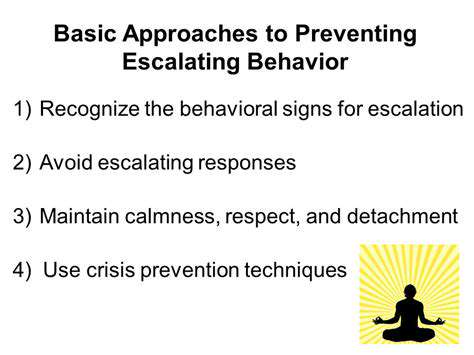

Conflict is inevitable in any co-parenting relationship, but how parents address and resolve it significantly impacts the child. It's vital to approach disagreements with a focus on finding solutions that benefit the child. Avoid bringing up past grievances or personal issues during discussions about the children. Instead, focus on the specific issues at hand and work towards mutually agreeable solutions. Utilizing a mediator or therapist can be invaluable in facilitating constructive dialogue and resolving conflicts in a healthy manner, ultimately prioritizing the child's best interests.

Seeking professional guidance is often beneficial in co-parenting disputes. A therapist or mediator can provide valuable tools and strategies for effective communication and conflict resolution. They can help facilitate understanding, promote compromise, and navigate complex situations with an objective perspective. This approach can prevent escalation of conflict and help maintain a positive environment for the child.

Prioritizing the Child's Well-being in Co-Parenting

Throughout the co-parenting process, placing the child's well-being at the forefront is essential. This involves focusing on the child's emotional, social, and academic needs, ensuring consistent support and a stable environment. Avoid dragging the child into adult disputes. Children should not be used as messengers or be forced to take sides in disagreements between parents. Maintaining a united front, even during challenging times, is crucial for the child's emotional security.

Consistent routines and clear expectations create a sense of stability for the child. This stability is vital for their emotional and psychological well-being, allowing them to feel secure and understood. Remember, the goal is to co-parent effectively, not just for the present, but for the long-term well-being of the child.

Read more about how to manage co parenting conflicts post divorce

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases