Divorce Financial Recovery Timeline

Understanding Your Post-Divorce Financial Picture

After a divorce, it's essential to take a realistic look at your financial state. This includes understanding all sources of income and expenses that are now solely yours. Start by compiling a comprehensive list of all your income sources, including salary, bonuses, and any other earnings. Additionally, make a note of recurring expenses, from housing costs to groceries, to paint a clear picture of your financial situation.

You might also want to gather documents related to assets acquired during the marriage. This includes property deeds, financial statements, and any investments. Keeping track of these will help in future Financial Planning and negotiations.

Creating a Realistic Budget

With your financial picture in hand, the next step is to draft a realistic budget. Prioritize essential expenses like housing and utilities, while being mindful of discretionary spending. A good approach is to use the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Tailor this formula to suit your specific circumstances; checks and balances are crucial at this stage.

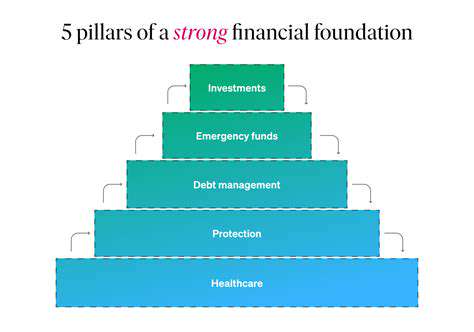

Emergency Savings Fund

An emergency fund is particularly vital post-divorce. Your financial stability can be significantly impacted by unforeseen events. It's advised to aim to save three to six months’ worth of living expenses. Having a cushion will reduce anxiety and offer a safety net if unexpected bills arise. Start small and gradually build that fund; even setting aside a small amount monthly can add up over time.

You may also consider having separate accounts for your emergency funds to avoid the temptation of dipping into it unnecessarily. This separation can assist in maintaining the integrity of your savings.

Assessing and Reducing Debt

Another critical aspect is to evaluate your current debt situation. List all debts incurred during and after the marriage, such as credit cards, loans, and mortgages. Identifying high-interest debts should be a priority; they can drain your finances quickly. Focus on paying these down before tackling lesser debts, using strategies like the avalanche or snowball method to stay organized and motivated.

Exploring Financial Assistance Programs

If you're finding it challenging to adjust to your new financial reality, look into local or national financial assistance programs. Many organizations offer support services specifically for individuals reestablishing themselves post-divorce. These programs can provide financial counseling, budgeting classes, and information on government benefits that you might qualify for.

Identifying Long-Term Financial Goals

Once you've tackled immediate budgeting needs, start forming long-term financial goals. This could range from saving for retirement to buying a home or simply enhancing your investment portfolio. Setting clear, achievable goals keeps you focused and motivated in your financial journey. Break these goals into actionable steps and revisit them regularly to track your progress and make adjustments as necessary.

Short-Term Financial Recovery: Addressing Debts and Essential Needs

Understanding Your Financial Obligations

After a divorce, it's crucial to assess your Financial Obligations clearly. Each partner’s responsibility regarding debts should be delineated in the divorce settlement. Make sure to seek a detailed list of joint liabilities from your spouse, including mortgages, credit card debts, and any other shared financial commitments. Failure to do so may result in inadvertently assuming additional debts.

An important factor to consider is how your debts will affect your credit score post-divorce. Credit agencies factor in both personal and joint loans, meaning the impact of unpaid debts can linger longer than expected. Understanding this can help you plan your recovery strategy more effectively.

Creating a Realistic Budget

Developing a budget tailored to your new financial situation is key to achieving short-term recovery. Begin by itemizing your income sources, which may have changed post-divorce. Take into account any alimony or child support payments you are entitled to receive. Knowing your total monthly income allows you to better allocate funds toward essential needs and debts.

Prioritizing Essential Expenses

After establishing your budget, it’s critical to prioritize essential expenses—housing, utilities, and food. A common mistake is underestimating the cost of living alone. Research from the Bureau of Labor Statistics indicates that single-person households often face higher per-capita expenses compared to couples. Therefore, consider using budgeting apps to help track your spending and avoid unnecessary expenses.

Another way to manage costs is to identify areas where you can reduce spending. This might mean cutting back on subscriptions or dining out. Redirect those savings toward paying off high-interest debts or establishing an emergency fund, which is vital for unforeseen expenses.

Exploring Debt Relief Options

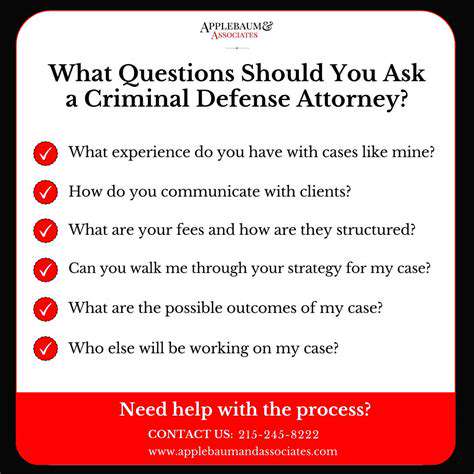

If debts are overwhelming, consider exploring debt relief options such as negotiation with creditors, debt consolidation loans, or even bankruptcy as a last resort. According to the American Bankruptcy Institute, many individuals find relief through structured repayment plans. Consulting with a financial advisor can provide insights into which route may be most beneficial for your unique situation.

Seeking Professional Financial Guidance

Do not underestimate the value of professional financial advice during this recovery phase. Financial planners can help build a solid recovery strategy tailored to your specific financial landscape. They can provide insights into investment options for the future, ensuring you rebuild wealth effectively post-divorce.

Furthermore, taking the time to educate yourself on personal finance topics can empower you to make informed decisions moving forward. Consider attending workshops or online courses focused on financial literacy. These initiatives can significantly enhance your ability to manage finances independently.

Mid-Term Recovery: Rebuilding Your Financial Foundation

Assessing Your Current Financial Situation

Understanding where you stand financially is a critical first step in the recovery process. Start by compiling a comprehensive list of all assets, including bank accounts, property, retirement accounts, and investments. Assess any liabilities too, such as credit card debts, loans, and pending financial obligations. This gives you a clear picture of your net worth and aids in budgeting effectively moving forward.

Utilizing personal finance software or spreadsheets can help track your income and expenses accurately. This will assist in identifying habitual spending patterns and revealing areas where savings can be made. As you gather this information, remember that accuracy is paramount; it will inform all subsequent decisions in your recovery journey.

Establishing a Realistic Budget

Creating a budget after a divorce is essential for managing your finances with clarity and purpose. Begin by examining your current income, which may change post-divorce. Factor in potential alimony, child support, or changes to your job situation. This new financial landscape needs to reflect not just survival but a sustainable way to live, including savings plans.

Divide your spending into fixed and variable categories. Fixed expenses such as housing and utilities are non-negotiable, while variable costs can often be adjusted. Allocating funds for savings and unexpected expenses early on will help build a financial cushion. Resources like Mint or YNAB (You Need A Budget) can simplify this task, offering tools to visualize and manage your budget effectively.

Rebuilding Credit Score

Your credit score can take a hit during a divorce due to potential changes in income, bill payments, and shared accounts. To start rebuilding, monitor your credit reports regularly for errors and fraudulent activity. It's crucial to understand the scoring models used by agencies and what factors influence your creditworthiness. A study by the Federal Trade Commission found that 1 in 5 Americans has an error on their credit report; correcting these errors can boost your score.

Make timely payments on all outstanding debts and avoid opening too many new accounts at once, as this can negatively impact your score. Many experts recommend using a secured credit card responsibly as a method to gradually improve credit ratings. Additionally, remember to maintain low credit utilization to demonstrate responsible credit management.

Exploring New Income Sources

Following a divorce, many individuals find reassessing their employment situation beneficial for financial recovery. Explore the possibility of advancing in your current position or seeking new opportunities that offer better pay or benefits. Research from the Bureau of Labor Statistics indicates that certain fields, like technology and healthcare, are rapidly growing and offer potential for increased earnings.

Apart from traditional employment, consider starting a side business or freelancing in your area of expertise to generate supplementary income. Platforms like Upwork and Freelancer can connect you with clients seeking services that match your skills. This multi-faceted approach to income can promote not just financial recovery but long-term financial stability.

Finally, engage in networking opportunities. Building connections in your industry can open doors to job prospects and partnerships that may not be widely advertised.

Prioritizing Long-Term Financial Goals

As you rebuild your financial foundation, it's vital to set long-term goals that prioritize Financial Independence and security. Consider speaking with a financial advisor to help develop a clear plan for retirement savings, real estate investments, or funding future educational needs for your children. According to a survey by Charles Schwab, individuals who set specific financial goals are more likely to feel optimistic about their financial futures.

In setting your goals, remember to keep them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. This structured approach ensures clarity in your objectives and helps maintain motivation throughout your recovery process. It’s also helpful to reassess these goals regularly and adjust them based on changing circumstances or aspirations.

Moreover, consider joining financial workshops or online courses to continuously educate yourself about personal finance. Empowering yourself with knowledge is one of the best strategies for achieving and maintaining financial health in the long run.

Long-Term Financial Stability: Investing in Your Future

Understanding the Importance of Financial Planning Post-Divorce

After the dissolution of a marriage, it's crucial to re-evaluate your financial situation. Many individuals find themselves unprepared for the shift in economic stability, leading to impulsive decisions. Establishing a solid financial plan can help mitigate these risks. Comprehensive planning includes budgeting, assessing assets, and projecting future expenses. By taking control of your financial landscape, you can pave the way for long-term stability.

Research indicates that roughly 32% of divorcees experience financial difficulty within the first two years following a separation. Such statistics underscore the importance of consulting a financial advisor who specializes in divorce recovery. They can assist in developing a strategic plan that not only addresses immediate needs but also prepares you for future financial obligations, such as those related to child support or alimony.

Investing Wisely for Future Growth

Post-divorce, many people overlook Investment Opportunities in favor of low-risk savings. While preserving capital is essential, an effective investment strategy can facilitate wealth growth over time. It’s advisable to focus on a diversified portfolio that includes stocks, bonds, and other assets appropriate to your risk tolerance and financial goals. Over time, such a strategy can generate substantial returns and enrich your financial position.

Consider seeking education around investment options available to you. Many community colleges and online platforms offer free or low-cost classes on personal finance and investing. This knowledge empowers you to make informed decisions about where and how to allocate your resources, fostering both confidence and financial literacy as you navigate your post-divorce life.

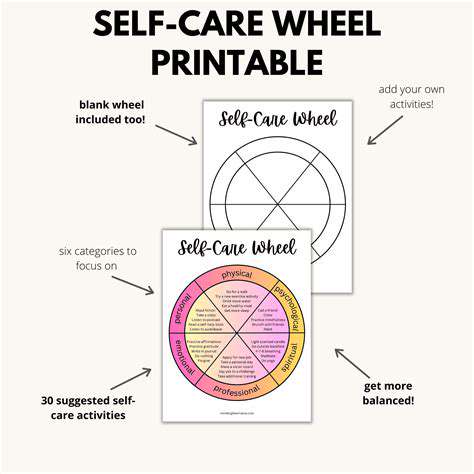

Bonus Tips: Emotional Support and Financial Education

Understanding Emotional Support Systems

Emotional support is vital during the divorce recovery process. Surrounding oneself with supportive friends and family can help mitigate feelings of isolation and anxiety. Research indicates that those who maintain strong social networks often recover more effectively from emotional distress stemming from divorce.

Consider joining a support group specific to divorcees. These groups provide a platform to share experiences and gain insights from others undergoing similar challenges. Hearing stories of resilience can foster a sense of hope and encourage personal growth as you strategize your recovery plan.

The Role of Financial Education in Recovery

Financial literacy is a crucial component of navigating post-divorce life. Understanding the basics of budgeting, investments, and credit can empower individuals to rebuild their financial health. Studies show that individuals who are financially educated post-divorce tend to make more informed decisions, reducing the risk of falling into debt.

Utilizing Professional Resources

Engaging with financial advisors or divorce coaches can be a significant asset in your recovery journey. These professionals provide personalized advice tailored to your situation, helping you understand the nuances of asset division, tax implications, and long-term financial planning.

Additionally, consider consulting with a therapist specializing in divorce. They can assist you in processing emotional pain while developing adaptive coping strategies, thus facilitating a smoother transition into a new financial and personal landscape.

Setting Realistic Financial Goals

After a divorce, it's essential to reevaluate your financial goals and set realistic objectives. This might mean creating a short-term budget or a long-term savings plan. The Smart Asset research suggests that having clearly defined goals can result in better financial success and reduced stress.

Investing in Your Future

As you recover financially from divorce, consider investing in your skill set or education to enhance your employability. Community colleges and online platforms offer a range of affordable courses that can boost your qualifications, leading to better job prospects and increased income potential.

Moreover, look into retirement accounts if you've never contributed before. Prioritizing retirement savings, even in small amounts, can set you on a path to long-term financial stability.

Practicing Mindfulness in Financial Decisions

Integrating mindfulness practices into your financial decisions can be an effective way to manage stress and emotional turmoil. Techniques like meditation and journaling can help clarify your thoughts and feelings regarding money. Research published in the Journal of Financial Therapy highlights that mindfulness can decrease impulsive financial decisions, promoting healthier spending habits.

Incorporating mindfulness can also lead to a more intentional focus on your financial goals, helping you stay aligned with your priorities post-divorce. Recognizing emotional triggers around spending can help you develop resilience, making the recovery process smoother.

Read more about Divorce Financial Recovery Timeline

Hot Recommendations

- how to maintain a respectful ex relationship

- divorce mental health improvement tips

- divorce self improvement guide for fresh start

- best divorce recovery support tips

- how to handle divorce legal challenges easily

- divorce counseling support groups online

- divorce self help resources for women

- best divorce mediation reviews 2025

- how to prepare for divorce mediation sessions

- how to rebuild confidence after divorce