practical guide to divorce asset division

Negotiation and Mediation

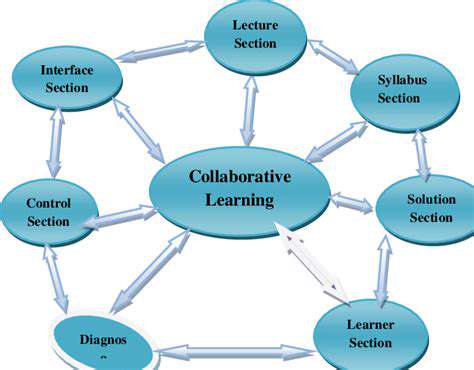

Negotiation, often facilitated by a mediator, is a common approach to dividing marital assets. This method allows both parties to participate actively in the process, potentially reaching a mutually agreeable solution that considers both financial and emotional factors. It can be a more cost-effective and less adversarial approach compared to litigation, and often leads to a more amicable resolution that preserves relationships, particularly important when children are involved. The goal is to achieve a settlement that addresses each party's needs and concerns fairly and efficiently. Mediation can provide a neutral platform to discuss complex financial issues and arrive at a balanced outcome.

In mediation, the parties are encouraged to communicate openly and honestly, potentially leading to a more personalized and tailored solution than a judge-ordered settlement. This process fosters collaboration, allowing for a greater degree of control over the outcome and can result in a stronger sense of commitment to the agreement.

Litigation: The Courtroom Route

When negotiation fails, litigation becomes the primary path to dividing assets. This involves presenting evidence and arguments before a judge, who will ultimately make a decision on the division of marital assets. It's a more formal and often more adversarial process, potentially leading to higher costs and a longer timeframe. Each party presents their case, including financial records, and the judge weighs the evidence to determine a fair division. This route can be necessary in cases of significant disputes or when one party is unwilling to cooperate in the negotiation process. Legal representation is crucial in this process.

Equitable Distribution: A Fair Approach

Equitable distribution is a legal principle that guides the division of marital assets. It doesn't necessarily mean equal division, but rather a fair and just distribution considering the contributions, efforts, and circumstances of each party during the marriage. Factors like the length of the marriage, each spouse's income and earning capacity, and any contributions to the marital estate, such as homemaking or raising children, are taken into account. This approach aims to ensure a just outcome that reflects the totality of the marital relationship. It's essential to understand the specific criteria used in your jurisdiction regarding equitable distribution.

Community Property: A Different Model

In community property states, marital assets are viewed as jointly owned by both spouses. This means any income earned during the marriage is typically considered joint property. The division of assets in these states is often more straightforward, frequently following a 50/50 split. However, exceptions can exist depending on the specific circumstances of each case. Understanding the specific laws of your jurisdiction is crucial in community property states to ensure a proper understanding of the division process.

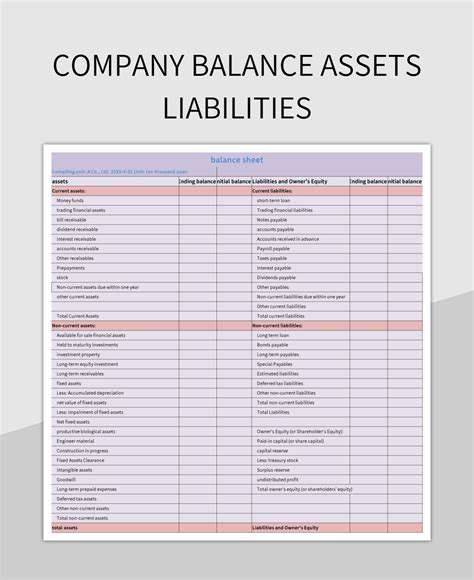

Valuation of Assets: A Critical Step

Accurate valuation of all marital assets is essential for a fair division. This includes real estate, bank accounts, investments, retirement accounts, and other personal property. Detailed financial records are necessary to determine the current market value of these assets. Often, professional appraisers or valuators are required for complex assets like businesses or property portfolios. Accurate valuation is essential to ensure that both parties receive their fair share of assets.

Division of Debts: An Often Overlooked Aspect

Dividing marital debts is frequently a crucial aspect of divorce proceedings that often gets overlooked. Both the assets and liabilities acquired during the marriage are usually subject to division. This includes credit card debt, loans, and other outstanding financial obligations. The division of debts is usually handled in conjunction with the division of assets, and understanding the applicable laws and procedures is essential for a smooth process. The division of debts is just as important as the division of assets and requires careful consideration.

Prenuptial Agreements: A Proactive Strategy

Prenuptial agreements, also known as prenuptial contracts, are legally binding agreements made between partners before marriage. These agreements outline how assets will be divided in the event of a divorce. They can be a proactive way to avoid disputes and define expectations regarding finances. Prenuptial agreements can protect individual assets, outline future income division, and specify the treatment of inherited assets. However, these agreements require careful legal review and discussion with counsel to ensure they are fair and enforceable. Prenuptial agreements require careful consideration and legal advice.

Addressing Retirement Accounts in Divorce Proceedings

Understanding the Importance of Retirement Accounts in Divorce

Retirement accounts, such as 401(k)s, IRAs, and pensions, often represent a significant portion of a couple's accumulated assets. These accounts, built over years of contributions, can substantially impact the financial well-being of each spouse following a divorce. Understanding the legal framework surrounding these accounts is crucial for navigating the complexities of a divorce proceeding and ensuring a fair division of assets.

Often, the division of these accounts is not simply a matter of splitting the balance in half. Special considerations and legal rules govern how these assets are treated during the divorce process. This necessitates careful attention to the specific circumstances of each case and the applicable laws in the jurisdiction.

Legal Considerations Regarding Retirement Account Division

State laws vary significantly in how retirement accounts are divided during divorce. Some jurisdictions adhere to equitable distribution principles, meaning assets are divided fairly, considering factors like duration of the marriage, each spouse's contributions, and the overall financial circumstances. Other jurisdictions may apply community property laws, which often mandate a 50/50 division of assets accumulated during the marriage.

It's essential to consult with an attorney experienced in family law to understand the specific laws governing retirement accounts in your jurisdiction. This will help you comprehend the potential outcomes and how to best protect your interests.

Types of Retirement Accounts and Their Implications

Different types of retirement accounts, such as traditional IRAs, Roth IRAs, 401(k)s, and pensions, have distinct characteristics that affect how they are treated in divorce. Understanding these differences is crucial for determining the appropriate division strategy. For example, traditional IRAs may involve tax implications that need careful consideration during the division process.

Valuation of Retirement Accounts

Accurate valuation of retirement accounts is essential for a fair division. This often involves expert appraisals or utilizing current market values. This process can be complex, especially for accounts with fluctuating investments. The valuation date and the methods employed can significantly impact the final division.

Proper valuation is key to ensuring both parties receive a fair share of the account's value, taking into account any potential future growth or losses.

Spousal Support and Retirement Accounts

In some cases, spousal support may be awarded, and the division of retirement accounts can be intertwined with these considerations. The court will assess the circumstances of the marriage and each spouse's financial needs to determine the appropriate level of support, potentially factoring in the division of retirement accounts.

The potential impact of retirement account division on spousal support obligations must be considered during the divorce proceedings. It's crucial to understand how the court might balance these two aspects of the divorce settlement.

Tax Implications of Retirement Account Division

Dividing retirement accounts can have significant tax implications for both spouses. Distributions from retirement accounts are often subject to income tax and potentially penalties. Understanding these tax consequences is vital for making informed decisions about the division of these assets.

Consulting with a tax professional is highly recommended to fully understand the tax implications of the proposed division.

Protecting Your Interests During Divorce Proceedings

Navigating the complexities of retirement account division in a divorce can be overwhelming. Seeking professional legal counsel is critical to protecting your interests. An experienced family law attorney can guide you through the process, ensuring that you understand your rights and options.

Remember, making well-informed decisions requires thorough understanding of the legal framework, financial implications, and potential tax consequences.

Legal Counsel and Documentation in the Asset Division Process

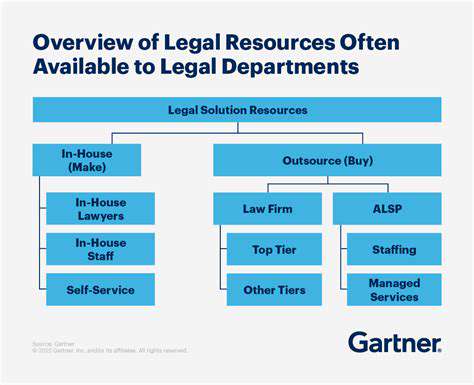

Understanding Legal Counsel

Legal counsel plays a crucial role in navigating the complexities of legal frameworks and ensuring compliance. A qualified legal professional can provide expert guidance on a wide range of legal issues, from contract negotiation to intellectual property protection. This expertise is essential for businesses to avoid costly mistakes and potential legal repercussions. This includes understanding and adhering to relevant regulations, and ensuring all operations are conducted within the bounds of the law.

Moreover, legal counsel can be instrumental in risk mitigation. By proactively identifying potential legal challenges and developing strategies to address them, businesses can protect their interests and minimize their exposure to legal disputes. Thorough legal advice is invaluable in preventing costly and time-consuming litigation.

Importance of Comprehensive Documentation

Comprehensive documentation is critical for supporting legal claims and demonstrating compliance with regulations. Detailed records of agreements, transactions, and internal policies are essential for establishing a clear audit trail and defending against potential legal challenges. This meticulous record-keeping can be vital in resolving disputes or demonstrating adherence to legal obligations.

Well-maintained documentation can significantly strengthen a company's legal position in case of a dispute. It provides concrete evidence of actions and decisions, making it easier to substantiate claims and counter arguments. Robust documentation is a cornerstone of legal defense.

Contract Review and Negotiation

Thorough contract review and negotiation are critical to safeguarding a company's interests. A lawyer's expertise in contract law is essential for understanding the implications of various clauses and ensuring that the agreement protects the company from potential risks. By meticulously examining the terms and conditions, legal counsel can identify potential ambiguities or loopholes that could be exploited by the other party.

Intellectual Property Protection

Protecting intellectual property (IP) is paramount for businesses that rely on innovative ideas and creations. A legal professional specializing in IP law can advise on the best strategies for patenting inventions, trademarks, and copyrights. This ensures that the company's valuable assets are protected from unauthorized use or infringement.

Protecting intellectual property is crucial for maintaining a company's competitive edge and safeguarding its investments in innovation. It also enables the company to leverage its IP for commercial gain and to defend against infringement claims.

Compliance with Regulations

Staying compliant with various regulations is vital for any business operating within a specific jurisdiction. Legal counsel can provide guidance on navigating complex regulatory landscapes, ensuring that the company's operations are in line with all applicable rules and standards. This proactive approach to compliance minimizes the risk of penalties and legal challenges.

Dispute Resolution and Litigation

Legal counsel is essential during disputes and litigation. They can provide guidance on the best course of action, representing the company's interests in negotiations, mediations, arbitrations, and court proceedings. Effective legal representation during a dispute can significantly impact the outcome. A skilled legal team can help minimize financial losses and reputational damage.

Read more about practical guide to divorce asset division

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases