Post Divorce Legal Support for Asset Division

These valuations form the foundation for all negotiation, whether the couple aims for an amicable settlement or prepares for courtroom battles. Getting this step right prevents future disputes about whether the division was truly equitable.

Negotiation and Settlement Strategies

The art of compromise becomes crucial when dividing a life built together. Some couples find creative solutions - one keeps the house while the other retains the retirement accounts, for instance. Mediators can help identify priorities that aren't immediately obvious. Maybe one spouse values the family business for sentimental reasons, while the other cares more about liquid assets.

When negotiations stall, understanding the litigation alternative becomes important. Courtroom battles increase costs dramatically, both financially and emotionally. Skilled attorneys can often predict likely judicial outcomes, helping clients make informed decisions about when to settle and when to fight.

Legal Representation and Expert Testimony

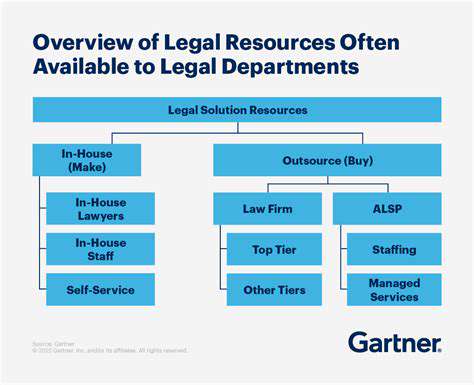

Navigating asset division without professional guidance is like sailing stormy seas without a compass. Attorneys do more than file paperwork - they provide strategic advice about what's truly negotiable and what's worth contesting. In complex cases involving business valuations or obscure investments, forensic accountants might join the team.

These professionals can trace hidden assets or uncover questionable financial maneuvers. Their expert testimony carries weight in court, often making the difference between an equitable settlement and an unjust outcome. The right team transforms an overwhelming process into a manageable one.

Understanding Equitable Distribution Principles and Strategies

Understanding Equitable Distribution: A Foundation for Fair Outcomes

Equitable distribution isn't about equal splits - it's about fair ones. Courts consider numerous factors: the length of the marriage, each spouse's earning capacity, contributions to the marriage (including homemaking), and even health considerations. The goal is to prevent either party from suffering disproportionate financial harm due to the dissolution.

This approach recognizes that marriages represent economic partnerships where contributions take many forms. The stay-at-home parent who supported a spouse's career advancement made sacrifices that the law acknowledges when dividing assets.

Key Principles of Equitable Distribution

Several bedrock principles guide this process. First is full disclosure - hiding assets violates the spirit of equitable distribution and can result in severe penalties. Second is the consideration of future needs - a spouse with primary custody of young children might receive the family home regardless of whose name is on the deed.

Perhaps most importantly, equitable distribution seeks to balance outcomes without punishing either party. It's not about assigning blame for the marriage's failure, but rather ensuring both individuals can move forward with dignity.

The Role of Transparency in Equitable Distribution

Hidden assets represent one of the most common - and damaging - issues in divorce proceedings. Full financial disclosure forms the cornerstone of equitable distribution. Both parties must provide complete documentation of all assets, debts, income streams, and expenses.

Modern tools like forensic accounting can uncover attempts to conceal wealth, but the process works best when both parties approach it honestly. Transparency saves time, reduces legal fees, and fosters settlements that hold up over time.

Addressing Systemic Barriers to Equitable Distribution

Certain groups face particular challenges in achieving equitable outcomes. Stay-at-home parents, often women, may struggle to demonstrate their non-financial contributions. Older divorcing individuals might find their retirement prospects dramatically different post-divorce.

The legal system continues evolving to address these inequities. Some jurisdictions now explicitly consider the economic consequences of career sacrifices made for the marriage. These refinements help ensure equitable distribution lives up to its name.

Economic Implications of Equitable Distribution

The financial ripple effects of divorce extend far beyond the immediate asset division. Credit scores, future earning potential, retirement security - all require careful consideration. Equitable distribution aims to position both parties for financial stability, recognizing that two households cost more to maintain than one.

Social Implications of Equitable Distribution

When handled fairly, asset division can minimize the social disruption of divorce. Children benefit when both parents maintain stable living situations. Communities suffer less when divorcing couples avoid plunging into financial distress.

Equitable distribution isn't just about dollars - it's about preserving social fabric during life's difficult transitions.

The Importance of Ongoing Evaluation and Adaptation

As society changes, so too must approaches to asset division. The rise of cryptocurrency, remote work arrangements, and new forms of intellectual property all present fresh challenges for equitable distribution frameworks.

Legal professionals must stay abreast of these developments to ensure the system remains relevant. The best solutions adapt to new realities while maintaining core principles of fairness.

Define renovation goals to prioritize time and spending effectively.

The Role of Legal Counsel in Asset Division Proceedings

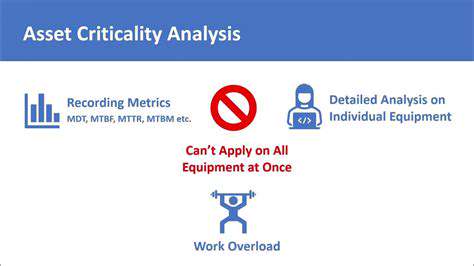

The Importance of Legal Expertise in Asset Valuation

Valuing complex assets requires specialized knowledge. Take a family business - is it worth its physical assets, its earning potential, or some combination? Experienced attorneys bring valuation experts who understand these nuances, preventing either party from getting shortchanged.

They also know which assets often get overlooked - frequent flyer miles, season tickets, even valuable collectibles. Comprehensive valuation forms the foundation for fair distribution.

Protecting Asset Rights and Interests

Legal counsel serves as both shield and advocate. They ensure proper procedures get followed when tracing asset origins or uncovering hidden transfers. Title searches, business record examinations, and financial statement analyses all play roles in protecting client interests.

Thorough due diligence prevents nasty surprises down the road, like discovering an ex-spouse transferred property to relatives before filing for divorce.

Navigating Complex Asset Transactions

Some assets can't simply be split down the middle. What happens to the marital home when neither can afford it alone? How are stock options that haven't vested handled? Attorneys help craft creative solutions - maybe the house gets sold with proceeds divided, or one spouse keeps certain assets in exchange for others.

These negotiations require understanding both legal parameters and human emotions. Good counsel helps clients see beyond immediate wants to long-term needs.

Addressing Potential Disputes and Conflicts

Even with best intentions, disputes arise. Maybe valuations differ dramatically, or one party suspects asset hiding. Legal teams prepare for these scenarios, gathering evidence and building strong positions.

They also know when mediation might resolve issues more effectively than litigation. The right approach depends on the specific conflict and the clients' broader goals.

Seeking Professional Advice for a Smooth Transition

Understanding Your Legal Landscape

Divorce laws vary significantly by jurisdiction. Some states follow community property rules, others equitable distribution. Some consider fault in the marriage's dissolution, others don't. Local legal expertise proves invaluable in navigating these variations.

Attorneys also help interpret how specific assets get treated - is that inheritance really protected? Does the prenup hold up? These nuances make professional guidance essential.

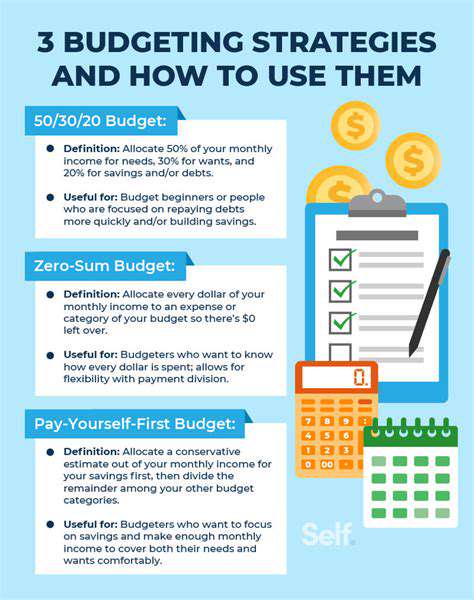

Addressing Financial Implications

The financial aftershocks of divorce can last years. Alimony calculations, tax consequences of asset transfers, dividing retirement accounts - all require specialized knowledge. Financial planners working alongside attorneys can model different settlement scenarios.

They might show how keeping the house could strain finances compared to taking liquid assets. These insights help clients make informed, not emotional, decisions.

Securing the Best Interests of Your Children

Child-related decisions often intertwine with financial ones. The custodial parent might need the family home for stability, but can they afford its upkeep? Attorneys help balance these competing priorities while keeping children's needs central.

They also ensure support agreements get properly structured and enforced. Children deserve stability during this transition, and proper legal frameworks help provide it.