Self Development Guide for Divorced Individuals

Reclaiming Your Finances: Building a Solid Foundation

Budgeting for a Brighter Financial Future

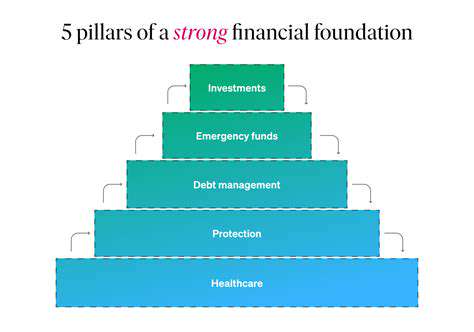

Creating a realistic budget is the cornerstone of financial stability. It's not about deprivation, but about understanding where your money goes. A detailed budget allows you to identify areas where you can cut unnecessary expenses and allocate more funds toward savings and debt reduction. This conscious allocation of resources, coupled with disciplined spending habits, is crucial for achieving long-term financial goals. By tracking income and expenses meticulously, you gain valuable insights into your spending patterns and can make informed decisions about your financial future.

A well-structured budget isn't a one-size-fits-all solution. It should be tailored to your individual circumstances, considering your income, expenses, and financial goals. Whether you're a student, a young professional, or a seasoned homeowner, a tailored budget will empower you to take control of your finances. This personalized approach ensures that your budget reflects your specific needs and aspirations.

Debt Management Strategies for Financial Freedom

Managing debt effectively is essential for achieving financial freedom. High-interest debt, such as credit card debt, can quickly accumulate and become a significant burden. Developing a debt repayment strategy, such as the snowball or avalanche method, is crucial for getting a handle on these debts. Prioritizing high-interest debts for repayment can significantly reduce the overall interest paid over time. This focused approach to debt management allows you to regain control of your financial future.

Debt consolidation, while not always the best option, can be a valuable tool if used strategically. Consolidating multiple debts into a single loan with a lower interest rate can significantly reduce monthly payments and potentially save you money in the long run. However, it's essential to carefully evaluate the terms and conditions of any consolidation loan to ensure it aligns with your long-term financial goals. This proactive approach can provide a clear path towards debt elimination and financial freedom.

Investing in Your Financial Future: Strategies for Growth

Investing is a critical component of building wealth and achieving long-term financial security. Understanding different investment options, such as stocks, bonds, and mutual funds, is key to making informed decisions. Diversification is a crucial strategy for mitigating risk and maximizing potential returns. Investing in a range of assets allows you to spread your risk and potentially benefit from the growth of various sectors.

Understanding your risk tolerance is essential when choosing investment strategies. Conservative investors may prefer low-risk options like bonds, while more aggressive investors might seek higher potential returns through stocks. Careful consideration of your risk tolerance, combined with a well-researched investment plan, can set you up for long-term financial success.

Seeking professional financial advice can provide valuable guidance. A financial advisor can help you develop a personalized investment strategy that aligns with your financial goals and risk tolerance. They can also provide valuable insights into market trends and help you navigate complex investment decisions. This expert guidance can be invaluable in maximizing the potential of your investments and achieving your financial aspirations.

Read more about Self Development Guide for Divorced Individuals

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases