how to overcome divorce trauma quickly

Global trade sentiment reflects the overall outlook and expectations surrounding international trade activities. It encompasses a wide range of opinions, from optimistic projections of growth and prosperity to pessimistic forecasts of decline and instability. Analyzing this sentiment is crucial for businesses, policymakers, and investors alike, as it can provide valuable insights into potential market trends and risks. This analysis helps to anticipate shifts in trade patterns and adjust strategies accordingly.

Practical Steps to Navigate the Transition: Re-establishing Financial Stability and Daily Routine

Assessing Your Current Financial Situation

Taking stock of your current financial situation is crucial for developing a plan to regain stability. This involves a thorough review of all income sources, including salary, investments, and any other potential revenue streams. Detailed records of expenses are equally important, categorizing them into essential needs (housing, food, utilities) and discretionary spending (entertainment, dining out). Identifying areas where you can potentially cut back without sacrificing essential needs is a key element in this assessment. Understanding your current debts, including outstanding loans, credit card balances, and any other financial obligations, is vital to developing a realistic repayment strategy.

This analysis should also consider any existing savings or emergency funds. Evaluating their adequacy in relation to your current expenses and anticipated future needs is essential. A clear understanding of your financial position empowers you to make informed decisions about your next steps and aids in developing a sustainable plan for re-establishing financial stability.

Re-evaluating and Prioritizing Expenses

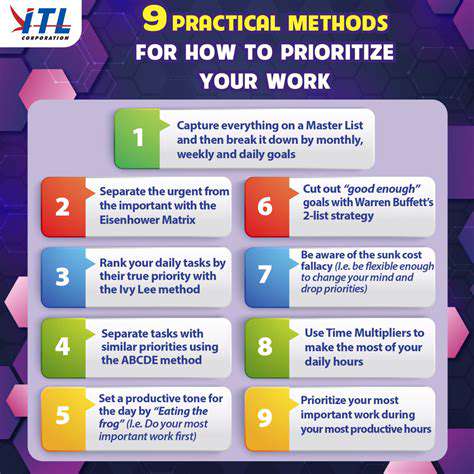

Once your current financial situation is clear, re-evaluate your spending habits. Prioritize essential expenses and identify areas where you can reduce spending without compromising your well-being. This could involve negotiating lower utility bills, finding more affordable housing options, or exploring less expensive transportation alternatives. Understanding the difference between needs and wants is critical in this process. A budget or financial tracking tool can be invaluable in helping you stay organized and monitor your progress towards financial stability.

Be realistic and avoid drastic cuts that could negatively impact your daily life. A gradual approach, focusing on small, sustainable changes, is more likely to lead to long-term success. Review your spending habits regularly and adjust your budget as needed to ensure that it aligns with your financial goals and overall well-being.

Developing a Realistic Budget and Savings Plan

Creating a realistic budget is a cornerstone of financial stability. This involves carefully allocating your income to different categories, ensuring that essential expenses are adequately covered. Develop a plan that includes a breakdown of your income and expenses, considering both fixed and variable costs. Include provisions for savings, aiming for a certain percentage of your income to be allocated for emergency funds or future goals. Be realistic about your savings goals and break them down into smaller, achievable targets.

Implementing Strategies for Debt Management

Managing debt effectively is a critical aspect of re-establishing financial stability. Prioritize high-interest debts and consider strategies like debt consolidation or balance transfers to lower your overall interest burden. Explore options like debt management plans or working with a financial advisor to develop a tailored debt reduction strategy. Creating a repayment schedule that aligns with your budget and financial capabilities is key to successfully managing your debt. Avoid accumulating further debt while you're working on existing debt.

Establishing a Sustainable Daily Routine for Success

Re-establishing a stable daily routine is vital for managing stress and promoting overall well-being, which is closely tied to financial stability. Creating a structure that includes dedicated time for work, rest, and personal activities can help you feel more in control and reduce feelings of overwhelm. This includes setting realistic goals, prioritizing tasks, and scheduling regular breaks. Prioritizing sleep, healthy eating, and physical activity are essential aspects of this routine. A consistent routine can improve focus, reduce stress, and create a more positive mindset, ultimately supporting your efforts to achieve financial stability.

Embracing Self-Compassion and Patience: The Long Road to Resilience

Understanding Self-Compassion

Self-compassion is a powerful tool for navigating life's challenges. It involves treating yourself with the same kindness and understanding you would offer a friend struggling with similar difficulties. This includes acknowledging your imperfections and failures without judgment, recognizing that suffering is a universal human experience, and offering yourself support and encouragement.

Developing self-compassion is crucial for emotional well-being. It allows you to respond to setbacks and disappointments with greater resilience and a reduced tendency toward self-criticism. By practicing self-compassion, you create a more supportive and nurturing inner environment.

Identifying Negative Self-Talk

A significant component of embracing self-compassion is recognizing and challenging negative self-talk. This often involves harsh internal dialogues that criticize our actions, abilities, and appearances. Identifying these patterns is the first step towards changing them.

Identifying these negative patterns allows you to consciously choose different responses. For instance, instead of berating yourself for a mistake, you can acknowledge it as a learning opportunity and offer yourself understanding and forgiveness. This shift in perspective is key to cultivating self-compassion.

Practicing Self-Kindness

Self-kindness involves treating yourself with the same care and concern you would offer a loved one. This means offering yourself empathy and support, even when you're struggling. It's about reframing your inner dialogue from one of criticism to one of understanding and acceptance. It is important to remember that imperfections are a natural part of the human experience.

Actively practicing self-kindness through acts of self-care and self-support is essential. This could involve taking a relaxing bath, engaging in a hobby you enjoy, or simply taking a moment to breathe deeply and acknowledge your feelings without judgment.

Cultivating Mindfulness

Mindfulness, the practice of paying attention to the present moment without judgment, is a valuable tool for fostering self-compassion. By focusing on your thoughts, feelings, and sensations without getting carried away by them, you gain a greater understanding of yourself and your experience. This awareness allows you to respond to challenges with more equanimity and less reactivity.

Cultivating mindfulness through meditation or simply taking moments to observe your breath can significantly impact your ability to be self-compassionate. It helps you detach from negative self-judgments and instead connect with your inner experience with a sense of acceptance.

Setting Realistic Expectations

Embracing self-compassion often involves setting realistic expectations for yourself. Recognizing that perfection is an unattainable goal can significantly reduce the pressure and self-criticism associated with striving for ideals. This allows for a more balanced perspective on your accomplishments and failures.

By accepting that setbacks and imperfections are inevitable, you create space for growth and learning. Instead of focusing on what you perceive as shortcomings, you can approach challenges with a growth mindset, recognizing that each experience contributes to your overall journey of self-discovery.

The Importance of Forgiveness

Forgiveness, both self-forgiveness and forgiveness of others, is a cornerstone of self-compassion. Holding onto resentment and self-criticism creates unnecessary suffering. Learning to forgive yourself and others, acknowledging that everyone makes mistakes, creates space for healing and growth.

Self-forgiveness is crucial for moving forward and embracing a more compassionate view of yourself. It allows you to release the burden of past mistakes and embrace a more positive and hopeful future.

Read more about how to overcome divorce trauma quickly

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases