practical divorce financial planning guide

Understanding Your Combined Income and Expenses

A crucial first step in assessing your joint finances is to meticulously detail all sources of income for both partners. This includes wages, salaries, freelance earnings, rental income, and any other regular or occasional sources of revenue. It's essential to be as comprehensive as possible in documenting these details, as even seemingly small amounts can significantly impact your overall financial picture. Understanding where your money comes from is vital to budgeting effectively and making informed financial decisions. Furthermore, a detailed breakdown of all recurring and irregular monthly expenses is equally important, including housing costs, utilities, groceries, transportation, debt payments, and entertainment. This exercise will provide a clear picture of your current financial situation.

Categorizing expenses is helpful for identifying potential areas for savings and optimization. For example, if you find that a significant portion of your combined income goes towards dining out, exploring alternative options like cooking at home can lead to substantial cost savings over time. By meticulously analyzing your spending habits, you can identify patterns and pinpoint areas where you can make adjustments to improve your financial health. Detailed records of these expenses will be invaluable in developing a realistic budget and making necessary financial adjustments.

Developing a Joint Budget and Financial Goals

Once you have a thorough understanding of your combined income and expenses, it's time to develop a joint budget. This budget should outline your projected income and expenses for a specific period, such as a month or a year. It's crucial that both partners actively participate in creating this budget to ensure that it reflects the needs and priorities of both individuals. This collaboration will foster a shared understanding and ownership of the financial plan, which is essential for long-term success.

Simultaneously, establishing clear financial goals is paramount. These goals could range from paying off existing debts to saving for a down payment on a house, funding your children's education, or simply building a secure financial future. Defining these goals will help you stay motivated and focused on your desired financial outcomes. Having specific, measurable, achievable, relevant, and time-bound (SMART) goals will provide a roadmap for your financial journey and keep you on track.

Regular review and adjustments to your budget and goals are essential. Your circumstances and needs may change over time. Periodically reviewing your progress toward your goals and making necessary adjustments to your budget will ensure that your financial plan remains relevant and effective. Regular communication and transparency about financial matters are vital for maintaining a strong and healthy financial partnership.

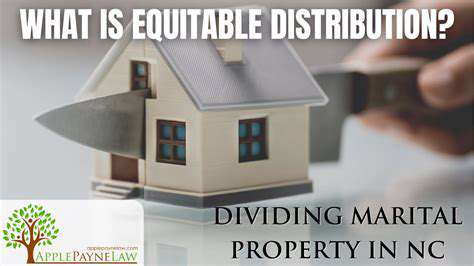

Dividing Assets: Equitable Distribution and Legal Considerations

Dividing Assets in a Fair Manner

Dividing assets fairly during a separation or divorce is a crucial aspect of the process. This often involves complex negotiations, legal considerations, and emotional sensitivity. Understanding the legal frameworks and procedures is paramount to ensuring a just outcome for all parties involved. Careful consideration of each asset's value and its impact on the future of the individuals involved is essential.

It's important to remember that fairness doesn't always mean equal division. Factors such as pre-marital assets, contributions to the relationship, and future needs of each individual should be weighed. This often requires professional guidance to ensure the process is conducted transparently and equitably.

Identifying and Valuing Assets

A critical first step in dividing assets is accurately identifying and valuing all jointly owned property. This encompasses everything from real estate and bank accounts to retirement funds and personal belongings. Thorough documentation is key to establishing a clear record of each asset's existence and value.

Appraisals may be necessary for certain assets, such as real estate or collectibles, to establish a fair market value. This process helps ensure a comprehensive understanding of the total value of the marital estate.

Considering Pre-Marital Assets

Pre-marital assets typically remain the sole property of the individual who acquired them. These assets are not subject to division in the divorce process, provided they were not commingled with marital funds or property in a way that significantly altered their character.

A detailed accounting of pre-marital assets is vital for a clear separation of assets and to ensure that those assets aren't inadvertently included in the marital estate subject to division.

Addressing Retirement Funds

Retirement funds, particularly 401(k)s and pensions, often pose unique challenges during asset division. Understanding the specific rules and regulations governing these funds is essential to avoid penalties and ensure a fair distribution. It's often prudent to seek guidance from financial professionals to navigate these complexities.

Proper division strategies are crucial to minimize tax implications and ensure the long-term financial well-being of both parties. This can include considering qualified domestic relations orders (QDROs) to facilitate a smooth transfer of retirement benefits.

Negotiation and Mediation Strategies

Effective communication and negotiation are critical in reaching an agreement that satisfies both parties. Mediation can be a valuable tool to facilitate productive discussions and help find common ground.

Mediation offers a less adversarial approach to resolving disputes, potentially saving time and money. It's important to be realistic about expectations and to focus on achieving a mutually acceptable outcome.

Legal Counsel and Representation

Seeking legal counsel is highly recommended during the asset division process. An experienced attorney can provide guidance on applicable laws, advocate for your interests, and ensure the process is conducted fairly and legally.

Legal representation is vital for navigating the complexities of asset division, protecting your rights and interests, and ensuring that all relevant factors are considered.

Tax Implications of Asset Division

Asset division can have significant tax implications. Understanding the tax consequences of various division strategies is crucial to minimize potential liabilities and optimize financial outcomes.

Consulting with a tax professional is highly recommended to understand the tax implications of the agreed-upon asset division and ensure compliance with tax laws. A professional can help to outline potential tax obligations and provide strategies to mitigate tax burdens.

Managing Debt: Responsibilities and Obligations

Understanding Your Financial Obligations

In a divorce, understanding your financial obligations is paramount to a smooth and fair settlement. This encompasses not only existing debts, like mortgages and credit card balances, but also potential future liabilities, such as alimony or child support payments. A thorough evaluation of your current financial situation, including all income sources, assets, and outstanding debts, is crucial for establishing a realistic and responsible financial plan. This process necessitates careful documentation and potentially consulting with financial professionals to ensure a comprehensive understanding of the full scope of your responsibilities.

Furthermore, it's important to recognize that certain debts may be subject to division or allocation as part of the divorce proceedings. Understanding the specific laws and regulations governing debt division in your jurisdiction is essential for navigating this aspect of the divorce process. This involves not only identifying the debts but also comprehending the legal frameworks surrounding their allocation. This knowledge empowers you to proactively participate in the negotiations and make informed decisions regarding your financial future.

Managing Debt During and After Divorce

Managing debt during the divorce process requires careful planning and proactive steps. It's crucial to maintain accurate records of all financial transactions, including payments made, debts incurred, and any changes in income or expenses. This meticulous record-keeping will be invaluable in the divorce proceedings and will help to establish a clear picture of your financial standing.

After the divorce, effectively managing debt remains a vital aspect of financial stability. Establishing a budget that accommodates any new financial obligations, such as alimony or child support, is critical. This budget should also account for potential changes in income or expenses, which can include the loss of a spouse's contribution to household expenses or the need to cover additional costs associated with raising children.

Exploring options like debt consolidation or repayment plans can be helpful in streamlining your financial obligations and ensuring long-term financial health. These strategies can provide a more manageable approach to debt repayment and help avoid accumulating additional debt.

Seeking guidance from a financial advisor or counselor can be extremely helpful in developing a strategy to manage your debt post-divorce. They can provide valuable insights and support, helping you navigate the complexities of debt management and develop strategies for achieving financial stability.

Maintaining open communication with your creditors is also an important aspect of managing debt during and after the divorce. This can help avoid potential issues or problems down the line.

Diligent financial planning and proactive management of debts are essential for a successful transition through the divorce process and into a financially secure future.

Efficiently utilizing available space is crucial for optimizing storage capacity. Careful planning and strategic placement of items can dramatically increase the overall storage potential within a given area. This involves considering the dimensions and characteristics of storage units, and arranging them in a way that minimizes wasted space.

Post-Divorce Financial Planning: Building a Secure Future

Understanding Your Post-Divorce Financial Reality

Navigating the financial landscape after a divorce requires careful consideration of your new circumstances. This often involves a significant shift in income and expenses, requiring a fresh assessment of your assets and liabilities. Understanding your current financial situation, including debts, savings, and investments, is crucial for developing a solid post-divorce financial plan. You need to realistically evaluate your income streams and potential expenses, factoring in child support, alimony, and any other legal obligations. This initial step lays the foundation for responsible financial decision-making moving forward.

It's essential to seek professional guidance during this process. A financial advisor can help you understand your specific needs and provide tailored solutions. They can assist in developing a budget that accounts for all your obligations and goals, ensuring you're on a path to financial stability. They can also help you explore various investment strategies and retirement planning options that align with your post-divorce financial situation. This professional support is invaluable in the often-complex process of rebuilding your financial future.

Restructuring Your Budget and Expenses

Creating a post-divorce budget is paramount to managing your finances effectively. Detailed budgeting is crucial for tracking income and expenses, ensuring that you are aware of where your money is going. This detailed budget should meticulously account for all sources of income, including your salary, child support payments, and any other income streams. It's important to also account for all significant expenses, such as housing, utilities, food, and transportation.

Careful allocation of funds is essential to meet your needs and long-term goals. This includes prioritizing essential expenses, such as housing and debt repayment, while also allocating funds for savings and future investments. Prioritizing debt repayment can significantly reduce long-term financial stress.

Regular review of this budget is crucial for making adjustments as your financial situation evolves. This flexibility is key to adapting to changing circumstances, whether it's a pay raise, new expenses, or shifts in your financial responsibilities.

Rebuilding Your Assets and Investments

Following a divorce, rebuilding your assets and investments is an important step toward financial security. This involves reassessing your investment portfolio and making necessary adjustments to reflect your new financial situation. Consider consulting with a financial advisor who can help you make informed decisions about your investments based on your specific needs and goals. Diversification is often a key component of a sound investment strategy, especially in the context of post-divorce financial planning.

Rebuilding savings is crucial for achieving financial stability in the long run. Establishing a savings plan, even with modest contributions, allows for security in times of unexpected expenses. It can also serve as a foundation for future financial goals, such as retirement or buying a home.

Legal and Tax Implications

Divorce often brings complex legal and tax implications that need careful consideration. Understanding the tax implications of alimony, child support, and asset division is essential for minimizing tax burdens and maximizing deductions. It's crucial to consult with a tax professional to ensure you are adhering to all relevant tax laws and regulations. The tax implications of your divorce settlement can be complex, potentially requiring significant documentation and careful planning. Seeking professional advice in this area is paramount to avoiding potential tax problems down the road.

Legal obligations, such as child support and alimony, must be factored into your financial plan. Understanding these obligations will allow for proper allocation of funds and ensure compliance with legal requirements. It's vital to understand the implications of these obligations to avoid financial penalties and maintain a positive legal standing. Accurate record keeping is crucial for managing these obligations effectively and for future reference.

Read more about practical divorce financial planning guide

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases