Essential Divorce Preparation Advice

Understanding Your Income

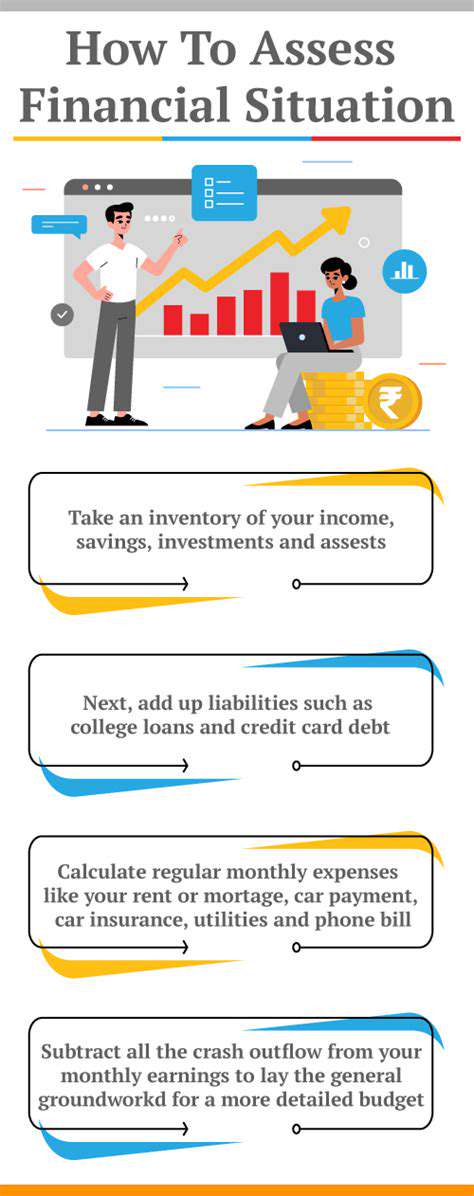

Taking stock of your finances begins with a deep dive into your income sources. Beyond just your paycheck, consider side gigs, investment dividends, or rental income—anything that adds to your monthly cash flow. Keeping meticulous records of all revenue streams paints the clearest picture of your financial health. Over time, tracking these numbers reveals spending patterns that can make or break your budgeting efforts.

This financial awareness becomes your compass for decision-making. When you know exactly what's coming in each month, you can allocate funds with precision—whether that means accelerating debt payments, saving for a home, or building that crucial emergency cushion.

Analyzing Your Expenses

Your spending habits tell the other half of your financial story. Categorizing expenses—housing, utilities, entertainment—exposes where your money actually goes. This forensic approach often uncovers surprising spending leaks that, when addressed, can free up significant funds. The real power comes from distinguishing between fixed costs (like your mortgage) and variable ones (like dining out), as this knowledge forms the foundation of any sustainable budget.

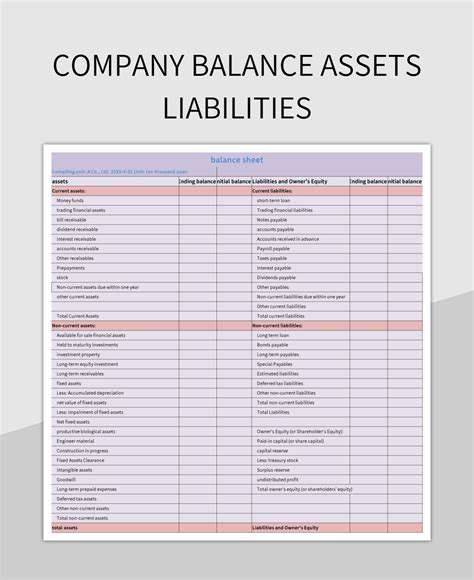

Evaluating Your Assets

Everything you own—from your savings account balance to your car's current value—comprises your financial assets. Creating a detailed asset inventory is the only way to accurately calculate your true net worth. Regular valuations of investments and property ensure you're working with current numbers when planning major financial moves.

Determining Your Liabilities

Debts represent the counterbalance to your assets. Student loans, credit card balances, and car payments all factor into your financial obligations. Facing these numbers head-on transforms them from abstract worries into concrete problems you can solve. This clarity is the first step toward developing a payoff strategy that works with your unique situation.

Creating a Budget

A well-crafted budget acts as both map and compass for your financial journey. This living document—when regularly updated—becomes your most powerful tool for aligning spending with priorities. Beyond just tracking numbers, it helps identify opportunities to redirect funds toward what matters most, whether that's debt freedom, travel, or early retirement.

Establishing Financial Goals

Clear targets transform money management from chore to purpose. Whether it's eliminating credit card debt in 18 months or saving $50K for a home down payment, specific goals create the motivation needed to stick with challenging financial changes. Breaking big ambitions into smaller milestones makes progress visible and keeps motivation high during the journey.

Understanding Legal Representation: Choosing the Right Advocate

Understanding the Role of a Legal Representative

Attorneys serve as navigators through the legal system's complexities, interpreting laws and advocating for clients' best interests. Their value lies not in general knowledge, but in specialized expertise—a divorce attorney won't be your best choice for a patent case. Recognizing this specialization early prevents wasted time and resources.

Types of Legal Representation

The legal field's diversity means there's a specialist for nearly every situation—from intellectual property disputes to immigration cases. Fee structures vary just as widely, with some attorneys charging flat rates while others bill by the hour. Understanding these differences upfront prevents unpleasant surprises down the road.

Factors to Consider When Choosing a Legal Representative

Selecting counsel requires weighing multiple factors: their win/loss record in similar cases, peer reviews, and even courtroom demeanor. A lawyer's communication style matters as much as their legal knowledge—you need someone who explains options clearly without legalese. Many offer free initial consultations; use these to assess both competence and personal fit.

The Importance of Communication in Legal Representation

The attorney-client relationship thrives on transparency. Regular updates—even when there's no news—build trust and prevent misunderstandings. Establish preferred communication methods early, whether that's weekly emails or monthly calls, to ensure you're always informed without feeling overwhelmed.

Understanding Your Rights and Responsibilities

Legal proceedings involve give-and-take. While your attorney handles strategy, you control major decisions. Knowing this balance—and your right to ask questions until you understand—makes you an active participant rather than a passive observer. This engagement often leads to better outcomes.

Preparing for Emotional Well-being: Strategies for Coping

Understanding Emotional Needs

Emotional health forms the foundation for handling life's challenges. Rather than judging feelings as good or bad, recognizing them as signals—like dashboard warning lights—allows for proactive response. This shift in perspective turns emotional awareness into a practical skill.

Developing Coping Mechanisms

Effective stress management resembles a toolkit—different situations call for different approaches. Some find solace in vigorous exercise, others in creative outlets or meditation. The key lies in having multiple researched-backed techniques ready before crises hit. Regular practice builds emotional muscle memory for tough times.

Cultivating Positive Relationships

Social connections act as emotional shock absorbers. Quality matters more than quantity—a few deeply supportive relationships often prove more valuable than dozens of superficial ones. Investing time in nurturing these bonds creates a safety net for life's inevitable stumbles.

Prioritizing Self-Care

Consistent self-care operates like preventive medicine for mental health. Small daily practices—whether a morning walk or evening gratitude journaling—compound into significant emotional resilience over time. The most effective routines address both body and mind through activities you genuinely enjoy.

Teen years bring unique emotional challenges that require tailored support strategies.

Read more about Essential Divorce Preparation Advice

Hot Recommendations

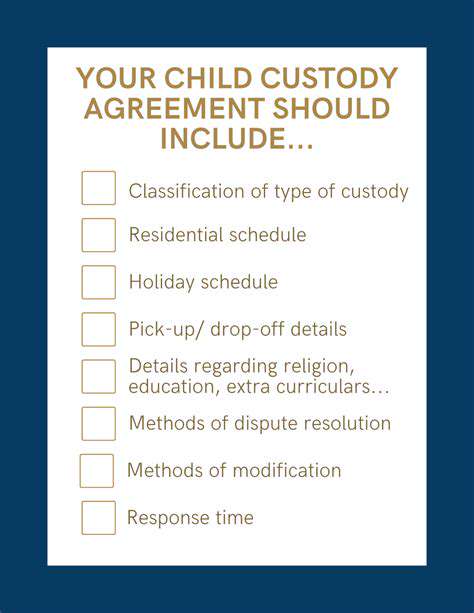

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases