how to prepare for divorce mediation sessions

Setting Realistic Expectations

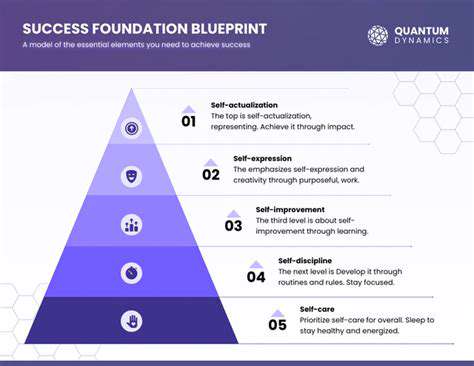

Defining your goals and expectations is crucial for a successful outcome. It's essential to be realistic and avoid setting targets that are unattainable or overly ambitious. A well-defined, achievable goal provides a clear roadmap and motivates sustained effort. Understanding the resources required, potential challenges, and the timeframe needed is crucial for establishing realistic expectations.

Consider the resources available, both internal and external. Are there any external factors that might impact the timeline or resources needed? If so, adjust the expectations accordingly. This proactive approach helps avoid disappointments and ensures a more positive experience.

Understanding the Process

Thoroughly understanding the process involved in achieving your goals is paramount. This involves researching the steps, identifying potential obstacles, and developing strategies for overcoming them. Detailed planning and preparation are essential for success. This in-depth understanding helps in efficient resource allocation and prevents potential roadblocks.

Researching the process and breaking down the tasks into smaller, manageable steps can make the whole journey less overwhelming and more manageable. Understanding the specific requirements, timelines, and dependencies within the process is vital. This clarity reduces ambiguity and allows for more effective strategy development.

Prioritizing and Organizing Tasks

Prioritizing tasks effectively is essential to stay on track. Identify tasks with the highest impact and allocate resources accordingly. Effective prioritization ensures that critical tasks are addressed promptly, ultimately contributing to a more efficient workflow. This enables you to focus your efforts on the tasks that have the greatest potential for success.

Organizing tasks into manageable sections or projects can also make the process of achieving your goals feel less daunting. Breaking down larger goals into smaller, more manageable tasks helps to avoid feeling overwhelmed. Creating a timeline and assigning deadlines for each task can help maintain momentum and keep you on schedule.

Monitoring Progress and Adapting

Regular monitoring of progress is crucial to ensure that you're on track to meet your goals. This involves tracking key metrics, assessing performance, and identifying any deviations from the planned path. Regular check-ins and performance evaluations are essential for maintaining a proactive approach to goal achievement. This proactive approach ensures you can identify and correct any issues early on.

Adaptability is key in any process. Be prepared to adjust your strategies and timelines as needed. Circumstances can change, and it's vital to remain flexible and responsive to those changes. This allows for continuous improvement and ensures that you stay on the path to achieving your goals, even when faced with unforeseen obstacles.

Thoroughly Documenting Your Financial Situation: The Foundation for Fair Agreements

Understanding the Importance of Documentation

Thoroughly documenting your financial situation is crucial for navigating various aspects of life, from negotiating fair agreements to securing loans or resolving disputes. A comprehensive record provides a clear and verifiable history of your income, expenses, assets, and liabilities. This detailed documentation serves as a solid foundation for understanding your financial standing and empowers you to make informed decisions.

Without proper documentation, it becomes significantly harder to prove your financial position accurately. This lack of evidence can lead to misunderstandings, unfair treatment, and potentially costly errors in financial dealings. This process of documentation is not just for complex situations; it's a valuable practice for everyday financial management.

Categorizing and Tracking Income Sources

Precisely detailing all income sources is fundamental. This involves not only your salary but also any side hustles, investments, or other forms of earnings. Maintaining a detailed record of each income stream, including dates and amounts, helps you understand your overall financial inflow and aids in budgeting and future financial planning. Regularly updating this record ensures accuracy and prevents potential discrepancies when reviewing your financial position.

Detailed Record of Expenses

Keeping meticulous records of your expenses is equally vital. This includes everything from essential bills to discretionary spending. Classifying expenses into categories like housing, food, transportation, and entertainment helps you identify areas where you can potentially cut costs and optimize your budget. Analyzing this data allows you to pinpoint spending patterns and make informed choices about your financial habits.

This detailed record of expenses allows you to understand where your money is going and makes it easier to stay within your budget. Regularly reviewing these records can help you identify areas where you may be overspending and adjust your spending habits accordingly, leading to greater financial control.

Asset Valuation and Inventory

A comprehensive financial record should include a clear valuation of your assets. This encompasses everything from bank accounts and investments to real estate and personal property. Regularly updating the values of your assets, considering market fluctuations and any changes in their value, is essential for maintaining an accurate picture of your financial worth. This accurate valuation is critical for understanding your current net worth and making informed decisions about your financial future.

Liability Management and Debt Tracking

Documenting your liabilities is just as crucial as detailing your assets. This includes all debts, such as loans, credit card balances, and outstanding bills. Keeping a precise record of your outstanding debts, including interest rates and due dates, helps you stay organized and manage your financial obligations effectively. This organized approach to liability management empowers you to track your progress toward debt reduction and make informed decisions about debt repayment strategies.

Negotiating Fair Agreements and Resolving Disputes

Comprehensive financial documentation plays a significant role in fair negotiations and dispute resolution. When entering into agreements, having detailed records of your financial position provides a strong foundation for understanding your rights and obligations. In the event of a dispute, these records act as crucial evidence, supporting your claims and facilitating a more efficient and equitable resolution. This thoughtful documentation is invaluable in ensuring that your interests are protected and that you receive fair treatment in financial transactions.

Positive reinforcement is a cornerstone of effective communication and a powerful tool for building positive relationships. It involves recognizing and rewarding desired behaviors, which strengthens the likelihood of those behaviors being repeated. This approach fosters a supportive and encouraging environment where individuals feel valued and motivated to contribute. By focusing on the positive aspects of a person's actions, you create a cycle of encouragement that leads to improved performance and a more positive overall experience for everyone involved. Positive reinforcement strengthens the connection between the desired behavior and the positive outcome, creating a powerful incentive for continued improvement.

Preparing for Potential Challenges: Anticipating and Addressing Obstacles

Identifying Potential Obstacles

A crucial first step in preparing for potential challenges is identifying the possible obstacles that could hinder your public relations (PR) efforts. This involves a thorough understanding of your target audience, the competitive landscape, and the overall industry climate. Analyze past PR campaigns, both successful and unsuccessful, to pinpoint recurring issues or patterns. Forecasting potential crises, such as negative publicity or shifts in public opinion, is also essential to proactive PR strategy.

Developing Contingency Plans

Once you've identified potential challenges, you need to develop contingency plans to address them. These plans should outline specific actions and strategies for dealing with various scenarios. This proactive approach allows your PR team to react swiftly and effectively if a crisis arises. For example, if a negative review appears online, a pre-determined response strategy should be in place, ensuring a controlled and professional handling of the situation.

Building Relationships with Key Stakeholders

Strengthening relationships with key stakeholders, such as journalists, influencers, and community leaders, is vital for mitigating potential challenges. Strong relationships can act as a buffer during difficult times, providing support and understanding. Cultivating these connections demonstrates a proactive approach to PR, fostering trust and credibility that can be invaluable when faced with obstacles.

Creating a Robust Crisis Communication Plan

A comprehensive crisis communication plan is essential for navigating potential PR challenges. This plan should outline procedures for handling various scenarios, from negative publicity to product recalls. Define roles and responsibilities, establish communication protocols, and identify key spokespersons. Regularly review and update the plan to ensure its relevance in the face of evolving circumstances.

Monitoring and Evaluating Public Sentiment

Staying informed about public sentiment towards your organization or brand is crucial for anticipating and mitigating potential challenges. Utilize social media monitoring tools and other resources to track conversations and identify emerging trends. This ongoing analysis allows your PR team to understand public perceptions and adjust strategies accordingly, preemptively addressing concerns before they escalate into crises.

Practicing Effective Communication Strategies

Mastering effective communication strategies is paramount in overcoming PR challenges. This includes crafting clear, concise, and empathetic messages. Practice delivering these messages in various scenarios to ensure your team is prepared and confident in communicating effectively during challenging times. Strong communication skills are essential for maintaining credibility and trust with stakeholders during a crisis or other PR hurdles.

Read more about how to prepare for divorce mediation sessions

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

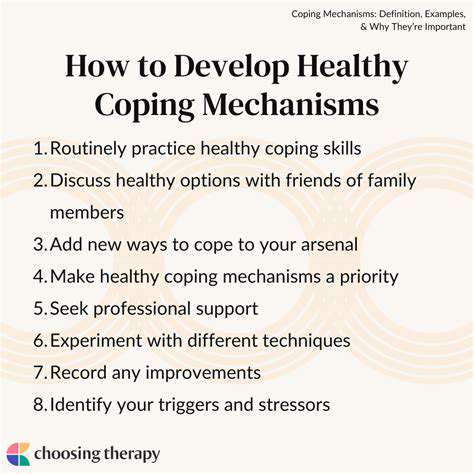

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

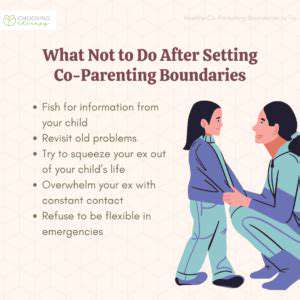

- best co parenting solutions for divorce cases