Property Rights and Divorce Legal Matters

Defining Community Property

In many U.S. states, community property refers to assets and debts accumulated by a married couple during their union. This includes salaries, investments, and purchases made with joint funds. The law treats these assets as equally owned by both partners, irrespective of who earned or acquired them. This principle often plays a pivotal role when marriages dissolve, affecting how courts distribute marital assets.

Since state laws vary considerably, consulting a local attorney becomes essential for understanding how these rules apply in your area. Knowing your rights can prevent unpleasant surprises during divorce proceedings.

Defining Separate Property

Assets owned before marriage or received as gifts/inheritances during the marriage typically qualify as separate property. These remain under individual ownership and don't become part of the marital estate. Common examples include pre-existing real estate, family heirlooms, or trust fund distributions. Properly identifying these assets early can prevent contentious battles during divorce.

Maintaining clear boundaries between marital and separate property requires vigilance. Commingling funds or using separate assets for joint purposes might unintentionally convert them into community property.

Tracing Ownership: The Importance of Documentation

Meticulous record-keeping proves indispensable when distinguishing property types. Bank statements, purchase contracts, and gift letters serve as critical evidence. These documents help establish clear ownership trails that courts recognize. Organized records simplify asset division and reduce conflict during emotionally charged separations.

Implications for Divorce Settlements

Courts typically split community property 50-50 while preserving separate assets for their original owners. Misclassification can lead to unfair settlements or prolonged litigation. Some spouses attempt to hide assets or manipulate valuations - having proper documentation thwarts such attempts.

Tax Implications of Separate Property

Income generated from separate assets usually flows to the owning spouse's tax return. Understanding these nuances helps with financial planning and prevents unexpected tax burdens. For instance, rental income from inherited property or dividends from pre-marriage investments require special consideration.

Protecting Your Interests

Engaging a skilled family law attorney provides crucial protection. Legal experts can:

- Identify asset classifications

- Recommend protective measures

- Navigate complex valuation processes

Valuation of Assets and Liabilities: A Critical Aspect

Understanding Asset Valuation in Divorce Proceedings

Professional appraisals become essential when dividing complex assets like businesses or collectibles. Standard valuation methods include:

- Market comparisons for real estate

- Discounted cash flow analysis for businesses

- Expert appraisal for unique items

Assessing Liabilities in Divorce Settlements

Debt division follows similar principles to asset distribution. Joint credit card balances, mortgages, and co-signed loans typically split equally. However, pre-marital student loans or personal credit card debt usually remain with the original borrower. Full financial disclosure prevents post-divorce surprises about undisclosed obligations.

The Role of Legal Counsel in Valuation and Liability Assessment

Attorneys bring critical expertise to:

- Select appropriate valuation methods

- Challenge questionable appraisals

- Ensure compliance with local laws

The Role of Lawyers and Courts in Property Division

The Importance of Legal Representation

Experienced attorneys provide indispensable guidance through complex legal terrain. They interpret obscure regulations, negotiate favorable terms, and prevent procedural missteps. Without proper representation, individuals often forfeit rights or accept unfair settlements.

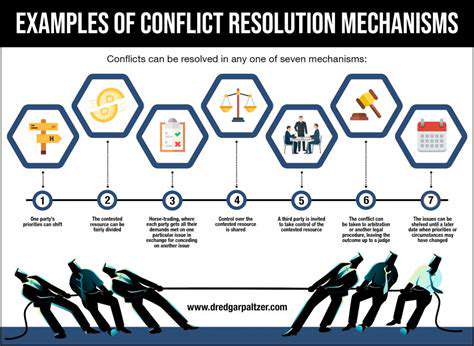

The Function of Courts in Dispute Resolution

Judges serve as impartial arbiters when couples cannot agree. They evaluate evidence, interpret laws, and make binding decisions. Court interventions become necessary when:

- Spouses conceal assets

- Valuations conflict significantly

- Emotions prevent rational negotiation

The Interaction Between Lawyers and Courts

Effective attorneys understand how to:

- Present evidence persuasively

- Frame arguments according to judicial preferences

- Navigate local court procedures

The Impact of Legal Decisions on Society

Landmark divorce cases often establish precedents affecting future rulings. For example, courts increasingly recognize:

- Digital assets as property

- Professional licenses as valuable assets

- Pets as more than simple property

Access to Justice and Legal Aid

Pro bono services and sliding-scale fee arrangements help bridge the justice gap. Many bar associations offer:

- Free initial consultations

- Document preparation assistance

- Limited-scope representation options

Read more about Property Rights and Divorce Legal Matters

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases