How to Draft a Fair Divorce Agreement

Defining the Purpose and Intent

When establishing the framework for a divorce settlement, one of the most critical steps involves clarifying its fundamental purpose and objectives. This process requires outlining specific goals such as equitable asset distribution, custody arrangements, and spousal support provisions. By explicitly defining these elements upfront, both parties can minimize potential misunderstandings and conflicts down the road. The agreement should comprehensively address how these arrangements will impact both individuals moving forward, with particular attention to eliminating any ambiguous language that could lead to differing interpretations.

Comprehensive Asset Identification

A thorough inventory of all marital assets forms the backbone of any fair settlement. This includes not just obvious items like real estate and bank accounts, but also less tangible assets such as intellectual property, frequent flyer miles, and even collectibles. Proper documentation of each asset's current market value and ownership history is absolutely essential for creating an equitable division plan. Professional appraisals may be necessary for certain high-value or complex assets to ensure accurate valuation.

Liability Assessment

Many couples focus primarily on asset division while underestimating the importance of properly addressing shared liabilities. The agreement must clearly outline responsibility for all outstanding debts, including mortgages, credit card balances, personal loans, and tax obligations. Specific provisions should detail payment schedules and consequences for non-payment to protect both parties' financial interests.

Child-Related Provisions

For parents, crafting detailed custody arrangements requires careful consideration of numerous practical factors beyond just legal custody designations. The agreement should address:

- School district boundaries and educational decisions

- Healthcare authorization protocols

- Travel consent procedures

- Technology usage guidelines during parenting time

Spousal Maintenance Considerations

Alimony determinations require analysis of multiple variables including:

- Duration of the marriage

- Each spouse's earning potential

- Career sacrifices made during the marriage

- Standard of living established during the union

Future-Proofing the Agreement

Well-drafted agreements anticipate potential future scenarios such as:

- Relocation of either party

- Significant changes in income

- Health crises

- Remarriage or cohabitation

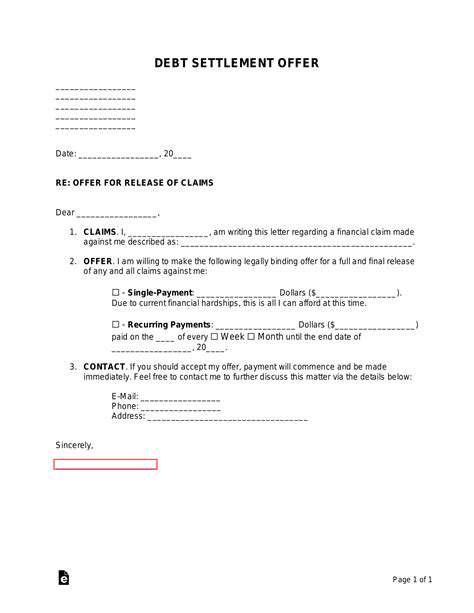

Final Review Process

Before execution, both parties should:

- Conduct line-by-line reviews with their respective attorneys

- Verify all financial disclosures

- Confirm understanding of all terms

- Address any remaining questions or concerns

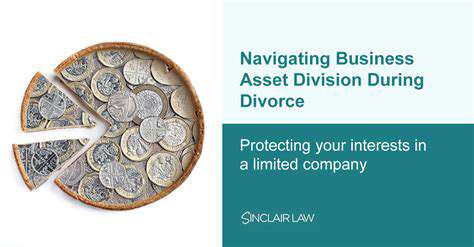

Addressing Property Division: A Balanced Approach

Property Classification Fundamentals

Proper categorization of assets requires understanding jurisdictional nuances in marital property definitions. Some states employ community property principles while others use equitable distribution models. Misclassification of even a single significant asset can dramatically alter settlement outcomes. Particular attention should be paid to assets with mixed character, such as inheritance funds that were commingled with marital accounts.

Valuation Methodologies

Different asset classes require specialized valuation approaches:

- Real estate: Comparative market analysis vs. formal appraisal

- Business interests: Discounted cash flow analysis

- Retirement accounts: Present value calculations

- Collectibles: Expert appraisal

Creative Distribution Solutions

Beyond simple percentage splits, consider:

- Asset swaps to maintain ownership continuity

- Staggered distribution timelines

- Buyout arrangements with financing terms

- Shared ownership structures with clear usage protocols

Tax Implications

The agreement must account for:

- Capital gains exposure

- Retirement account distribution rules

- Dependency exemptions

- Potential alimony deductibility

Modern businesses increasingly rely on digital infrastructure to maintain competitive advantage and operational efficiency. This technological integration affects everything from customer interactions to back-office processes.

Finalizing the Agreement: Legal Review and Signatures

Comprehensive Legal Scrutiny

A thorough attorney review should examine:

- Statutory compliance

- Internal consistency

- Enforceability of each provision

- Potential unintended consequences

Execution Protocols

Proper signing procedures require:

- Notarization where mandated

- Witness requirements

- Multiple original copies

- Secure storage of executed documents

Post-Signature Steps

After execution, parties should:

- File necessary court documents

- Implement asset transfer mechanisms

- Update beneficiary designations

- Establish monitoring systems for ongoing obligations

Read more about How to Draft a Fair Divorce Agreement

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases