divorce custody battle resolution strategies

Understanding Your Current Financial Standing

A crucial first step in any financial planning process is a thorough assessment of your current financial situation. This involves evaluating your income sources, expenses, assets, and liabilities. Detailed budgeting and tracking of spending habits are essential to understanding where your money is going and identifying potential areas for improvement. Recognizing areas where you're overspending is key to creating a more effective financial plan. This self-awareness allows you to make informed decisions about saving, investing, and debt management.

Defining Your Short-Term Financial Objectives

Short-term financial goals typically encompass objectives achievable within a year or less. These might include saving for a down payment on a car, paying off high-interest debt, or building an emergency fund. Establishing clear, measurable short-term goals provides a roadmap for immediate progress and motivation. This focus on immediate achievements fosters a sense of accomplishment and encourages continued financial discipline.

Considering your immediate needs and desires is vital for creating a realistic and effective plan.

Identifying Your Long-Term Financial Aspirations

Long-term financial goals typically extend beyond a year, often encompassing retirement planning, education funding, or significant purchases like a home. These aspirations require careful planning and consideration of factors like inflation, potential market fluctuations, and personal circumstances. Long-term goals require a strategic approach, considering both the current financial situation and projected future needs. Developing a plan that aligns with your long-term objectives is essential for building a secure financial future.

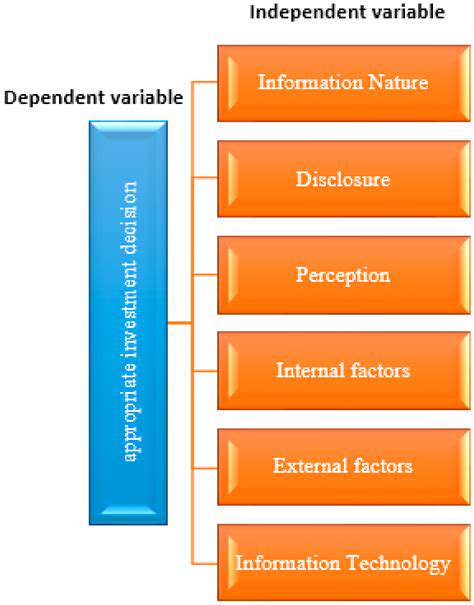

Analyzing Your Risk Tolerance

Understanding your risk tolerance is crucial in investment decisions. Different investment options carry varying degrees of risk and potential reward. If you're comfortable with higher risk, you might be open to investing in stocks or other volatile assets with the potential for higher returns. Conversely, if you prefer lower risk, you might lean towards safer investments like bonds or savings accounts. Careful consideration of your risk tolerance is essential for aligning investment choices with your personal comfort level. Avoiding impulsive decisions is crucial when dealing with financial matters.

Evaluating Your Available Resources

Evaluating your available resources encompasses not just your current income, but also existing assets, such as savings accounts, investments, and valuable property. Identifying and assessing these resources allows for a comprehensive understanding of your financial position and potential for growth. This evaluation provides a concrete foundation for developing a realistic financial plan. A thorough inventory of your resources is critical to building a solid financial strategy.

Considering External Factors and Influences

External factors, such as economic conditions, market trends, and personal circumstances, can significantly impact your financial situation. Understanding these influences is essential to adapting your strategies accordingly. Economic downturns or sudden life events can drastically alter your financial outlook. A flexible and adaptable financial plan is necessary for navigating these challenges. Proactive monitoring of external factors is crucial for staying on track with your financial goals.

Collaborative Law: A Cooperative Approach to Divorce

Understanding Collaborative Law

Collaborative law is a unique approach to divorce and other family law matters. Instead of adversarial proceedings in court, collaborative law fosters a cooperative environment where both parties work together to reach a mutually acceptable agreement. This approach prioritizes open communication, respect, and a focus on the best interests of the family, particularly children, aiming to minimize emotional distress and financial burden often associated with traditional litigation.

Key Principles of Collaborative Law

Collaborative law is built on several key principles. These include a commitment to communication and negotiation, a focus on the needs of all parties involved, especially any children, and a shared understanding that a collaborative approach is more beneficial than a confrontational one. Both parties must acknowledge that the process is not solely about winning or losing but about finding mutually acceptable solutions.

Advantages of Collaborative Law

Collaborative law offers several advantages over traditional litigation. It often leads to faster resolutions, significantly reducing the time and expense associated with court proceedings. The emphasis on communication and negotiation can also foster a more amicable and respectful environment for all parties involved, particularly children. The focus on finding a solution that works for everyone can also lead to agreements that are more sustainable and less likely to result in future conflict.

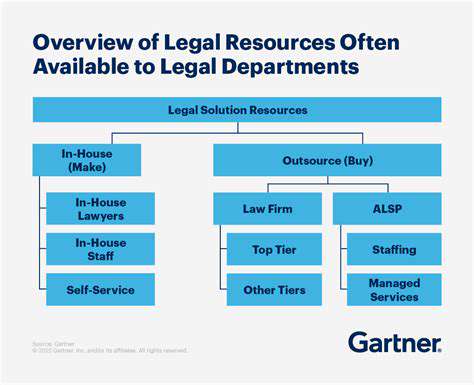

The Role of Attorneys in Collaborative Law

Collaborative law attorneys play a crucial role in guiding the process. They are committed to the collaborative approach and must be trained in collaborative law principles and techniques. These attorneys educate their clients about the collaborative process, help facilitate communication, and negotiate solutions that are fair and equitable. They are also committed to working together with the other party's attorney to achieve a mutually agreed-upon resolution.

Financial Implications of Collaborative Law

Collaborative law often results in significant cost savings compared to traditional litigation. The avoidance of extensive court hearings and legal fees associated with discovery and motions can lead to substantial financial benefits for both parties. However, it's important to be aware that collaborative law agreements may still involve legal fees for each party's attorney and any required expert assistance, such as child custody evaluations.

Dispute Resolution and Collaborative Agreements

Collaborative law is designed to resolve disputes outside of court. The process focuses on creating legally binding agreements that address all aspects of the divorce, including property division, child custody and support, and spousal support. These agreements are then reviewed by legal professionals and drafted to ensure they are legally sound and enforceable. This approach aims to avoid the often lengthy and costly court process and provide a more efficient method to achieve a satisfactory resolution for all parties.

Litigation: When Other Options Fail

Navigating the Legal Landscape

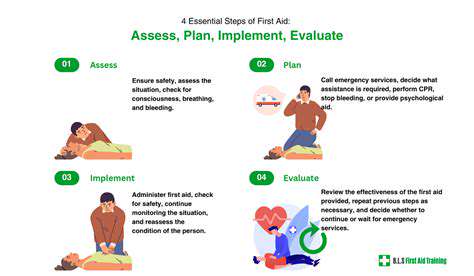

Litigation, while often a last resort, can be a crucial tool for resolving disputes when other avenues, such as negotiation or mediation, prove unsuccessful. Understanding the complexities of the legal process is paramount for anyone considering this path. It's essential to carefully evaluate the potential costs and benefits, considering factors like the value of the claim and the likelihood of success. This involves seeking legal counsel to understand the specific requirements and procedures pertinent to your situation.

The legal landscape is intricate and varies significantly based on jurisdiction. Different regions have distinct legal frameworks and procedures, demanding a thorough understanding of local regulations. Navigating these intricacies often requires expert legal advice, tailored to the specific circumstances of the case.

Assessing the Value of the Claim

A crucial step in considering litigation is assessing the potential value of the claim. This includes not only the financial compensation sought but also the potential for long-term ramifications and the implications for future relationships. A thorough assessment should consider all potential outcomes, including the possibility of a settlement or a complete loss. This evaluation is vital in determining whether the costs and risks associated with litigation are justified.

Identifying Potential Legal Remedies

Understanding the possible legal remedies available is critical in litigation. This involves exploring various legal options, including injunctions, damages, and specific performance. Each option has unique implications, and understanding these implications is key to making informed decisions about the course of action. The choice of remedy often depends on the nature of the dispute and the desired outcome.

The Role of Legal Counsel

Engaging competent legal counsel is paramount in any litigation process. A skilled attorney can provide guidance and support throughout the process, ensuring that all legal requirements are met. An experienced attorney will advise on the strengths and weaknesses of the case, helping to strategize and identify potential obstacles. Seeking legal representation from a reputable and experienced attorney is crucial for a successful outcome.

Pre-Litigation Strategies

Effective pre-litigation strategies can significantly influence the outcome of a case. These strategies may involve exploring alternative dispute resolution methods, such as mediation or arbitration. Documenting relevant evidence and assembling a strong case foundation is crucial. Thorough preparation can often lead to a more favorable outcome and potentially avoid the lengthy and costly process of full-blown litigation.

Understanding the Litigation Process

The litigation process itself is often complex and time-consuming. It involves various stages, including pleadings, discovery, motions, and trial. Each stage presents unique challenges and requires meticulous attention to detail. Understanding the timeline and the procedural requirements is essential for navigating the process effectively and managing expectations. This understanding is critical for navigating each stage effectively and minimizing potential delays.

Post-Litigation Considerations

Even after a successful resolution, post-litigation considerations are important. These can include enforcing judgments, managing settlements, and potentially addressing long-term implications. Ensuring the agreed-upon terms are adhered to and managing potential follow-up issues are critical components of a successful conclusion. Understanding the long-term ramifications of the legal action is essential. This requires careful planning to ensure all aspects of the resolution are addressed effectively.

Post-Divorce Support and Maintenance: Long-Term Considerations

Understanding the Long-Term Financial Implications

Post-divorce financial support, often referred to as alimony or spousal maintenance, is a crucial aspect of navigating the complexities of a separation. Understanding the long-term financial implications of these arrangements is vital, as it extends far beyond the initial settlement agreement. It's not just about the present but also about anticipating potential changes in income, expenses, and even unforeseen circumstances that could affect the recipient's or payer's financial stability.

Factors such as career changes, health issues, or even market fluctuations can dramatically alter the financial landscape. A thorough understanding of how these factors could impact the support payments is essential for both parties to ensure long-term financial security and stability.

Negotiating Fair and Sustainable Agreements

Achieving a fair and sustainable agreement regarding spousal support requires careful consideration of both parties' needs and circumstances. It's crucial to avoid emotionally charged discussions and focus on objective factors such as income disparities, length of the marriage, and each party's contribution to the marriage's financial well-being.

Open communication and the involvement of qualified financial advisors can be instrumental in navigating these negotiations. This helps ensure that the agreement is both legally sound and addresses the long-term financial needs of both parties involved.

Navigating Potential Changes in Support Obligations

Life rarely stays static, and unforeseen circumstances can significantly impact the ability of one party to maintain support obligations. Understanding the circumstances under which support payments can be modified or terminated is crucial for both parties to avoid future legal battles.

This includes understanding relevant legal precedents, potential triggers for modifications, and the legal process for initiating such changes. Being proactive and well-informed will help avoid costly and time-consuming legal disputes.

Managing Child Custody and Support Responsibilities

Post-divorce arrangements often involve child custody and support responsibilities. These arrangements require careful consideration and detailed documentation to ensure the best interests of the children are prioritized. A well-defined custody agreement, outlining visitation schedules, decision-making authority, and child support payments, is essential for minimizing future conflicts and ensuring stability for the children.

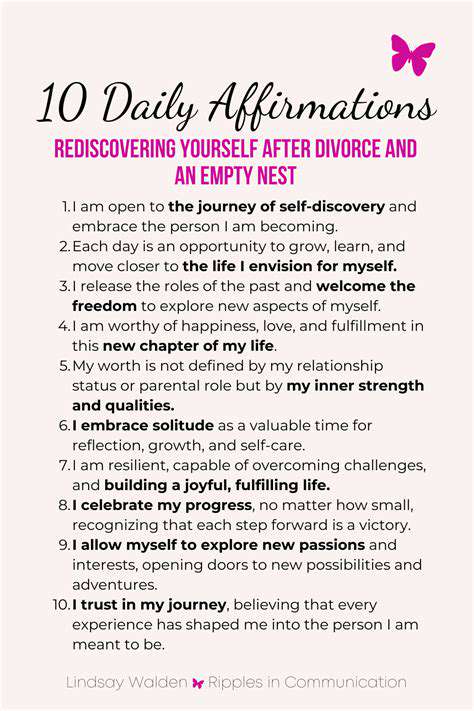

Addressing the Emotional Impact of Financial Changes

The transition to post-divorce life can be emotionally challenging, particularly when dealing with financial adjustments. Acknowledging and addressing the emotional impact of these changes is crucial for both parties. Seeking support from therapists or counselors can provide the necessary tools to cope with the emotional stress and navigate the changes effectively.

Long-Term Financial Planning and Security

Post-divorce financial planning is not just about the immediate support arrangements; it's about securing a sustainable future for both individuals. Each party should develop a comprehensive financial plan that takes into account their current financial situation, anticipated future expenses, and potential financial risks. This includes exploring options like retirement savings, investments, and estate planning to ensure long-term financial security.

This proactive approach allows individuals to navigate the complexities of a new financial reality and build a secure future after divorce.

Read more about divorce custody battle resolution strategies

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases