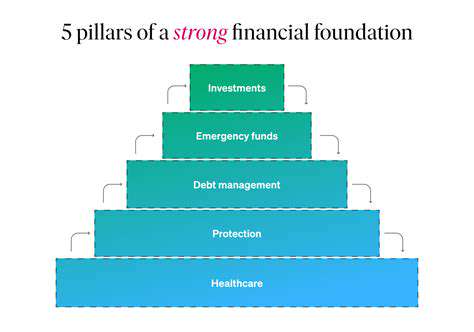

How to Create Financial Security After Divorce

Additionally, make a clear inventory of all debts associated with your former spouse that could still impact your financial health. This includes mortgage liabilities and joint credit accounts. Take special care to consult your divorce decree, as it outlines the division of debts between parting spouses, which can provide guidance on what you are legally responsible for paying.

Develop a Repayment Strategy

After you’ve mapped out your debts, the next step is to create a tailored repayment strategy. You might consider using either the snowball or avalanche methods. The snowball method focuses on paying off the smallest debts first for quick wins, while the avalanche method targets the debts with the highest interest rates to save money over time. Research shows that the latter, while arguably less psychologically rewarding, can save significantly on interest payments over the long run.

Communicate with Creditors

Don’t shy away from reaching out to your creditors. Many institutions are willing to work with customers experiencing financial hardship, particularly in the aftermath of divorce. Inquire about hardship programs or any opportunities for restructuring your payment plans. In a study by Credit Karma, over 70% of consumers found success in negotiating payment terms after approaching lenders with genuine concerns.

Consider Professional Help

If debt feels overwhelming, consulting a financial advisor or a credit counselor specializing in post-divorce financial rebuilding can be a wise investment. These professionals can provide personalized guidance tailored to your specific financial situation, helping you create a workable budget that takes into account your new lifestyle. Keep in mind that organizations like the National Foundation for Credit Counseling (NFCC) can offer resources and referrals to certified credit counselors.

Be cautious, however, when choosing financial help; always check for credentials and ensure that any counselor you work with is a certified professional to avoid potential scams.

Establish a Budget

Creating a budget is critical to ensure that you manage debts effectively after divorce. Itemize your monthly income and expenditures thoroughly, leaving room for savings and unexpected emergencies. A recent survey indicated that individuals who stick to a budget are one-third more likely to feel financially stable compared to those who do not. Allocate specific amounts for debt repayment aligned with your repayment strategy to avoid falling back into old habits.

Build an Emergency Fund

While it may seem counterintuitive to save when dealing with debt, establishing an emergency fund can prevent future financial setbacks. Aim to save at least three to six months of living expenses, which acts as a buffer against unexpected costs. According to a Charles Schwab survey, almost 60% of respondents wished they had saved more money for emergencies to mitigate financial stress during life transitions like divorce.

Monitor Your Credit Score

Finally, regularly monitoring your credit score is essential in the debt management process. Changes to your credit score can significantly affect your financial opportunities, such as qualifying for better interest rates or even a mortgage down the line. Utilize free services like Credit Karma or annual credit reports to track your progress and ensure that your debts are reported accurately. Remember, maintaining a positive credit history not only helps in debt recovery but is also critical for future Financial Stability.

4. Build an Emergency Fund

Understanding the Importance of an Emergency Fund

Creating an emergency fund is a fundamental step in regaining financial stability after a divorce. It acts as a safety net for unexpected expenses that often arise during challenging times. By establishing this fund, you are providing yourself with peace of mind and reducing stress related to uncertain financial situations.

Typically, financial experts recommend saving three to six months’ worth of living expenses. This amount can cover necessary bills such as rent, utilities, and groceries, allowing you to focus on recovering rather than worrying about finances.

How to Calculate Your Target Emergency Fund

Determining the appropriate size of your emergency fund requires a clear understanding of your monthly living costs. Start by tracking your expenses over a few months to identify essentials versus discretionary spending. Once you have this data, multiply your total monthly expenses by the number of months you aim to cover.

This tailored approach ensures that your fund is adequate for your specific situation, reflecting your lifestyle and obligations while providing sufficient security.

Steps to Build Your Emergency Fund

- Set a clear savings goal based on your calculated monthly expenses.

- Create a separate savings account to avoid dipping into your fund.

- Automate your savings by transferring a fixed percentage of your income regularly.

Starting small can be vital for building a substantial emergency fund. Begin by saving a manageable amount each month, and gradually increase this contribution as your financial situation improves. Over time, these small efforts can lead to a significant financial cushion.

Recommended Savings Strategies

Consider utilizing high-yield savings accounts or money market accounts, as they typically offer better interest rates than standard savings accounts. This can help grow your emergency fund more effectively. Moreover, review your current budget to identify areas where you can cut back and redirect those savings to your fund.

Finding ways to increase your income, whether through side gigs or investing in personal development, can also expedite reaching your emergency fund goal.

Maintaining and Replenishing Your Fund

After successfully building your emergency fund, it's essential to maintain it. Ensure that it’s solely reserved for genuine emergencies such as medical expenses or unexpected repairs. If you ever need to dip into it, make a plan to replenish those funds as soon as possible, ideally within six months.

Regularly assessing your financial situation can also influence how much you should have in your fund. Adjust your savings goal according to changes in your income, expenses, and financial responsibilities to ensure you're always prepared for the unexpected.

5. Reassess Your Investment Strategy

Understand Your Current Financial Position

Before making any adjustments to your investment strategy, it's essential to conduct a thorough review of your current financial standing. This includes assessing your total assets, liabilities, income sources, and current expenditures. Gather documentation regarding your savings, real estate, stocks, bonds, and any other investments you hold. A financial planner can assist in this process, providing you with a clear snapshot of your fiscal landscape post-divorce.

In addition to a numerical assessment, consider your emotional readiness for making investment decisions. Emotional factors can skew your judgment regarding Risk Tolerance and investment goals. Engaging with financial professionals can help tailor your strategy to reflect both your financial and psychological readiness to navigate potential market volatility.

Lastly, keep in mind that your financial situation is dynamic; market conditions, personal circumstances, and investment opportunities can shift. It’s prudent to review your financial circumstances regularly, ideally quarterly, to ensure your strategy remains aligned with your overall life goals.

Evaluate Risk Tolerance and Investment Goals

After establishing your Financial Position, the next step is to evaluate your risk tolerance. This is especially critical after significant life changes such as divorce. Risk tolerance describes how much market fluctuation you can withstand without it impacting your peace of mind. Tools such as risk assessment questionnaires can help clarify whether you lean towards conservative or aggressive investing.

Once you understand your risk tolerance, you can establish clear, measurable investment goals. Do you prioritize short-term liquidity for daily expenses, or are you aiming for long-term growth through diversified investments? Having defined goals allows you to choose investments that are well-aligned with your financial aspirations, creating a roadmap that keeps your focus sharp amidst market changes.

Consulting with an investment advisor can provide insight into constructing a balanced portfolio. They'll suggest a suitable allocation among assets such as equities, fixed income, and real assets based on your unique risk profile and objectives.

Diversification: Building a Balanced Portfolio

The principle of diversification involves spreading your investments across various asset classes to mitigate risk. As you reassess your strategy, consider the importance of not putting all your eggs in one basket. A well-diversified portfolio may include a mix of stocks, bonds, real estate, and perhaps alternative investments like commodities. This balanced approach helps cushion your portfolio from downturns in any single sector.

Furthermore, periodic rebalancing is crucial to maintaining diversification. After market movements, your allocations may drift away from your intended strategy, potentially increasing vulnerability to market fluctuations. Rebalancing involves adjusting your asset mix back to your desired allocation without incurring excessive tax liabilities.

Ultimately, a diversified portfolio not only acknowledges the unpredictability of the market but enhances the potential for financial growth. Engaging with financial tools or professional advisory services can improve your ability to implement and execute a robust, diversified investment strategy effectively.