divorce asset division legal checklist

Addressing Complex Assets: Retirement Funds and Businesses

Retirement Funds in Divorce

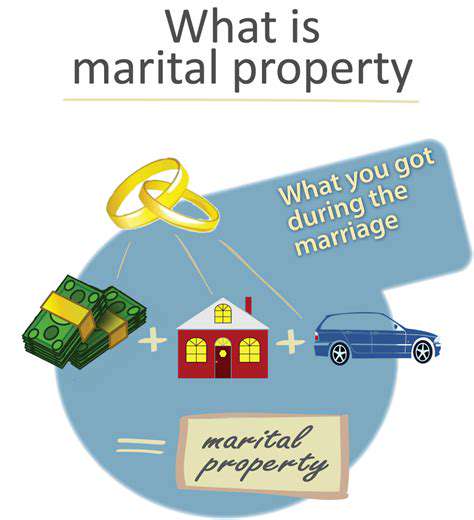

Dividing retirement funds during a divorce is a complex process that often requires careful consideration of both state laws and the specific circumstances of the parties involved. Understanding the different types of retirement accounts, such as 401(k)s, IRAs, and pensions, is crucial for navigating this aspect of asset division. State laws vary significantly regarding the treatment of these funds in a divorce, some allowing for equitable distribution while others might specify that retirement accounts are considered separate property. This often involves complex legal interpretations and potential tax implications for both parties, making professional legal counsel essential in this process.

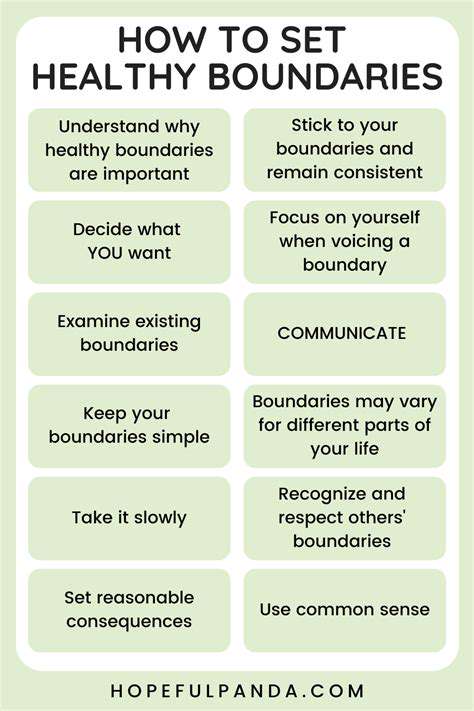

Spousal support or alimony may be affected by the division of retirement funds. The court may consider factors such as the length of the marriage, the parties' respective incomes, and the contributions each spouse made to the retirement account during the marriage. It's essential for both parties to understand how the division of retirement funds might impact their future financial well-being and to seek advice from qualified financial advisors to understand the long-term implications of the decisions made in the divorce settlement.

Business Interests in Divorce

The division of business interests during divorce is another area fraught with complexities. Determining the value of a business, whether a sole proprietorship, partnership, or corporation, can be challenging and often requires expert valuation services. This valuation is necessary to fairly distribute the business's assets and liabilities during the divorce process. The court may need to consider the contributions of each spouse to the business's success, the potential for future growth and profitability, and the ongoing operational requirements of the business. Ultimately, the goal is to achieve an equitable distribution of assets while ensuring that the business can continue to operate without undue hardship.

Often, the best course of action is to sell the business and divide the proceeds. However, this isn't always feasible or desirable. Other options include one spouse purchasing the other's interest in the business, or establishing a structured buy-out plan. These options require meticulous planning and legal guidance to protect the interests of all parties involved and to avoid potential future disputes related to the business's ownership and operation.

Tax Implications and Considerations

The division of retirement funds and business interests in a divorce often has significant tax implications for both parties. Distributions from retirement accounts, for example, may be subject to income tax and potentially penalties. It's crucial to consult with tax professionals to understand the tax consequences of various division strategies and to ensure that the division is conducted in a tax-efficient manner. Tax implications vary significantly based on the specific laws of the jurisdiction where the divorce is being finalized.

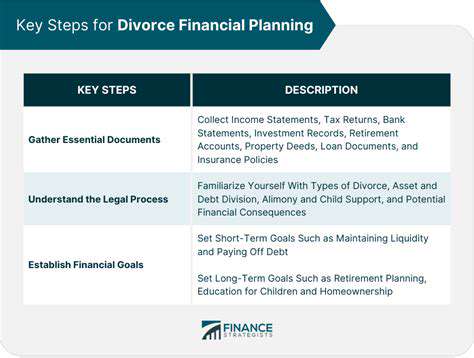

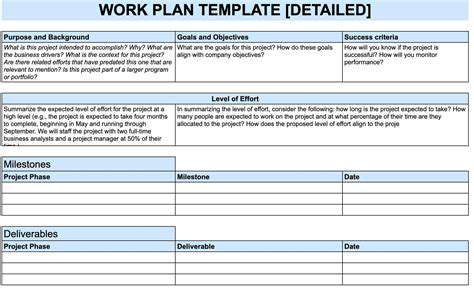

Proper documentation and record-keeping are essential throughout the entire process. This includes maintaining detailed financial records, consulting with legal and financial professionals, and carefully reviewing any agreements or stipulations related to the division of assets. Understanding the long-term financial implications of the decisions made is crucial, and both parties should seek advice from qualified professionals to ensure they are making informed choices.

Careful consideration must be given to how the division of assets affects future financial obligations, such as spousal support or child support. The tax implications of various division strategies should be carefully evaluated, and the parties should seek professional advice to navigate these complexities.

Consulting with a qualified financial advisor is essential to understand how the division of assets will affect retirement planning and future income. This includes assessing the impact on investment strategies and potential estate planning needs.

The complexities of divorce asset division necessitate careful consideration of the legal and financial implications. Both parties should seek competent legal and financial advice to navigate the intricacies of these processes effectively.

The emotional aspects of divorce should not overshadow the need for meticulous attention to detail in the division of assets. Seeking professional guidance ensures that both parties are treated fairly and that their future financial well-being is adequately protected.

Read more about divorce asset division legal checklist

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases