divorce legal advice for property split

Identifying and Valuing Marital Property

Identifying Marital Property

When couples decide to part ways, one of the most critical steps is determining what falls under marital property. This category typically includes all assets and debts accumulated by either spouse during their marriage, irrespective of whose name appears on official documents. From paychecks and savings accounts to homes, cars, and retirement funds, anything obtained while married usually counts. Getting this classification right from the start helps ensure both parties receive their fair share when dividing possessions.

However, not everything automatically becomes shared property. Items owned before tying the knot, personal gifts received during the marriage, or inherited assets often remain separate. These exceptions can significantly impact the final settlement, which is why consulting with legal professionals becomes indispensable for accurate classification and protection of individual rights.

Separate Property Considerations

Distinguishing between shared and individual assets requires careful attention. Belongings acquired prior to marriage, special gifts given specifically to one partner, and family inheritances typically stay with their original owner. Maintaining clear records - purchase receipts, inheritance documents, or gift certificates - helps prevent conflicts during division proceedings. Proper documentation serves as concrete evidence when establishing ownership claims.

Valuation of Assets

Putting a price tag on shared possessions forms another essential phase. While houses and vehicles might seem straightforward to appraise, more complex holdings like business stakes or investment portfolios often demand expert evaluation. Professional assessors bring necessary expertise to determine current market worth, especially for assets with fluctuating values. Their impartial estimates help create equitable distribution plans that reflect true monetary realities.

Debt Allocation

Financial obligations don't disappear when marriages end. Joint credit card balances, home loans, and other liabilities incurred together must get addressed alongside asset division. Creating a clear plan for responsibility sharing prevents future financial entanglements and ensures both parties move forward with defined obligations. Sometimes this means selling shared assets to settle mutual debts, while other situations may involve negotiated payment arrangements.

Community Property States

Certain regions operate under community property frameworks where marriage automatically creates equal ownership of all assets and debts acquired during the union. In these areas, courts typically mandate precise 50/50 splits regardless of individual circumstances. Understanding these strict guidelines helps set realistic expectations about potential outcomes in such jurisdictions.

Equitable Distribution States

Most locations favor fairness over strict equality when dividing marital property. Judges here consider multiple factors like marriage duration, each spouse's financial and non-financial contributions, and future earning capacities. This flexible approach allows for customized solutions that account for stay-at-home parents' sacrifices or disparities in income potential post-divorce.

Legal Approaches to Property Division

Defining Property Division

When partnerships dissolve, whether marital or business, the systematic allocation of accumulated assets and liabilities becomes paramount. This complex process requires navigating intricate legal landscapes to ensure just outcomes for all involved parties. Mastering jurisdictional specifics often makes the difference between satisfactory and disappointing resolutions. Comprehensive asset identification and valuation form the foundation, frequently necessitating professional appraisers and forensic accountants to uncover hidden or undervalued holdings.

Documentation proves equally vital - from property deeds and financial statements to loan agreements and tax returns. Meticulous record-keeping creates indisputable evidence trails that streamline negotiations and prevent costly disputes over forgotten or misrepresented assets.

Jurisdictional Variations

Legal systems worldwide approach property division with distinct philosophies rooted in cultural and historical contexts. Some regions automatically presume equal ownership of marital assets, while others employ nuanced evaluation systems considering numerous personal factors. These fundamental differences significantly impact potential outcomes, making local legal expertise invaluable during proceedings.

For example, community property jurisdictions operate on strict fifty-fifty splits, whereas equitable distribution regions allow judicial discretion based on circumstances like earning potential disparities or caregiving sacrifices made during the marriage.

Community Property vs. Equitable Distribution

The philosophical divide between these approaches centers on fairness definitions. Community property systems view marriage as an economic partnership where both spouses contribute equally, regardless of visible financial inputs. This perspective leads to automatic equal splits absent preexisting agreements.

Equitable distribution frameworks recognize that marriages involve complex, often imbalanced contributions that rigid equality fails to address adequately. Here, judges weigh factors like future employability, health considerations, and non-monetary homemaking efforts to craft personalized solutions.

Factors Influencing Property Division

Multiple elements converge to shape final division outcomes. Marriage duration often correlates with asset commingling - longer unions typically see more blurred lines between separate and shared property. Prenuptial agreements can override default rules when properly executed, while spousal misconduct sometimes affects allocations depending on local statutes.

The interplay of these variables creates unique scenarios requiring careful legal navigation to protect client interests during emotionally charged proceedings.

Legal Representation and Documentation

Retaining skilled counsel transforms chaotic separations into orderly transitions. Attorneys not only interpret complex statutes but also anticipate opposing strategies and potential pitfalls. Their guidance proves particularly valuable when dealing with sophisticated assets like stock options, intellectual property, or international holdings.

Comprehensive documentation serves as the backbone of successful cases, whether through negotiated settlements or courtroom litigation. From notarized inventories to certified appraisals, thorough paper trails strengthen positions and accelerate resolutions.

Factors Influencing Property Division Decisions

Geographic Location and Market Conditions

Where assets physically reside dramatically affects their division. Properties in desirable locations with strong school districts and transportation links command premium values. Current economic climates further influence asset liquidity and valuation - booming markets facilitate smoother splits through sales, while downturns may necessitate creative solutions like co-ownership agreements or deferred divisions.

Property Characteristics and Features

Unique asset attributes often dictate division feasibility. Land parcels with natural boundaries or existing subdivisions simplify physical splits, while unusual layouts may require sale and proceeds distribution. Special features like waterfront access or historical significance can dramatically affect values and emotional attachment levels.

Structural conditions also play pivotal roles - well-maintained properties divide more cleanly than those requiring substantial renovations before marketability.

Legal and Regulatory Frameworks

Local ordinances frequently constrain division options through zoning restrictions, environmental protections, or historical preservation rules. Navigating these regulatory mazes demands specialized legal knowledge to avoid costly missteps that could derail settlement timelines or diminish asset values through non-compliance penalties.

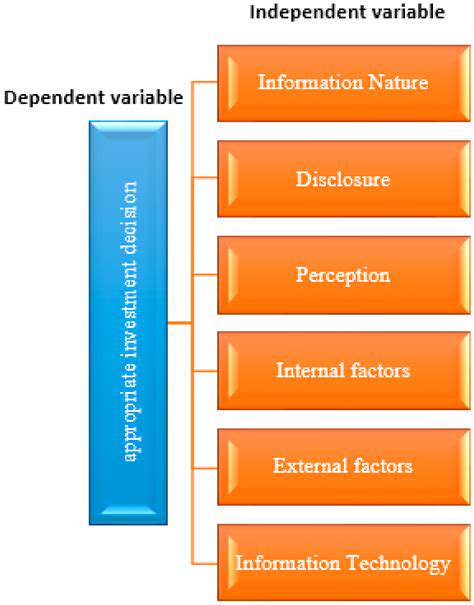

Financial Considerations and Investment Analysis

Thorough cost-benefit analyses should precede division decisions. Professional valuations establish baselines, while expense projections for necessary surveys, legal filings, and potential improvements inform feasibility assessments. Realistic financial modeling prevents unpleasant surprises and helps select optimal division strategies maximizing returns for both parties.

Market Analysis and Demand Forecasting

Understanding local real estate trends proves crucial when considering asset sales versus physical divisions. Demographic shifts, employment patterns, and development plans all influence which division approaches will yield optimal financial outcomes. Strategic timing based on market cycles can significantly enhance proceeds from any required property liquidations.

Potential Environmental Impacts and Sustainability

Modern division strategies increasingly consider ecological footprints. Environmentally sensitive areas may require specialized division approaches to preserve natural resources, while sustainable development opportunities can enhance divided parcel values. These considerations often intersect with regulatory requirements, necessitating expert guidance throughout the process.

Seeking Professional Legal Counsel

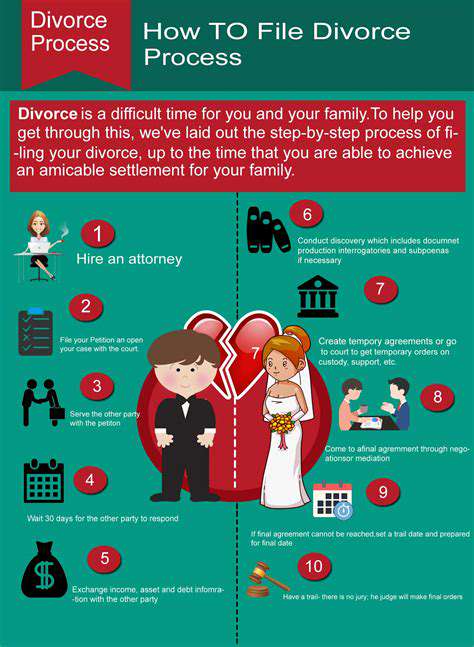

Understanding the Property Division Process

Divorce proceedings involving significant assets demand professional guidance. Legal professionals help clients comprehend complex property classification systems distinguishing marital from separate assets across different jurisdictions. This foundational knowledge informs strategy development and expectation management throughout often lengthy proceedings.

Assessing Your Assets and Liabilities

Comprehensive financial inventories form the bedrock of successful property divisions. Attorneys coordinate with financial specialists to uncover and properly value all holdings, from obvious real estate to more obscure assets like collectibles or digital currencies. This exhaustive approach prevents overlooked assets from disadvantaging clients during negotiations or litigation.

Strategies for Negotiating a Fair Settlement

Skilled negotiators balance assertiveness with pragmatism to achieve optimal outcomes. They help clients prioritize objectives while remaining flexible on less critical matters. Creative problem-solving often yields superior results compared to rigid positional bargaining, especially when dealing with emotionally charged situations or unique assets requiring customized solutions.

Protecting Your Interests During Litigation

When negotiations fail, courtroom advocacy becomes essential. Experienced litigators present compelling evidentiary packages while effectively countering opposing arguments. Their procedural expertise ensures proper compliance with court requirements while maximizing opportunities to favorably influence judicial decisions regarding asset allocations.

Read more about divorce legal advice for property split

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases