How to Set Financial Goals After Divorce

Prioritizing Your Spending

Within your new budget, it’s crucial to prioritize essential expenses while allocating funds for discretionary spending. Create categories for necessary expenses like housing, utilities, and groceries, ensuring these are fully funded first. Then assess your discretionary categories, which may include entertainment and dining out.

Implementing the 50/30/20 rule can be effective here, where 50% of your income goes to needs, 30% to wants, and 20% to savings or debt repayment. By prioritizing your spending, not only do you enhance financial stability, but you also create space to enjoy life within your means.

Utilizing Budgeting Tools

In today's digital age, numerous budgeting tools and applications can help you maintain an effective budget. Programs like Mint or YNAB (You Need A Budget) provide intuitively designed interfaces to categorize expenses, track spending, and visualize your financial goals. They also send reminders and alerts, making it easier to stick to your budget.

Furthermore, consider traditional methods such as the envelope system for cash-based spending. This method allows you to set aside cash for different categories, making it easier to avoid overspending. Experiment with different tools to find the one that suits your style best, as personal preference can greatly influence your budgeting success.

Reviewing and Adjusting Your Budget Regularly

A budget is not a one-time task; it requires regular review and adjustment to remain effective. Set aside time monthly to revisit your financial goals and assess your spending habits. This allows you to make necessary changes based on fluctuations in income or unexpected expenses.

During these reviews, consider any lifestyle changes that may affect your financial situation. For example, if you find that a particular category consistently exceeds your budget, investigate whether it’s necessary to reallocate funds or cut back on spending in that area.

Creating an Emergency Fund

A solid emergency fund is an essential component of any financial plan, especially after a major life change like divorce. Aim to save three to six months’ worth of living expenses to cover unforeseen emergencies such as job loss, medical expenses, or urgent home repairs. This buffer not only provides peace of mind but also protects you from relying on credit in times of need.

Start small; even setting aside a modest amount each month can build toward your goal over time. Automating the savings process can make this easier, as you can divert funds into a separate savings account without needing to think about it. This deliberate approach can help foster a sense of financial security in your new life.

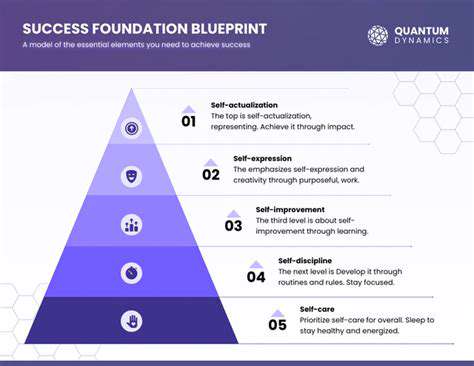

Setting Short-term and Long-term Financial Goals

Understanding the Importance of Financial Goals

Financial goals act as a roadmap to guide individuals through their economic journey, especially important after a divorce. By establishing clear objectives, you can ensure that your finances are aligned with your values and needs. Furthermore, understanding the difference between short-term and long-term goals can streamline your planning process.

Research indicates that individuals who set specific financial goals are more likely to achieve financial security. According to a study from the National Endowment for Financial Education, those with a plan in place were 50% more likely to stay on track with their saving and spending habits. This makes it vital to craft goals that suit your post-divorce lifestyle.

Defining Short-term Financial Goals

Short-term financial goals are typically those you aim to achieve within the next year or two. These can include building an emergency fund, creating a budget, or paying off debts accrued during the divorce process. It's essential to prioritize immediate needs while considering longer-term aspirations.

When setting these goals, think about what's most pressing in your financial landscape. If unexpected expenses arise—like legal fees or moving costs—addressing them should be at the top of your list. A practical approach is to allocate a percentage of your monthly income to these short-term objectives to maintain focus.

Additionally, tracking your progress through budgeting apps or spreadsheets can provide insightful feedback. Staying accountable will keep you motivated and help you adjust your plans as personal circumstances change.

Establishing Long-term Financial Goals

Long-term financial goals usually span a period of three years or more and often pertain to significant life events or investments, such as retirement, buying a home, or funding children's education. It's crucial to define these aspirations with consideration of your new financial reality post-divorce.

Many financial advisors emphasize the need for thorough research when setting long-term goals. For instance, understanding market trends or investment options can empower you to make informed decisions that align with your risk tolerance. Aim for a balanced mix of secure investments while allowing for some growth potential.

Creating a Realistic Budget

Following a divorce, crafting a realistic budget that encompasses your new financial situation is fundamental. Begin by listing all income sources, followed by essential expenses, such as housing, utilities, and food. This exercise will provide clarity on how much you have available for savings and discretionary spending.

To maintain financial discipline, consider the 50/30/20 Budget Rule—50% of your income goes to needs, 30% to wants, and 20% to savings or debt repayment. This structure can guide your spending habits and ensure that you're prioritizing your goals effectively.

Prioritizing Debt Management

Debt management is crucial, particularly after a divorce when financial situations can shift dramatically. Identify what debts you currently owe and prioritize them according to interest rates. High-interest debts, such as credit cards, should be tackled first due to their potential to accumulate quickly.

Conversely, consider if consolidating student loans or negotiating lower payments on existing debts makes sense for your circumstances. Engaging with a financial advisor may provide additional strategies to manage your debt effectively and relieve some financial pressure.

Adapting to Changing Circumstances

Your financial goals should remain flexible as life circumstances evolve. As you settle into post-divorce life, you may encounter unexpected changes—like a new job, relocation, or even changes in child support. Regularly reassessing your goals ensures they are aligned with your current situation and still attainable.

A good practice is to review your financial goals at least once every six months. This frequency allows for adjustments based on income changes, shifts in expenses, or new priorities that arise. Staying proactive will enable you to navigate life’s unpredictability with a solid financial foundation.

Seeking Professional Guidance

Finally, seeking professional financial advice can significantly enhance your goal-setting process. A certified financial planner can offer personalized insights based on your unique situation, helping you craft a strategic plan that builds upon your strengths and addresses your weaknesses.

Moreover, engaging in workshops or leveraging online resources provides additional educational tools that can refine your financial understanding. Many find that a varied approach—combining self-education with professional help—yields the best results in achieving financial stability after divorce.

Consulting Financial Professionals

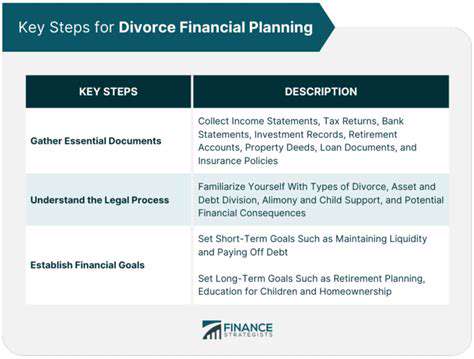

Understanding Your Financial Landscape

After a divorce, it is crucial to gain a clear understanding of your financial situation. Begin by taking stock of your income, expenses, and debts. Make a list of all your assets, including bank accounts, retirement funds, and properties. This comprehensive inventory will provide a solid foundation for setting realistic financial goals. Remember, being fully informed is the first step toward Financial Empowerment.

Additionally, consider engaging a financial planner who specializes in post-divorce finances. These professionals can help dissect your financial standing and tailor strategies based on your unique situation. They understand the complexities that come with divorce settlements and can guide you in making sound decisions.

- Assess income and expenses.

- List all assets and debts.

- Consult a specialized financial planner.

Setting Realistic Financial Goals

Once you have a clear picture of your financial landscape, it is time to set achievable financial goals. Begin with short-term goals, such as budgeting effectively or paying off specific debts. It's essential to make these goals specific and measurable to track your progress. For example, instead of saying I’ll save money, set a goal to save $200 each month. This level of specificity not only clarifies your target but also motivates you to achieve your goals.

In addition to short-term goals, identify medium and long-term goals, like saving for retirement or planning for children's education. These goals should align with your lifestyle changes post-divorce, ensuring they are realistic yet aspirational. Write these goals down and revisit them periodically to assess your progress and make necessary adjustments.

Effective goal setting is not just about numbers; it's about creating a balanced life. Ensure you factor in your personal aspirations alongside financial considerations, allowing for growth and satisfaction.

The Value of Continuous Financial Education

In today's fast-paced financial environment, continuous education is paramount. Familiarize yourself with the basics of personal finance, investment opportunities, and retirement planning. Resources such as online courses, books, and financial workshops can be highly beneficial in this regard. The more informed you are, the better equipped you will be to make smart financial choices.

Consider following financial news outlets and podcasts that focus on personal finance. Engaging with these resources regularly will keep you updated on economic changes that can impact your financial strategies. Staying educated allows you to adapt to changing circumstances, preserving your financial health.

Moreover, joining community groups or forums can provide valuable perspectives and support. Sharing experiences with others who have faced similar challenges can offer not just strategies but the reassurance that you’re not alone in your financial journey.

Monitoring and Adjusting Your Financial Goals

Understanding Your Current Financial Situation

The first step in monitoring and adjusting your Financial Goals Post-Divorce is to have a clear understanding of your current financial status. This involves gathering detailed information about your income, expenses, debts, and assets. Many individuals underestimate the importance of creating a comprehensive financial inventory, which can offer you a clearer picture and help in decision-making.

Additionally, consider consulting with a financial advisor who specializes in divorce-related finances. They can help you navigate through complexities such as asset division, alimony, and child support, ensuring that you have a well-rounded view of your financial landscape.

Setting SMART Goals for Financial Health

Once you have a complete financial overview, it’s essential to set SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, rather than simply stating, I want to save more money, redefine it to I will save $300 every month for the next year. This specificity provides clarity and motivation. Financial goals crafted in this manner are not only realistic but can also contribute to enhancing your overall financial literacy.

Developing a Budget That Works for You

A personalized budget is a critical tool for managing your finances after divorce. By categorizing your expenses into needs, wants, and savings, you can allocate your resources more effectively. Many people find the 50/30/20 rule helpful, which suggests that 50% of your income should go towards needs, 30% towards wants, and 20% towards savings. This structure aids in maintaining a balance and ensuring that you’re saving for the future while still enjoying life.

Regularly Reviewing and Adjusting Financial Plans

Financial situations can change swiftly due to unexpected circumstances such as job loss or medical expenses. Therefore, it’s advisable to earmark time for regular reviews—at least quarterly. During these assessments, check if you are on track with your savings goals, investment plans, and debt repayment strategies. By remaining proactive and adaptable, you can better navigate through financial uncertainties.

Moreover, tracking your progress not only keeps your financial health in check but also helps maintain a motivational momentum. Utilize apps and spreadsheets to monitor your budget against your goals; this digital insight can be beneficial.

Seeking Professional Guidance When Necessary

While self-management is crucial, seeking professional advice is beneficial in navigating complex financial decisions after a divorce. Financial planners or advisors can provide insights based on your unique situation, helping you align your goals with broader financial strategies. In fact, studies show that individuals who engage with financial professionals tend to achieve better financial outcomes than those who attempt to manage everything alone.

Emphasizing the Importance of Emergency Savings

One of the key aspects of financial stability post-divorce is the establishment of an emergency fund. Generally, experts recommend having at least three to six months’ worth of living expenses saved in an easily accessible account. This cushion not only provides peace of mind but also protects against future financial downturns. Developing this habit can significantly enhance your financial resilience and help you stick to your goals.