effective divorce property division strategies

Defining Marital Property

Marital property, in the context of divorce or separation, refers to assets and debts acquired by a couple during their marriage. This encompasses a wide range of items, from real estate and bank accounts to investments and personal property. Understanding the specific definition of marital property is crucial in determining how assets will be divided in a divorce proceeding. This often requires careful consideration of when and how the assets were acquired.

Specific legal standards vary by jurisdiction, but generally, assets acquired through joint efforts during the marriage are considered marital property. This means that contributions from either spouse, whether financial or otherwise, are taken into account when determining the ownership and division of assets.

Distinguishing Separate Property

Separate property, conversely, encompasses assets and debts acquired by a spouse before the marriage, or during the marriage through a gift or inheritance. These assets remain the sole property of the individual spouse and are not subject to division in a divorce or separation. Careful documentation is essential to establish the separate nature of the asset.

Examples of separate property can include gifts received during the marriage, inheritances, and assets owned prior to the marriage. It's important to note that the specific definition of separate property can vary depending on the jurisdiction and the circumstances of the case.

Importance of Documentation

Thorough documentation is paramount when distinguishing between marital and separate property. This includes meticulous records of financial transactions, receipts for gifts or inheritances, and any legal documents related to the acquisition of assets. Proper documentation significantly strengthens a claim for separate property and helps prevent disputes during the division process.

Maintaining accurate records throughout the marriage is crucial, and this should include not just financial transactions but also records of gifts, inheritances, and any other significant events that may impact the classification of assets.

Tracing the Origin of Assets

Tracing the origin of assets is a key aspect of determining their classification. If an asset was purchased with funds from a separate source, such as an inheritance or a pre-marital savings account, it is more likely to be considered separate property. Careful documentation and financial records can be vital for tracing the origins of assets and establishing their classification. This is especially important when assets have been commingled.

Commingling of Assets

Commingling of assets occurs when separate property is mixed with marital property. This can complicate the division process, as it becomes more difficult to determine the exact nature and origin of the assets. Careful records and clear evidence are essential to determine the extent of commingling. Legal counsel is often necessary to navigate such complexities.

Valuation of Assets

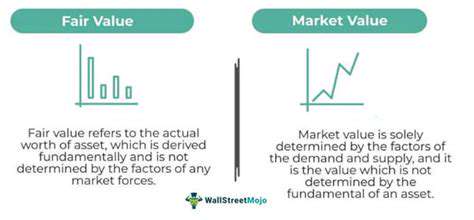

Accurate valuation of assets is crucial for fair division in divorce proceedings. This includes not only tangible assets like real estate but also intangible assets like business interests and retirement accounts. Appraisals and expert testimony may be required to establish the fair market value of certain assets. This process can be complex and require specialized knowledge.

Legal Counsel and Jurisdiction

Seeking legal counsel is highly recommended when dealing with marital and separate property issues. Experienced family law attorneys can provide guidance on the specific laws and procedures within your jurisdiction. Understanding the legal framework governing property division is essential to protect your rights and interests. Different jurisdictions may have varying rules and regulations regarding marital and separate property, so consulting with a local attorney is crucial.

Streamlining workflows is crucial for enhancing overall efficiency and productivity. By implementing a more flexible system, teams can adapt to changing priorities and demands with greater ease. This adaptability is particularly important in today's dynamic business environment, where responsiveness to market shifts and evolving customer needs is essential.

Valuation Methods: Determining the Fair Market Value of Assets

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a valuation method that attempts to determine the intrinsic value of an asset by projecting its future cash flows and discounting them back to their present value. This method considers the time value of money, a crucial concept in finance, as future cash flows are worth less than the same amount received today. Accurately projecting future cash flows is critical to the reliability of the DCF valuation and requires careful consideration of market trends, economic forecasts, and the company's specific business strategy. It's a complex process, demanding significant financial modeling expertise and a deep understanding of the business and its operating environment. It usually requires extensive research and data collection to support the projections.

The DCF method involves several steps, including forecasting future cash flows, estimating an appropriate discount rate, and calculating the present value of those future cash flows. Different approaches can be used to forecast future cash flows, including top-down and bottom-up analysis. The selection of the appropriate discount rate is also vital and often involves using the weighted average cost of capital (WACC) or a similar metric. The accuracy of the discount rate calculation significantly impacts the valuation result, making it a crucial input in the DCF valuation process.

Comparable Company Analysis

Comparable company analysis, also known as peer analysis, is a relative valuation method that determines the value of a company by comparing it to similar companies in the same industry. This method examines the financial ratios, multiples, and other key metrics of comparable companies to establish a range of values for the subject company. By analyzing these comparable companies, investors can gain insights into the market's perception of the company's value and potential investment opportunities. This process also allows investors to assess the potential risks and rewards associated with an investment.

The process typically involves identifying comparable companies based on factors such as size, industry, financial performance, and market position. Then, key financial ratios and multiples, such as price-to-earnings (P/E), price-to-book (P/B), and enterprise value-to-EBITDA, are calculated and compared across the comparable companies. Ultimately, the goal is to derive a range of values for the subject company, considering the similarities and differences with its peers. This approach leverages market data and the collective wisdom of the market to provide a valuation perspective.

Read more about effective divorce property division strategies

Hot Recommendations

- divorce asset division legal checklist

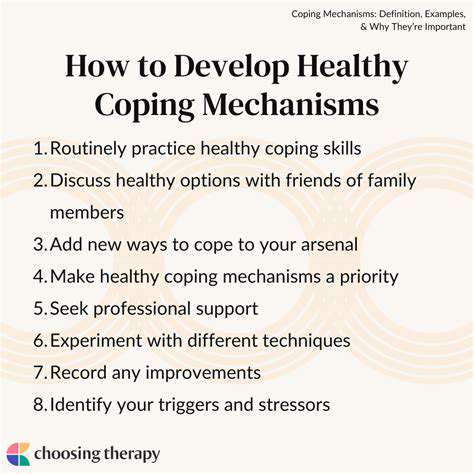

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases