how to manage divorce financial stress

Managing Debt and Credit During Divorce

Understanding the Impact of Divorce on Finances

Divorce significantly alters financial landscapes for both individuals involved. Assets and liabilities are often divided, leading to shifts in income, expenses, and overall financial stability. Understanding these changes is crucial for navigating the complexities of the divorce process and effectively managing the ensuing financial stress. This period requires careful planning and proactive steps to secure a stable future.

The emotional toll of divorce can also cloud financial decisions. It's essential to approach financial matters with a clear head and seek professional advice when needed. Ignoring the financial realities of the situation can lead to unforeseen challenges and difficulties later on.

Assessing Your Current Financial Situation

Before diving into debt management or credit strategies, a thorough assessment of your current financial situation is paramount. This involves evaluating all income sources, including salaries, investments, and any potential alimony or child support. Listing all existing debts, including mortgages, loans, credit card balances, and outstanding bills, is equally crucial.

Identifying your current assets, such as savings accounts, retirement funds, and property, is also vital. This comprehensive review provides a baseline understanding of your financial standing and helps to determine appropriate strategies for debt management and credit restoration during and after the divorce.

Managing Existing Debt

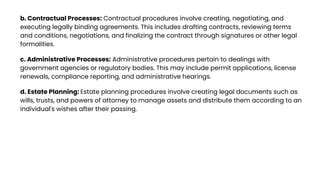

Divorce often leads to a reassessment of existing debt obligations. Understanding the terms of each loan, credit card, and other outstanding debts is crucial to making informed decisions. Negotiating with creditors, exploring debt consolidation options, or considering debt management plans can help alleviate the financial strain.

Prioritizing high-interest debts is often recommended. Strategies like balance transfers or aggressive debt repayment plans can help reduce the overall cost of debt and improve your financial outlook. It's important to be transparent with your creditors about your situation and to explore all available options for managing debt effectively.

Establishing a Post-Divorce Budget

Developing a realistic post-divorce budget is essential for maintaining financial stability. This involves carefully tracking all income and expenses, identifying areas where you can cut back, and creating a plan for managing these expenses. Consider the potential impact of alimony or child support on your budget and factor in the costs associated with maintaining a separate household.

Strategies for Rebuilding Credit

Divorce can negatively affect credit scores, especially if you're facing unexpected financial adjustments. Maintaining on-time payments on all accounts is essential to rebuilding credit. If you have a history of late payments or missed debts, explore options like credit counseling or debt consolidation to improve your credit score.

Seeking Professional Financial Advice

Navigating the complex financial aspects of divorce can be overwhelming. Consulting with a financial advisor or a certified divorce financial analyst (CDFA) can provide invaluable guidance. They can offer personalized strategies for managing debt, rebuilding credit, and planning for your future financial well-being.

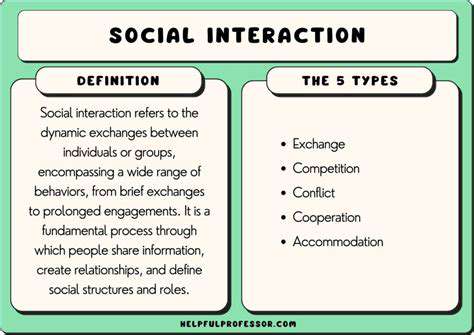

Communicating with Your Ex-Spouse

Open and honest communication with your ex-spouse regarding finances is vital. This includes adhering to the terms of any court-ordered financial agreements. Transparency and cooperation in financial matters can significantly reduce stress and conflict during and after the divorce process. Maintaining a professional and respectful approach, even when dealing with sensitive topics, is key to minimizing potential future financial disputes.

Seeking Professional Support

Understanding the Need for Professional Help

Seeking professional support can be a courageous and often essential step towards resolving personal or professional challenges. It signifies a willingness to acknowledge that a situation might be beyond your immediate capacity to handle, which is a strength, not a weakness. This recognition is the first crucial step in the process of healing and growth, paving the way for a more positive and fulfilling future.

Many people find that professional guidance offers a fresh perspective and objective insights. A trained professional can help you unpack complex emotions, identify patterns in behavior, and develop strategies for navigating difficult situations more effectively. This support can be invaluable in navigating life's transitions and overcoming obstacles.

Identifying the Types of Professional Support Available

A range of professional support options exist, catering to diverse needs and preferences. Counseling, therapy, and coaching are just a few examples, each with its unique focus and approach. Choosing the right type of support is crucial for ensuring that you receive the most effective and relevant assistance.

Navigating the Process of Seeking Support

Finding the right professional can seem overwhelming, but resources like online directories, recommendations, and referrals can make the process smoother. It's important to research different professionals and their specialties to find someone whose approach aligns with your needs and values.

Once you've chosen a professional, be prepared to be open and honest about your experiences and challenges. Building a strong therapeutic relationship is key to successful outcomes.

Benefits of Professional Support

The benefits of professional support are multifaceted and extend to various aspects of life. Improved emotional well-being, enhanced coping mechanisms, and a greater sense of self-awareness are just some of the positive outcomes that can be achieved through professional guidance.

Professional support can also lead to healthier relationships, better decision-making, and increased productivity in personal and professional settings.

Addressing Potential Barriers to Seeking Help

Sometimes, individuals hesitate to seek professional support due to concerns about cost, confidentiality, or perceived stigma. However, these concerns are often unfounded, and many resources are available to help mitigate financial burdens and ensure privacy.

Remember that seeking professional help is a sign of strength, not weakness. It's an investment in your well-being and future.

Understanding the Importance of Ongoing Support

Professional support isn't a one-time fix. Ongoing support can be instrumental in maintaining progress and addressing any new challenges that arise. It allows for continuous growth and development, empowering you to navigate life's complexities with greater resilience and confidence.

Regular check-ins and follow-up sessions can help you stay on track and make the most of the support you've received. This ongoing commitment to your well-being is a vital component of long-term success.

Read more about how to manage divorce financial stress

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases