best strategies for divorce property settlement

Assessing Your Assets and Liabilities

Understanding Your Assets

A crucial first step in any divorce property settlement is a comprehensive understanding of your assets. This encompasses everything from tangible items like real estate, vehicles, and jewelry to intangible assets such as retirement accounts, stocks, and intellectual property. Thorough documentation of each asset, including its current market value, ownership details, and any associated debts or encumbrances, is essential for a fair and equitable division. This detailed inventory lays the groundwork for negotiations and ensures that all parties are aware of the full extent of the marital estate.

Identifying the source of each asset—whether it was acquired before the marriage, during the marriage through gifts or inheritance, or as a result of joint efforts—is equally important. Understanding the origin of an asset can significantly impact its division in a divorce settlement, as some assets may be considered separate property, while others are considered marital property subject to equitable distribution.

Categorizing Your Liabilities

Equally important to understanding your assets is a precise accounting of your liabilities. This includes debts such as mortgages, loans, credit card balances, and outstanding taxes. A clear and accurate list of all outstanding debts, including the amount owed, interest rates, and any associated penalties, is vital for a fair settlement. This helps in calculating the net worth of the marital estate and determining the appropriate allocation of assets and liabilities during the divorce process.

Accurately documenting these liabilities, including their due dates and payment history, helps in the negotiation process and ensures that the division of assets is reflected in the final settlement agreement.

Evaluating Real Estate

Real estate often represents a significant portion of a couple's assets, and its valuation is critical during a divorce. Factors such as location, size, condition, and market value are crucial in determining the fair market price. Consider recent comparable sales in the area, property assessments, and expert appraisals to arrive at a realistic valuation. This helps in determining the fair distribution of the property in the settlement agreement.

Analyzing Retirement Accounts

Retirement accounts, including pensions, 401(k)s, and IRAs, often hold substantial value. Understanding the different types of retirement accounts and their respective regulations is critical in ensuring a fair division of these assets. Consulting with a financial advisor or legal professional specializing in divorce settlements is highly recommended to navigate the complexities of dividing retirement accounts and avoid potential tax implications.

Careful consideration should be given to the potential tax consequences of distributing retirement funds, and whether a Qualified Domestic Relations Order (QDRO) is necessary for a smooth transfer of assets. This is a critical aspect of the property settlement that requires specialized knowledge and support to ensure compliance with tax laws.

Assessing Other Marital Assets

Beyond real estate and retirement accounts, other assets, such as vehicles, personal property, and investments, need to be evaluated and documented. The value of each asset should be assessed, taking into account its current market value. Documentation of ownership, purchase dates, and any associated debts or liens is essential. This detailed inventory is crucial for establishing a clear picture of the overall marital estate.

Debt Allocation and Management

Dividing debts is a crucial component of a divorce settlement. A transparent and comprehensive list of all debts should be created, including the outstanding balance, interest rate, and payment terms. Negotiating a fair division of debts, taking into account individual financial situations, is essential to ensure both parties can manage their financial responsibilities post-divorce. Understanding the potential tax implications of debt division is also essential.

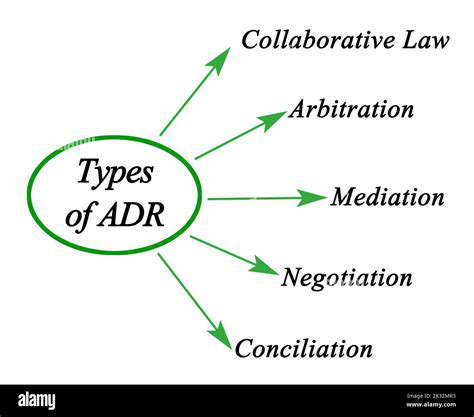

Utilizing Mediation and Alternative Dispute Resolution

Mediation as a Conflict Resolution Tool

Mediation is a structured process where a neutral third party, the mediator, facilitates communication and negotiation between disputing parties to help them reach a mutually agreeable resolution. This approach is often more effective than traditional litigation, as it allows the parties to actively participate in shaping the outcome and potentially preserving their relationship. Mediation fosters collaboration and understanding, aiming to find solutions that address the underlying concerns of all parties involved. This contrasts sharply with adversarial processes, where the focus is on winning rather than finding common ground.

Alternative Dispute Resolution (ADR) Options

Alternative Dispute Resolution (ADR) encompasses various methods beyond mediation, such as arbitration and negotiation. Arbitration involves a neutral third party who acts as a judge, hearing evidence and arguments from both sides and issuing a binding decision. Negotiation, on the other hand, involves direct discussion between the parties, potentially with or without the assistance of legal counsel. Each method offers unique advantages in specific contexts, allowing for tailored approaches to dispute resolution.

Cost-Effectiveness of Mediation

Mediation is often significantly more cost-effective than traditional litigation. Legal fees, court costs, and the time commitment involved in court proceedings can be substantial. Mediation, on the other hand, typically involves lower upfront costs and a more streamlined process, leading to quicker resolutions. This can save parties considerable financial resources and time, making it a practical choice for many disputes.

Preserving Relationships Through Mediation

A key advantage of mediation is its potential to preserve relationships between disputing parties. Unlike litigation, which often escalates conflict and animosity, mediation focuses on communication and understanding. This collaborative approach can foster a more positive and productive atmosphere, even after the dispute is resolved. This is particularly important in situations where a long-term relationship is at stake, such as business partnerships or family matters.

Confidentiality in Mediation Processes

Mediation proceedings are typically confidential, meaning that the discussions and information shared during the process are not disclosed to outside parties, including the courts. This confidentiality fosters a safe and open environment for communication, encouraging parties to be honest and forthcoming. This confidentiality is crucial for creating trust and encouraging open dialogue, which is essential for successful mediation.

Enhancing Communication Skills in Mediation

Mediation not only resolves disputes but also enhances communication skills for all participants. The process encourages active listening, clear articulation of concerns, and understanding the perspectives of others. These skills can be invaluable in personal and professional relationships, leading to improved communication dynamics in various contexts. By fostering effective communication, mediation can create a pathway to more amicable and productive interactions in the future.

Seeking Professional Legal Counsel

Understanding Your Rights and Responsibilities

Navigating a divorce can be emotionally and legally complex. Understanding your rights and responsibilities regarding marital assets is crucial for a fair and equitable property settlement. This involves recognizing the difference between community property (assets acquired during the marriage) and separate property (assets owned prior to the marriage or acquired during the marriage as a gift or inheritance). Failing to grasp these distinctions can lead to significant errors in the settlement process, potentially impacting your financial future.

Knowing your state's specific laws regarding divorce property division is paramount. Different jurisdictions have varying approaches to dividing assets, which can range from equitable distribution (fair division based on the circumstances of the marriage) to community property (dividing assets equally). This knowledge is essential to formulating a strategy for a favourable outcome.

Valuation of Marital Assets

Accurate valuation of all marital assets is fundamental to a fair property settlement. This includes not only tangible assets like real estate and vehicles but also intangible assets such as retirement accounts, pensions, and business interests. A thorough and professional appraisal is essential to ensure a precise valuation, as inflated or underestimated figures can disrupt the equilibrium of the settlement. This process requires careful consideration of market conditions and expert opinions.

Considering the current market value of assets is vital for establishing a realistic and equitable settlement. Fluctuating market conditions can influence the worth of certain assets, impacting the division process. Professionals can provide insights into current market trends and their potential impact on asset valuation.

Negotiation Strategies for a Settlement

Effective negotiation is a key component of achieving a favorable property settlement. This involves understanding your leverage, identifying your priorities, and presenting a clear and concise case for your position. Strong negotiation skills can help you achieve a fair division of assets without resorting to protracted legal battles.

Open communication and a willingness to compromise are crucial for successful negotiation. Understanding the other party's perspective, while maintaining your own interests, can lead to a mutually acceptable settlement. Seeking legal counsel can provide valuable guidance on negotiation strategies and tactics.

Mediation as an Alternative Dispute Resolution

Mediation offers an alternative approach to resolving disputes regarding property division, typically resulting in a quicker and more cost-effective resolution than litigation. A neutral mediator facilitates communication and negotiation between both parties, helping them reach a mutually agreeable settlement. This process can be particularly beneficial in preserving relationships and minimizing emotional distress.

Legal Representation and its Importance

Professional legal representation is essential for navigating the complexities of a divorce and property settlement. A skilled attorney can provide guidance on your rights, responsibilities, and the best strategies for achieving a fair outcome. They can also represent your interests throughout the legal process, ensuring your rights are protected and your needs are met.

An attorney's experience in divorce and property settlement cases will significantly impact the outcome. They can effectively evaluate the nuances of your situation, anticipate potential issues, and develop a comprehensive legal strategy to protect your interests.

Tax Implications of Property Division

Divorce property settlements often have significant tax implications that must be carefully considered. Understanding the tax consequences of asset division is vital to minimizing your tax liability and maximizing your financial advantages. A tax professional can provide valuable insight into these implications, ensuring you navigate the tax landscape proactively.

The division of assets can trigger capital gains taxes, which can be substantial. Legal and financial professionals can help you understand the tax implications of various settlement options and develop strategies to minimize the tax burden.

Protecting Your Financial Future After Divorce

A successful property settlement should lay a solid foundation for a secure financial future after divorce. This includes creating a clear plan for managing finances and assets, and understanding long-term financial goals. This crucial step involves developing a post-divorce financial strategy.

After the divorce, maintaining financial stability requires careful budgeting, asset management, and financial planning. Seeking professional financial advice can provide guidance and support in this crucial transition period.

Read more about best strategies for divorce property settlement

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases