divorce asset management for fairness

The Role of Legal Counsel in Asset Management

Defining the Scope of Legal Counsel's Role

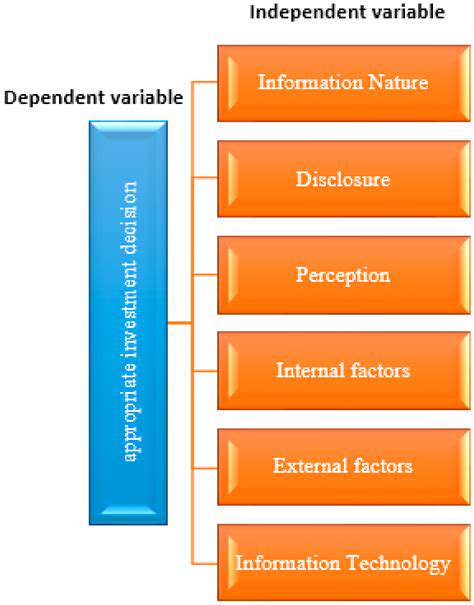

Legal counsel plays a crucial role in divorce asset management, ensuring fairness and protecting the interests of both parties. This involves a deep understanding of the relevant laws and regulations governing asset division in divorce proceedings. Their expertise is vital in navigating complex legal frameworks, ensuring that the division of assets aligns with the principles of equity and legal precedent within the jurisdiction.

Beyond simply understanding the law, legal counsel acts as a trusted advisor, guiding clients through the often-emotional and challenging process of asset valuation and division. This includes advising on strategies for preserving assets during the divorce process and formulating a plan that fairly considers the contributions and needs of each party.

Asset Identification and Valuation

A comprehensive inventory of all assets, both tangible and intangible, is a cornerstone of a fair divorce settlement. Legal counsel meticulously identifies and documents each asset, from real estate and bank accounts to retirement funds and personal property. Accurate valuation is critical, as it directly impacts the division process. This often involves expert appraisals of complex assets like businesses or real estate, ensuring a realistic and justifiable valuation.

This process includes researching and understanding the market value of assets, considering factors such as location, condition, and market trends. Understanding the complexities of asset valuation is essential for ensuring equitable division and avoiding disputes later.

Negotiation and Mediation Strategies

Legal counsel acts as a crucial negotiator in divorce proceedings, working to achieve a mutually agreeable settlement that respects the rights and needs of both parties. They employ effective communication and negotiation strategies to minimize conflict and foster a collaborative environment.

In cases where negotiation proves challenging, legal counsel can guide clients through mediation processes. Mediation offers a less adversarial approach to conflict resolution, potentially saving time and money while promoting a more amicable division of assets.

Protecting Vulnerable Assets

Divorce can impact vulnerable assets such as family businesses or inherited property. Legal counsel plays a critical role in protecting these assets from potential harm during the divorce process. This might involve strategies to safeguard the business's ongoing operations or ensure the proper handling of inherited assets, preventing disputes and ensuring that the asset's value is preserved.

Ensuring Equitable Division of Assets

Legal counsel meticulously considers the contributions of each party to the marital estate when determining an equitable division of assets. This analysis encompasses financial contributions, non-financial contributions such as homemaking, and other factors that contribute to the overall wealth accumulated during the marriage.

The goal is to ensure that the division of assets reflects the principles of fairness and justice, respecting the legal frameworks and the unique circumstances of each case. This involves thorough documentation and meticulous analysis to ensure a just and equitable outcome.

Addressing Complex Asset Structures

Divorce cases often involve complex asset structures, including trusts, joint ventures, and international holdings. Legal counsel must possess the expertise to navigate these complexities and understand the implications of each structure on the division process.

This requires familiarity with different legal jurisdictions and the ability to engage with financial experts to ensure that the valuation and division of these assets are handled correctly and in accordance with the law. Failure to account for these complexities can lead to significant errors and disputes down the road.

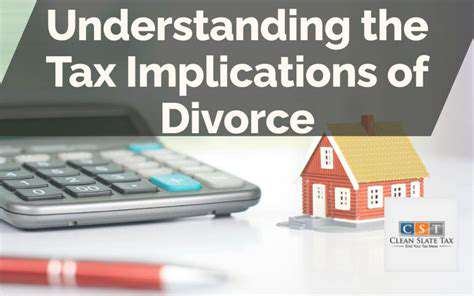

Tax Implications of Divorce Asset Division

Division of Marital Assets

Dividing marital assets during a divorce is a crucial aspect of the process, and understanding the tax implications is vital. The tax treatment of assets depends heavily on whether they are considered marital property or separate property under the laws of the jurisdiction where the divorce is finalized. Marital property typically includes assets acquired during the marriage, while separate property refers to assets owned before the marriage or received during the marriage as a gift or inheritance. A clear understanding of these classifications is essential for accurately reporting and paying taxes on the distributed assets.

Different jurisdictions have different rules for classifying assets as marital or separate property. The legal definition and division of assets can significantly impact the tax burden on each spouse post-divorce. This is a complex area and it is crucial to seek legal advice from a qualified professional.

Tax Implications of Property Transfers

The transfer of assets in a divorce settlement often triggers tax consequences. If assets are exchanged for cash or other property, capital gains or losses may arise, and these must be reported on the appropriate tax forms. Understanding these potential tax implications is crucial for both spouses to make informed decisions about the division of assets.

For example, if a house is transferred from one spouse to another, the transfer might trigger capital gains taxes for the spouse selling the house, depending on the sale price and the original purchase price. The tax consequences could be significant, and it's essential to consult with a tax professional to understand the specific implications.

Tax Deductions and Credits

Divorce settlements can sometimes offer specific tax deductions or credits, which can help mitigate the financial impact of the divorce. For instance, certain legal fees related to the divorce, such as attorney fees, might be deductible. Understanding which expenses are deductible is critical for minimizing the overall tax liability.

Additionally, some credits might be available depending on the specific circumstances of the divorce and the applicable tax laws. These credits can provide financial relief. It's important to note that the availability and amount of deductions and credits can vary based on the individual situation and applicable laws.

Capital Gains and Losses

When marital assets, particularly investments or real estate, are divided, capital gains or losses can arise. These gains or losses are calculated based on the difference between the asset's sale price and its original purchase price. Accurately calculating these gains or losses is essential for determining the tax liability associated with the divorce settlement.

Properly reporting these gains or losses on the appropriate tax forms is crucial to avoid penalties and ensure compliance with tax regulations. Tax professionals can offer guidance on the complexities of capital gains and losses in divorce settlements.

Alimony and Spousal Support

The tax treatment of alimony and spousal support differs from that of other assets. In some cases, alimony payments are taxable income for the recipient and deductible for the payor. This specific tax treatment is governed by the Internal Revenue Code, and it's essential to understand these rules to correctly report and pay taxes. Careful consideration of the tax implications of alimony payments is necessary for both parties.

It is important to note that the tax laws surrounding alimony have changed over time, and the specific rules may vary depending on when the divorce occurred. Consulting a tax professional is recommended to ensure compliance with current regulations.

Other Tax Considerations

Beyond the specific issues mentioned above, there are other tax implications to consider during a divorce. These include the potential impact on retirement accounts, pensions, and other assets. The division of these assets can have long-term tax consequences.

Careful planning and consultation with both legal and tax professionals are essential to navigate these complex issues effectively and minimize the tax burden associated with the divorce. A comprehensive understanding of all applicable tax laws and regulations is critical for making informed decisions during the divorce process.

Read more about divorce asset management for fairness

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases