How to Handle Hidden Assets in Divorce

Consulting with financial and legal experts is critical in the asset discovery process. These professionals not only bring specialized knowledge and experience but also an objective perspective that can help identify potential oversights. Their insights can be pivotal in recognizing patterns that may not be immediately apparent to the average individual.

Additionally, engaging experts before negotiations start can significantly shift the dynamics of the discussions. Armed with a comprehensive understanding of the full asset picture, individuals can enter negotiations with more confidence, leading to a potentially fairer resolution. An informed approach is invaluable in safeguarding your financial future amidst divorce proceedings.

Documenting Financial Information

Understanding Hidden Assets

Hidden assets refer to properties or investments that one spouse might try to conceal during divorce proceedings. This can include cash in secret accounts, investments in businesses, or even valuable collectibles. Recognizing the different forms hidden assets can take is crucial to securing a fair settlement. For example, one spouse may underreport income or fail to disclose valuable artwork, which can skew the division of assets significantly.

Statistics reveal that a significant percentage of divorce cases involve undisclosed assets. According to the American Academy of Matrimonial Lawyers, nearly 70% of lawyers report an increase in cases where one party intentionally hides assets. Understanding these statistics can help you grasp the potential pitfalls in your own divorce process.

Identifying Potential Concealment Methods

Spouses may employ various strategies to hide assets, and being aware of these can aid in your search. Some common methods include transferring money to friends or family members, using offshore accounts, or even purchasing assets in the name of a business. If your spouse operates a business, ensure you explore any financial records related to that enterprise.

It is important to keep a detailed record of all transactions, especially those made shortly before the divorce. Timing can be a significant indicator of deception, as the rush to conceal assets may create tell-tale signs. Documenting changes in behavior or financial statements can serve as vital evidence during negotiations.

Tools for Investigating Finances

- Bank statements

- Tax returns

- Investment portfolios

- Business records

- Property ownership documents

To thoroughly investigate a spouse's finances, utilizing available resources is essential. Reviewing bank statements, tax filings, and property ownership documents can uncover discrepancies or hidden money trails. For instance, tax returns can reveal unreported income or interest-bearing accounts that may otherwise be overlooked in casual discussions.

In specialized situations, hiring a forensic accountant might be beneficial. These professionals have the expertise to dig deeper into financial records, helping to locate hidden assets that standard procedures might miss. Engaging such experts can pay off substantially in asset recovery.

The Role of Legal Professionals

Involving legal counsel can significantly enhance your ability to uncover hidden assets. A divorce attorney experienced in asset division will have a solid grasp of the common tactics used to hide wealth. They will not only provide advice but can also utilize legal tools, such as subpoenas, to access necessary financial information.

Moreover, consulting with your attorney about potential strategies for disclosure can help you formulate a solid plan. Effective communication between you and your legal expert can bridge the gap between suspicion and discovery. This teamwork may prove instrumental in maximizing your financial outcome post-divorce.

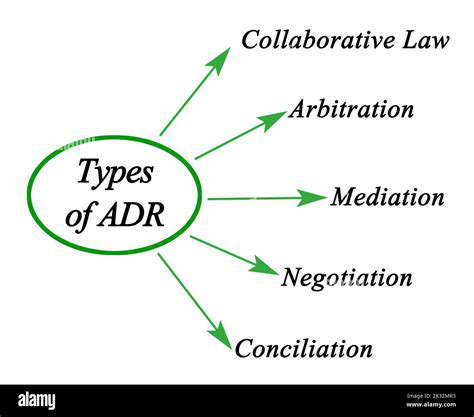

Negotiation Strategies for Asset Disclosure

When facing the reality of hidden assets, you should adopt clear negotiation strategies. Open the conversation about finances early in your divorce process, emphasizing the necessity for full transparency. Clear guidelines can prevent misunderstandings and make it easier for both parties to come to mutual benefits.

Utilizing mediation can also foster an environment where honest discussion is prioritized. This can lead to more amicable resolutions and might reduce the potential bitterness often associated with divorce. Remember, the goal is to secure a fair division, not just large assets. Building a cooperative approach can bear fruit for both sides.

Consequences of Hiding Assets

The implications of hiding assets during a divorce can be severe. In many jurisdictions, deliberately concealing assets can lead to Significant financial penalties and can even affect child custody outcomes. Courts take misrepresentation of finances seriously, and repeated attempts to hide assets can backfire dramatically.

Additionally, when hidden assets are discovered post-divorce, the aggrieved party may pursue legal action for modifications to the settlement. Understandably, breaching trust can have long-lasting effects on personal relations as well, long after financial matters are resolved. It's paramount to be upfront during discussions to avoid potential fallout.

Long-Term Implications Post-Divorce

Understanding the long-term implications of hidden assets is critical for your financial future. If a spouse successfully conceals assets, the unfair division could affect your lifestyle considerably. Recovering from a divorce's financial implications can take time, especially when you unknowingly start at a disadvantage due to concealed wealth.

After the divorce, remain vigilant with your finances, particularly if you suspect any lingering issues. Consider financial planning or counseling to assist you in strategizing for future economic stability. Being informed and proactive can mitigate the long-term effects of any hidden assets that may have impacted your initial settlement.

Legal Remedies for Uncovering Hidden Assets

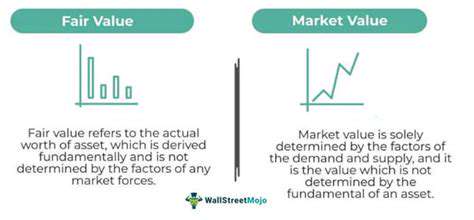

Identifying Hidden Assets

To effectively uncover hidden assets during a divorce, start by analyzing all financial statements thoroughly. This includes bank statements, tax returns, and credit reports. Forensic accountants often utilize these documents to trace undisclosed income or hidden accounts. In some cases, lenders may also have insights into joint debts that can signal concealed assets.

Moreover, gathering evidence like past appraisals, real estate deeds, or corporate documents can bolster your case.

Legal Resources and Tools

Various legal tools are available to aid in uncovering hidden assets. One of the most effective resources is the discovery process, which allows you to request relevant financial documents directly from your spouse. This can compel your spouse to disclose information they may not have otherwise shared.

Additionally, employing interrogatories—formal questions that require written answers under oath—can serve as another strategy to gather information. These methods can increase transparency and ensure that both parties are fully informed during the settlement process.

Benefits of Hiring a Forensic Accountant

Engaging a forensic accountant can significantly enhance your chances of discovering hidden assets. These professionals are trained to identify discrepancies in financial records that ordinary individuals might overlook. Forensic accountants can analyze complex financial situations and provide expert testimony in court if needed. Their expertise can prove invaluable in negotiating fair settlements.

Furthermore, their detailed reports can substantially strengthen your case if you decide to litigate. A well-documented financial analysis often acts as credible evidence, essential in court proceedings.

Legal Actions to Consider

If hidden assets are suspected, filing a motion to compel can be an effective legal course of action. This court order can mandate your spouse to produce financial documents that they have withheld. Always ensure your claims are substantiated—courts are less likely to favor actions based solely on suspicion.

Moreover, if financial misconduct is evident, you may want to consider pursuing punitive damages. This legal action requires proving that your spouse intentionally concealed assets, which can serve not only as a deterrent but also as a financial penalty.

Challenges in Discovering Hidden Assets

One major challenge is the sophisticated methods some individuals use to hide their wealth, such as transferring assets to third parties or utilizing offshore accounts. This can complicate the discovery process and cause delays. Additionally, the emotional strain of divorce can cloud judgments, making it essential to stay focused and methodical.

Furthermore, the legal cost of pursuing hidden assets can be significant, often necessitating a careful evaluation of the potential return on investment. Seeking the right balance between cost and benefit is critical.

Moving Forward After Discovery

Once hidden assets have been uncovered, it is important to understand your legal options. Consult with a family law attorney to discuss how these discoveries can impact your divorce settlement. This step is crucial for ensuring that you secure your fair share of marital assets.

Finally, learning from this experience is key to future financial planning. Understanding the patterns of asset concealment can help you protect your interests in any future financial dealings, not just in divorce.

Final Thoughts on Hidden Assets during Divorce

Understanding Hidden Assets

Hidden assets refer to properties, income, or valuables that one spouse intentionally conceals during divorce proceedings. Uncovering these assets is crucial for Achieving a fair settlement. Typically, they can include cash, investments, real estate, or unreported income that the other spouse is not aware of.

Recognizing what counts as hidden assets can empower individuals during the divorce process. For example, assets in offshore accounts or investments in family-owned businesses may not be as transparent as one might assume.

Common Types of Hidden Assets

- Offshore bank accounts

- Cryptocurrencies

- Business equity

- Cash payments or bonuses not reported

In today's digital age, cryptocurrencies have emerged as a frequently hidden asset. Their decentralized nature makes them attractive for individuals looking to shield their wealth.

Additionally, some people may fail to report side businesses that generate significant income. This can be particularly relevant if one spouse runs a publicly visible business while concealing revenue sources.

Strategies for Identifying Hidden Assets

When seeking hidden assets, one effective strategy is to conduct a thorough financial audit. This could involve reviewing bank statements, tax returns, and any financial documents from the marriage.

Another useful approach is to engage forensic accountants who specialize in tracing hidden funds. They have tools and expertise that can unveil discrepancies, especially in complex cases involving business valuations.

Legal Implications of Hidden Assets

Disregarding hidden assets can lead to severe legal consequences, including the potential for settlement agreements to be overturned. Courts are increasingly vigilant about ensuring transparency during divorce proceedings.

If hidden assets are discovered post-divorce, courts generally allow for modifications to the settlement. It's important for individuals to understand that failing to disclose assets can also impact alimony and child support arrangements.

The Emotional Toll of Hidden Assets

The revelation of hidden assets can significantly heighten the emotional stress involved in divorce. Individuals may feel betrayed, confused, or even angry upon discovering that their spouse was concealing assets.

Understanding these feelings is important, as they can influence decision-making processes. Engaging with a counselor or therapist may help address the emotional ramifications while navigating the financial complexities.

The Role of Mediation in Uncovering Hidden Assets

Mediation can serve as a valuable tool in addressing hidden assets, providing a confidential environment for both parties to discuss finances openly. A skilled mediator can facilitate discussions focused on uncovering hidden resources.

Once both parties agree on a comprehensive financial disclosure, it can lead to a more equitable division of assets, reducing the likelihood of future disputes. This cooperative approach often fosters better communication during a difficult time.

Preparing for Financial Disclosure

Before entering a divorce agreement, both parties must gather and provide accurate financial disclosures. This preparation is key to preventing misunderstandings about each spouse's assets and liabilities.

Individuals should compile documentation related to all properties owned, income sources, and debts incurred throughout the marriage. This meticulous preparation can Significantly affect the overall outcome of sustainable agreements.