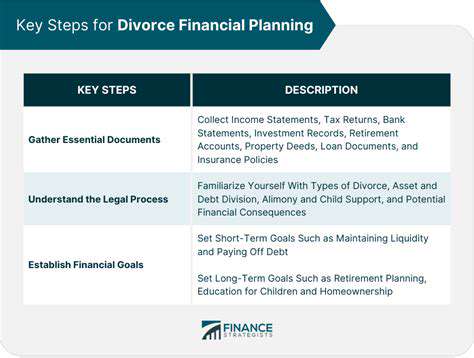

best practices for divorce financial planning 2025

Protecting and Preserving Assets: Minimizing Financial Losses

Understanding Asset Valuation

Getting an accurate Asset Valuation isn't just about numbers—it's about understanding what your possessions are truly worth in today's market. This means looking beyond price tags to consider wear and tear, rarity, and how useful items might be down the road. When you know exactly what your assets are worth, you can make smarter decisions about insurance and financial planning. This knowledge becomes your safety net if something gets damaged or goes missing.

Different assets require different approaches. That family heirloom in your attic? It needs a completely different valuation method than your brand-new laptop. Bringing in specialists, checking recent sales of similar items, and digging into historical data are all part of painting the full financial picture. This groundwork makes all the difference when protecting what matters most.

Implementing Robust Security Measures

Keeping your valuables safe starts with common sense but shouldn't stop there. Basic precautions like sturdy locks matter, but modern threats call for modern solutions—think motion sensors, 24/7 monitoring, and smart security systems. The best protection comes from creating a security plan that fits your specific situation, whether you're safeguarding a home office or a warehouse full of equipment.

Security isn't a set it and forget it deal. Regular checkups on your systems and training sessions for anyone who has access make sure your defenses don't develop weak spots. Investing in quality protection today can prevent devastating losses tomorrow—that's why smart security measures pay for themselves over time.

Maintaining Proper Insurance Coverage

Insurance acts as your financial parachute when accidents happen, but only if your policy actually matches what you own. That policy you signed five years ago? It probably doesn't cover the new additions to your art collection or the upgraded equipment in your workshop. Regular policy reviews with your agent ensure you're never caught off guard.

Policy fine print matters more than most people realize. Did you know many policies won't cover flood damage unless you specifically add it? Scheduling annual insurance check-ins helps spot these gaps before disaster strikes, turning potential financial nightmares into manageable situations.

Implementing Preventative Maintenance

That strange noise coming from your car's engine? The leaky pipe in the basement? Addressing small issues promptly prevents them from becoming budget-busting disasters. A stitch in time doesn't just save nine—it can save thousands when it comes to maintaining valuable assets. Keeping everything in good working order through scheduled checkups extends their lifespan and protects your investment.

Diversifying Investments

Putting all your financial eggs in one basket is risky business. Spreading investments across different sectors and asset types creates a safety net—when one area struggles, others may thrive. This balanced approach cushions the blow during market downturns while positioning you to benefit from various growth opportunities.

A well-mixed portfolio does more than reduce risk—it opens doors. While tech stocks soar one year, real estate might lead the next, and international markets could surge after that. This strategic variety helps your money work smarter, not harder, through economic ups and downs.

Establishing Clear Asset Documentation

Imagine trying to file an insurance claim after a fire when you can't remember what was in your home office. Detailed records—complete with photos, receipts, and serial numbers—turn disaster recovery from impossible to manageable. This paperwork becomes your evidence when proving what you owned and what it was worth.

Organization is key whether you prefer cloud storage or old-fashioned filing cabinets. Digital systems with searchable tags can save hours during stressful situations, while physical copies provide backup when technology fails. Regular updates to your inventory ensure you're always prepared for the unexpected.

Seeking Professional Guidance: Navigating the Complexities

Understanding the Role of a Divorce Attorney

Divorce attorneys do more than fill out paperwork—they translate legal complexities into plain English while protecting your interests. A skilled lawyer spots potential pitfalls you might miss and crafts strategies tailored to your unique circumstances. Their guidance often means the difference between a fair settlement and costly oversights.

Beyond the courtroom, these professionals provide stability during emotional turmoil. They become your voice in negotiations about children, homes, and finances—areas where emotions often cloud judgment. Their objective perspective helps prevent decisions you might regret years later.

The Importance of a Mediator in Divorce Proceedings

When communication breaks down, mediators rebuild bridges. These neutral professionals help couples find middle ground without expensive court battles. Their techniques often lead to solutions that rigid legal processes can't achieve, especially when children's needs are involved.

Mediators shine when both parties want resolution but struggle to talk productively. They identify shared priorities neither spouse may recognize and help craft agreements that respect both sides. This approach preserves relationships and bank accounts alike.

Financial Experts and Their Contributions

Untangling shared finances requires more than basic math. Forensic accountants dig deeper, uncovering hidden assets and accurately valuing complex holdings. Their analysis prevents one party from unknowingly accepting less than they deserve when dividing retirement accounts or business interests.

These specialists project future financial needs too. Seeing how today's decisions will impact next decade's budget helps avoid shortsighted agreements. Their reports give negotiations and court rulings the factual foundation they require.

Psychologists and Emotional Support Professionals

Divorce shakes lives beyond finances. Counselors provide tools to manage the rollercoaster of emotions—grief, anger, fear—that accompany this life change. Their strategies help maintain clarity when making decisions that will shape your future.

Children especially benefit from professional support during family transitions. Specialists create safe spaces for kids to process changes while teaching parents how to provide stability. Early intervention can prevent years of emotional fallout.

When to Seek Legal Guidance vs. Self-Representation

Simple divorces with full agreement on all terms might not require attorneys. But the moment complications arise—disputed custody, significant assets, or power imbalances—professional representation becomes essential. Lawyers navigate procedural landmines that trip up even the most prepared individuals.

Even in amicable splits, consulting an attorney ensures you understand all implications. That quick agreement about the house might have tax consequences neither of you considered. An hour with a professional can prevent years of regret.

Read more about best practices for divorce financial planning 2025

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases