Financial Planning After Divorce for Single Mothers

Regularly reviewing your spending habits can highlight areas where you can cut back. Consider whether any discretionary expenses can be reduced without sacrificing quality of life.

Evaluating Debts and Liabilities

Another critical aspect of evaluating your financial situation is understanding your debts. List out all liabilities, including credit card debt, student loans, and any other obligations. This will give you a complete picture of your financial health and help determine your net worth.

It's essential to assess not only the total debt amount but also the terms associated with each liability. This includes interest rates and minimum payments, as these factors significantly affect your financial strategy moving forward.

Analyzing Your Assets

Take an inventory of your assets, which may include savings accounts, retirement funds, real estate, and personal property such as vehicles. Understanding your assets is crucial as they can act as a safety net in case of emergencies.

Consider working with a financial advisor to accurately assess the value of your major assets. Knowing *what you own* is equally as important as knowing *what you owe*, and this balance will play a significant role in your overall financial strategy.

Setting Financial Goals

Once you have a thorough understanding of your income, expenses, debts, and assets, it's time to establish clear Financial Goals. Set both short-term and long-term objectives that align with your lifestyle and dreams, such as saving for a child’s education or purchasing a home.

Having specific, measurable goals will provide direction and motivation as you navigate your post-divorce financial landscape. By breaking these goals down into achievable steps, you can stay focused and make progress without feeling overwhelmed.

Adjusting Your Financial Mindset

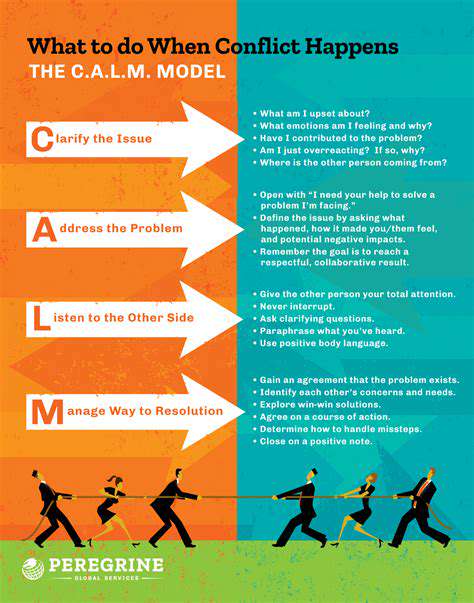

Financial assessment isn’t just about numbers; it’s also about mindset. Post-divorce, it’s common to feel financially insecure or anxious. A positive mindset will empower you to take actionable steps toward improving your financial situation.

Engage in discussions about finances with trusted friends or seek professional guidance. Sharing experiences can eliminate feelings of isolation and help build resilience as you move forward.

Seeking Professional Advice

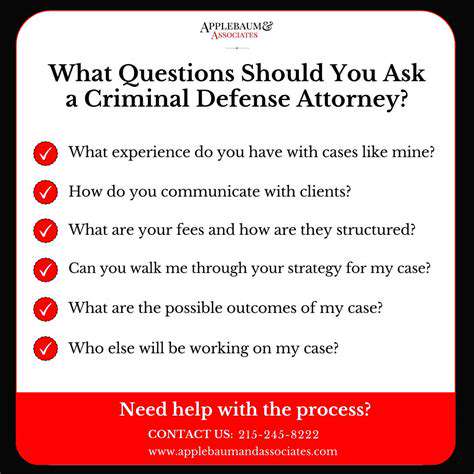

Lastly, don’t hesitate to seek professional financial advice, especially after a life change like divorce. A certified financial planner can provide personalized strategies based on your unique situation, helping you navigate complex issues like tax implications and investment planning for the future.

Consider attending workshops or online courses focused on financial planning. The more informed you are, the better equipped you will be to make sound financial decisions tailored to your circumstances.

Creating a Realistic Budget

Assessing Your Financial Situation

Before creating a budget, it’s essential to have a clear picture of your current financial status. Gather all relevant documents, such as bank statements, pay stubs, and bills. Understanding your monthly income and expenses is the first step toward financial empowerment. Make sure to account for any child support or alimony you might be receiving, as these can significantly impact your budget.

Once you have all the information, categorize your expenses into fixed and variable costs. Fixed costs include rent or mortgage, insurance, and loan payments, while variable costs cover groceries, entertainment, and discretionary spending. This assessment helps you identify areas where you can make adjustments.

Setting Clear Financial Goals

Setting Financial Goals is crucial for maintaining focus and motivation throughout the budgeting process. Begin by defining short-term goals, such as saving for an emergency fund, and long-term goals, like saving for retirement or your child's education. According to financial experts, having specific, measurable objectives can improve your likelihood of success.

Consider utilizing the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—for your goals. For example, instead of saying, I want to save money, say, I will save $200 per month for the next year. This clarity enhances your commitment and allows for better tracking of progress.

Tracking Your Income and Expenses

Effective budgeting involves consistent tracking of both your income and expenses. You can use a variety of tools, such as budgeting apps, spreadsheets, or even pen and paper, depending on what works best for you. Regularly documenting your daily spending will help you identify patterns and areas for improvement.

Experts suggest updating your tracking system weekly. This regular check-in allows you to adjust your spending and stay on target with your budget. Identify any irregular expenses, like medical bills or car repairs, and plan for them in advance to avoid financial surprise down the road.

Additionally, review your expenses monthly to see if you can cut any non-essential items. This practice fosters mindfulness in your spending habits and contributes to achieving your set financial goals.

Creating a Flexible Budget

When creating your budget, it's vital to incorporate flexibility. Life is unpredictable, and some months may require more financial resources than others. Structuring your budget to accommodate changes, like unexpected expenses or fluctuations in income, can reduce stress.

Your budget should be a living document that you review and adjust regularly. Designate a portion of your budget for discretionary spending to ensure you have some breathing room. This prevents feelings of deprivation, which can lead to overspending later. Remember, a budget should empower you, not constrain you.

Considering Emergency Savings

An essential component of any financial plan, especially for single mothers, is building an Emergency Savings fund. Financial advisors recommend saving at least three to six months' worth of living expenses to cover unforeseen costs such as medical emergencies or home repairs. This cushion can provide considerable peace of mind.

Start by allocating a small portion of your monthly income to this fund until it reaches your desired goal. Automated transfers to a high-yield savings account can help make this process seamless. Aim for gradual growth rather than an overwhelming lump sum—building this fund is a marathon, not a sprint.

Utilizing Available Resources and Support Networks

Exploring resources available to single mothers can significantly ease financial stress. Many community organizations and nonprofits offer financial literacy programs, workshops, and budgeting assistance specifically designed for single parents. These resources can provide you with essential skills and knowledge.

Additionally, consider reaching out to other single mothers or support groups for advice and encouragement. Sharing experiences can help you gain insights on handling finances effectively while also providing emotional support. Remember, seeking help is a sign of strength, not weakness.

Reviewing and Adjusting Your Budget

The final step in creating a realistic budget lies in its ongoing review and adjustment. Monitor your budget at least once a month to assess how well you are meeting your goals. During this review, take note of areas of unexpected overspending or income changes. This will allow you to recalibrate accordingly.

Over time, your financial situation and goals may change, which means your budget should evolve too. Be prepared to adapt your spending habits and savings strategies as circumstances change. Staying engaged with your budget will not only enhance your financial literacy but also instill greater confidence in managing your finances moving forward.

Setting Financial Goals

Identifying Your Financial Needs

Before setting financial goals, it's essential to evaluate your current financial situation. Take a close look at your income, expenses, and any existing debts. Knowing where you stand financially will provide a foundation for defining your goals. Create a spreadsheet that tracks your monthly income against your expenses, factoring in necessities such as housing, childcare, and transportation.

Another key aspect is identifying future financial needs, such as education costs for your children or retirement savings for yourself. Establishing these needs will create a roadmap for your financial planning. Engaging with financial professionals can provide insight into anticipated future costs, which can help in setting measurable goals.

Setting Realistic, Measurable Goals

When determining your financial goals, it’s critical to make them specific and measurable. Instead of saying, I want to save more money, define an amount, like I aim to save $5,000 over the next year. Utilizing the SMART criteria—specific, measurable, achievable, relevant, and time-bound—can enhance the clarity of your goals and track your progress effectively.

For single mothers post-divorce, goals may include saving for child-related expenses or building an Emergency Fund. Assess your priorities and ensure your goals align with your family's current situation. For instance, if your income is limited, focus on short-term goals like building a modest emergency fund before tackling long-term investments.

Creating a Budget that Works for You

A detailed, well-thought-out budget is a crucial tool for financial management. It enables you to allocate funds effectively toward various needs and goals. Include all sources of income and categorize your expenses to gain a clear picture of your financial landscape. There are many budgeting tools available, both digital and paper-based, to help streamline this process.

In building your budget, ensure you leave room for savings. Aim to set aside 10-20% of your income, if possible. This might require sacrifices or adjustments, but the long-term benefits of having savings can provide peace of mind and stability during uncertain times.

Emergency Funds and Insurance

An emergency fund acts as a financial cushion in times of unexpected expenses such as medical bills, car repairs, or sudden loss of income. It's generally advisable to save at least three to six months’ worth of living expenses in an easily accessible account. This fund can alleviate stress and provide a safety net while you work towards long-term financial goals.

Along with an emergency fund, reviewing and adjusting your insurance coverage is crucial. Ensure you have adequate health, life, and possibly disability insurance. The right insurance can protect your family financially in case of unforeseen circumstances, making it an essential component of any financial plan.

Understanding Tax Implications

After a divorce, it's essential to understand the tax implications of your new financial situation. Familiarize yourself with tax credits and deductions that you may be eligible for as a single parent. For instance, the Child Tax Credit can provide substantial financial relief, depending on your income and the age of your children.

Consider consulting a tax professional to navigate these complexities efficiently. Accurately filing your tax returns while leveraging appropriate deductions can significantly affect your financial standing, allowing you to allocate more towards your goals.

Investing for the Future

Once you’ve established a budget and emergency fund, consider investing for long-term security. While it may seem daunting, even small investments can grow significantly over time with the help of compound interest. Explore options like employer-sponsored retirement plans, IRAs, or education savings accounts for your children.

Research different investment vehicles, including stocks, bonds, and mutual funds, and understand the associated risks and returns. Even basic knowledge of investing can help in making informed decisions that align with your future goals, enabling you to accumulate wealth over time.

Monitoring and Adjusting Your Goals

Financial planning is not a one-time event but an ongoing process. As your life circumstances change, so should your financial goals. Regularly review your budget, savings, and investments to ensure they align with your evolving needs. Set a routine—perhaps monthly or quarterly—to assess your financial health and adjust your goals accordingly.

Flexibility in your financial planning allows for the adaptation to life changes, whether it’s a new job, relocation, or changes in childcare costs. Maintaining this adaptability will not only keep your financial plans on track but also provide a sense of stability in your family's financial situation.

Exploring Additional Resources and Support

Understanding Financial Assistance Programs

Many single mothers navigating financial planning after divorce might overlook the various assistance programs available. Government and nonprofit organizations often offer financial aid, including food assistance, childcare subsidies, and housing support. For example, the Temporary Assistance for Needy Families (TANF) program can provide cash aid to eligible families, putting essential resources within reach during a challenging transition.

Additionally, each state has its own set of programs designed to support single mothers. It's crucial to research local support, which can range from community food banks to specific career training programs aimed at those reentering the workforce. Websites like Benefits.gov and your local Department of Social Services can provide tailored information on applying for these resources and what to expect.

Building a Strong Support Network

Developing a robust support network is essential for single mothers post-divorce both financially and emotionally. Reaching out to family, friends, or local support groups can provide not only practical assistance but also a sense of community. Engaging with organizations like Single Parent Advocate helps connect mothers with others in similar circumstances, fostering shared experiences and advice tailored to navigate the complexities of financial independence.

Moreover, consider utilizing social media platforms for joining specialized groups aimed at single mothers. These virtual spaces allow for the sharing of resources, budgeting tips, and supportive messages that can significantly lighten emotional burdens. Balancing financial responsibilities and family dynamics can feel isolating, but a strong network significantly alleviates these feelings and increases resilience.

Building a Sustainable Future

Understanding Financial Priorities Post-Divorce

After a divorce, single mothers often face the challenge of redefining their financial priorities. It’s crucial to start by creating a detailed budget that reflects both current income and necessary expenses. Research shows that nearly 30% of single parents live below the poverty level, making it important to track all sources of income, including child support and potential government assistance programs. A budget should factor in day-to-day expenses like groceries, childcare, and housing while also acknowledging variable costs.

Another essential aspect is evaluating long-term financial goals. Many single mothers may have to adjust their expectations regarding savings and investments. It’s advisable to prioritize an emergency fund, targeting at least three to six months’ worth of living expenses. As financial goals shift, so should the approach to financial management. Consulting with a financial advisor experienced in working with single-parent households can provide tailored advice that aligns with both current realities and future aspirations.

Exploring Support Systems and Resources

Single mothers can benefit significantly from tapping into Community Resources and Support systems designed to provide financial education and assistance. Organizations such as the National Coalition for Single Parent Families offer workshops that cover financial literacy, job training, and emotional support. Utilizing these resources not only alleviates stress but also empowers single parents with the skills necessary to build a stable future.

Networking with other single mothers can also provide much-needed emotional support and practical advice on managing finances. Local meetups and online forums are practical avenues for sharing experiences and strategies. It's important for single mothers to understand that they are not alone in their journey, and such connections can lead to shared resources, potential job opportunities, or even co-living arrangements that can significantly cut housing expenses.

Additionally, exploring educational scholarships and grants can empower single mothers to further their careers. Many institutions and nonprofit organizations offer financial aid specifically for single parents looking to obtain higher education or vocational training. This investment in oneself can lead to better job opportunities and greater financial independence in the long run.