divorce asset management strategies for fairness

Role of Prenuptial Agreements in Equitable Distribution

Valid prenuptial agreements substantially alter asset division outcomes. These contracts establish predetermined division frameworks that courts typically honor. However, not all agreements withstand legal scrutiny - some face challenges regarding fairness or proper execution. Consulting experienced attorneys ensures proper understanding and enforcement.

Valuation of Assets for Equitable Distribution

Professional appraisals prove indispensable for accurately valuing complex assets like real estate or businesses. Precise valuations prevent future disputes and guarantee equitable divisions. Engaging qualified appraisers represents a non-negotiable step in the process.

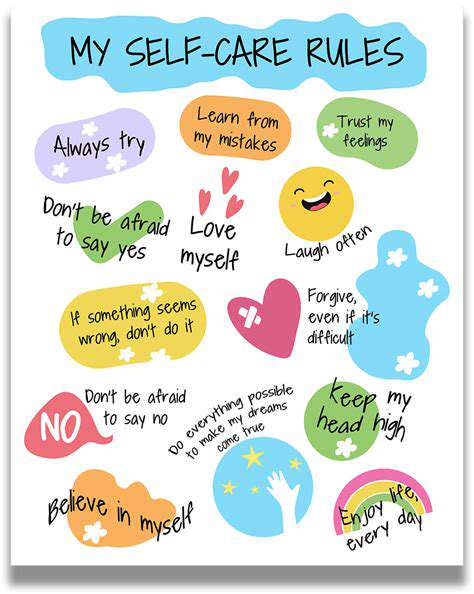

Strategies for Managing Assets During Divorce

Protecting assets requires strategic planning: maintain thorough records, avoid rash decisions, and consult financial/legal experts. Good-faith negotiations and clear communication significantly smooth the division process while adhering to legal protocols ensures proper outcomes.

Identifying and Valuing Marital Assets

Identifying Marital Assets

Comprehensive asset identification forms the bedrock of fair divorce settlements. This exhaustive process must account for both tangible possessions and intangible holdings like retirement funds, investments, and intellectual property. Overlooking assets invites future conflicts and potential legal action.

Special attention should focus on gifted/inherited assets during marriage. While often classified as separate property, jurisdictional variations exist. Detailed documentation of such assets' origins proves essential for preventing misclassification during division.

Valuing Marital Assets

Establishing fair market value requires professional input, especially for complex assets. Accurate valuations form the cornerstone of equitable distribution, with different methodologies applying to various asset types. When disagreements arise, expert testimony may become necessary to resolve valuation disputes.

Tracing Asset Acquisition

Financial forensics play a vital role in establishing assets' marital status. Scrutinizing bank records, purchase documents, and ownership histories helps determine proper classification. Clear acquisition timelines prove particularly valuable for assets obtained near the marriage's beginning or end.

Addressing Separate Property

Pre-marital assets and certain gifts/inheritances typically remain individual property. Meticulous documentation serves as the best protection against accidental inclusion in marital asset pools. Maintaining separate accounts for pre-marriage assets helps preserve their distinct status.

Legal Implications and Considerations

Asset classification carries significant legal consequences affecting final distribution outcomes. Consulting specialized family law attorneys provides critical guidance through jurisdiction-specific regulations and protects individuals' rights during this complex process.

Strategies for Dividing Retirement Assets

Understanding Your Options

Retirement asset division presents unique challenges requiring specialized approaches. QDROs (Qualified Domestic Relations Orders) represent the primary mechanism, but alternatives exist for complex situations. State-specific laws dramatically influence available options, making localized legal advice indispensable.

Qualified Domestic Relations Orders (QDROs)

These court orders legally redirect retirement plan benefits to alternate payees (typically ex-spouses). Precise legal formatting proves critical - improperly drafted QDROs risk rejection by plan administrators, potentially causing significant financial consequences.

Alternative Asset Division Strategies

When QDROs prove impractical, options like asset swaps or offsetting other marital property may be considered. Each alternative carries distinct tax implications and financial risks requiring careful evaluation by financial professionals.

Tax Implications of Asset Division

Retirement fund divisions trigger various tax consequences depending on account types and distribution methods. Early withdrawals often incur substantial penalties, making expert tax guidance essential for avoiding unexpected liabilities.

Investment Considerations and Risks

Transferred retirement assets demand prudent investment management aligned with the recipient's financial goals and risk tolerance. Understanding market volatility and long-term growth strategies becomes paramount for preserving these critical assets.

Protecting Your Financial Future

Retirement asset division represents a pivotal financial crossroads. Strategic planning incorporating legal, tax, and investment expertise helps ensure both parties emerge with secure retirement prospects.

Seeking Professional Guidance

The complexity of retirement asset division necessitates specialized assistance. Collaborative teams combining divorce attorneys, financial planners, and tax professionals provide comprehensive support through this challenging process.

Consider the symbiotic relationship between muscles and bones. Resistance training creates beneficial stress that stimulates bone strengthening - a physiological response to mechanical demands that benefits long-term skeletal health.

Handling Separate Property and Marital Debt

Managing Separate Property and Marital Assets

Clear distinction between separate and marital property prevents numerous post-divorce conflicts. This classification process demands rigorous documentation, sometimes requiring forensic accounting for complex financial situations. While emotionally taxing, transparent communication and professional assistance facilitate smoother resolutions.

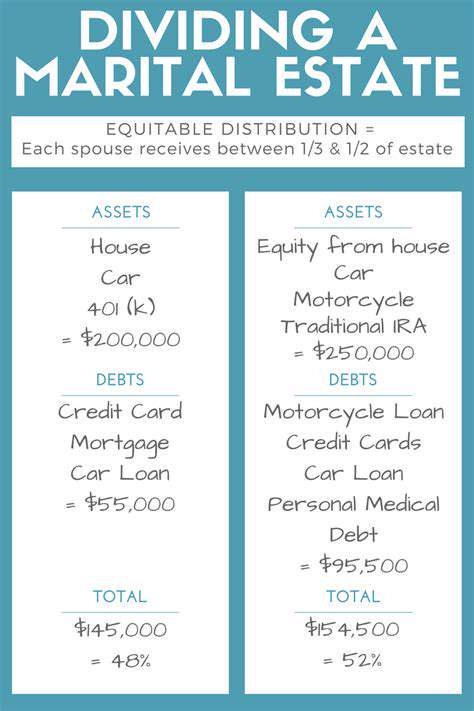

Separate property generally includes pre-marital possessions and designated gifts/inheritances. Marital assets encompass all joint acquisitions during the union. The equitable division principle primarily applies to marital property pools, making proper classification fundamentally important.

Tracing Asset Origins

Asset provenance investigation examines financial paper trails to establish proper categorization. This forensic process often requires examining years of bank records, property deeds, and transaction histories. Comprehensive documentation serves as the most reliable evidence when establishing asset classification.

Legal Implications of Asset Classification

Proper asset classification directly impacts distribution outcomes. Misclassification can lead to unjust divisions and potential legal challenges. Understanding jurisdictional nuances proves critical, as state laws vary significantly regarding separate/marital property definitions.

Strategies for Protecting Separate Property

Preserving separate property status requires proactive measures: maintaining distinct accounts, avoiding commingling of funds, and documenting gifts/inheritances. These precautions create clear evidentiary trails that withstand legal scrutiny during divorce proceedings.

Negotiation and Mediation in Asset Division

Alternative dispute resolution methods often prove more efficient than litigation for asset division. Mediation fosters cooperative solutions that consider both parties' needs while reducing legal expenses and emotional strain. Successful mediation requires willingness to compromise and clear understanding of legal entitlements.

Seeking Professional Guidance and Mediation

Understanding the Importance of Professional Guidance

Expert assistance proves invaluable when navigating divorce's legal and emotional complexities. Qualified professionals help clients understand rights, anticipate challenges, and develop protective strategies. This guidance promotes fairer outcomes while reducing conflict and emotional distress.

Specialized legal counsel significantly influences final settlements - from initial negotiations to court decrees. Professional expertise prevents costly missteps and ensures proper understanding of asset division laws and procedures.

Evaluating Asset Types and Values

Comprehensive asset evaluation forms the basis for equitable division. Professional mediators assist with complex valuations, particularly for unique assets like businesses or intellectual property. Accurate assessments prevent disputes and facilitate fair distributions.

Developing a Comprehensive Asset Management Plan

Effective divorce planning requires holistic asset management strategies considering tax consequences, future needs, and children's welfare. Well-structured plans minimize future conflicts while ensuring practical, sustainable division outcomes.

Negotiation Strategies for Asset Division

Successful negotiations balance assertiveness with compromise. Professional mediators facilitate productive discussions that protect clients' interests while fostering mutually acceptable solutions. Alternative approaches like collaborative law often prove less adversarial than traditional litigation.

Protecting Your Interests in Retirement Funds and Investments

Retirement assets require specialized division strategies considering long-term impacts. Professional advisors help navigate complex regulations while minimizing tax liabilities and preserving financial security.

Addressing Complex Assets and Business Interests

Business divisions demand specialized valuation and negotiation approaches. Expert mediators with business valuation experience help achieve fair, legally compliant resolutions for these particularly complex assets.

Minimizing Future Disputes and Financial Risks

Forward-looking asset plans account for potential market changes, tax implications, and evolving needs. Professional guidance helps create durable solutions that withstand future challenges while protecting both parties' financial stability.