divorce asset division advice for secure settlements

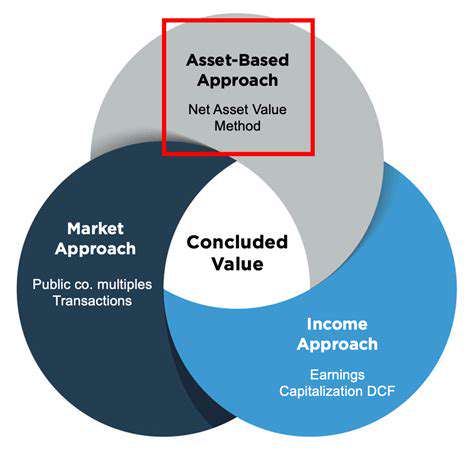

Understanding Asset Valuation

Asset valuation is a crucial process in finance and accounting, enabling businesses and individuals to determine the worth of their assets. This process considers various factors, including market conditions, historical data, and anticipated future performance. Accurate asset valuation is essential for making informed investment decisions, ensuring fair financial reporting, and ultimately maximizing profitability.

Methods for Valuing Tangible Assets

Tangible assets, such as property, plant, and equipment (PP&E), are typically valued using methods like cost, market, or net realizable value. Cost-based valuation reflects the original purchase price, less any accumulated depreciation. Market-based valuation, on the other hand, considers the current market value of comparable assets. Net realizable value assesses the asset's expected selling price after deducting any costs associated with the sale.

Valuing Intangible Assets: A Complex Process

Valuing intangible assets, like patents, trademarks, and goodwill, presents a greater challenge. These assets lack a readily available market value and their worth often depends on factors such as future revenue potential and competitive advantages. Expert opinions and detailed analysis of the asset's value-driving characteristics are crucial, as well as understanding the economic environment and industry trends.

The Role of Market Conditions in Valuation

Market conditions significantly impact the valuation of assets. Fluctuations in the overall economy, interest rates, and specific industry trends heavily influence the market value of assets. Understanding these market forces is critical for making accurate and informed valuation judgments. For instance, during periods of economic downturn, the market values of certain assets may decline significantly, potentially requiring re-evaluation.

Factors Affecting Asset Value

Numerous factors influence the ultimate value of an asset. These include the asset's physical condition, its location, its current and projected demand in the market, and its future usage. Assessing the risk associated with the asset, including potential obsolescence and technological changes, is a significant part of the valuation process. A comprehensive analysis considers these factors to arrive at a reliable estimate of the asset's worth.

Importance of Professional Valuation

Complex asset valuations often require the expertise of professional appraisers and valuators. They possess specialized knowledge and experience in evaluating assets, using sophisticated methods and tools to determine their fair market value. Professional valuations are crucial for legal proceedings, financial reporting, and investment decisions. These professionals consider numerous factors and provide a detailed report supporting the valuation, ensuring the process is accurate, reliable, and defensible.

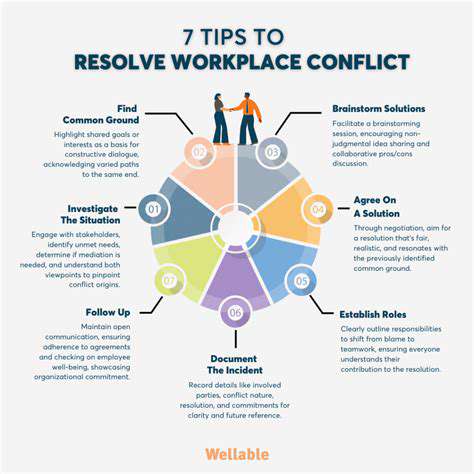

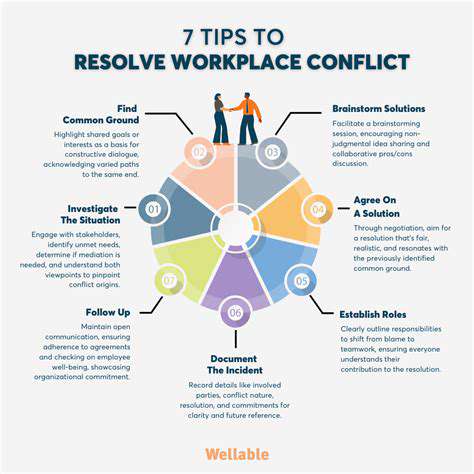

Strategies for Negotiating and Resolving Asset Disputes

Negotiation Strategies for Success

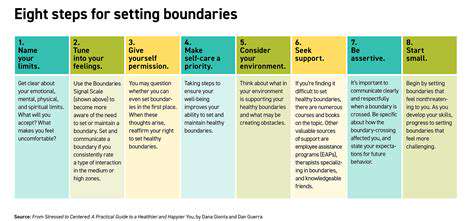

Effective negotiation requires a strategic approach that goes beyond simply stating your desired outcome. Understanding the other party's needs and motivations is crucial for building rapport and identifying potential areas of compromise. This involves active listening, asking clarifying questions, and demonstrating empathy. A well-prepared negotiator anticipates potential objections and has alternative solutions ready to address them. This proactive approach fosters a more collaborative environment, increasing the likelihood of a mutually beneficial agreement.

Careful preparation is paramount. Researching the other party, understanding their priorities, and defining your own objectives are essential steps. This includes identifying your bottom line and what you're willing to concede. Knowing your limits is critical to avoiding unnecessary concessions and ensuring a favorable outcome. Thorough preparation allows you to confidently navigate the negotiation process and maintain a strong position throughout.

Building Rapport and Trust

Establishing rapport and trust is fundamental to successful negotiation. Creating a positive and collaborative atmosphere is key to fostering open communication and encouraging a willingness to find common ground. This involves active listening, demonstrating respect for the other party's perspective, and acknowledging their concerns. Building trust allows for a more productive discussion and increases the likelihood of reaching a mutually beneficial agreement.

Demonstrating sincerity and genuine interest in the other party's needs is essential for building rapport and trust. Showing empathy and understanding their position, even if you don't agree with it, helps create a more collaborative and open environment. This approach fosters a sense of shared purpose and encourages the other party to reciprocate, ultimately leading to a more positive negotiation experience for all involved.

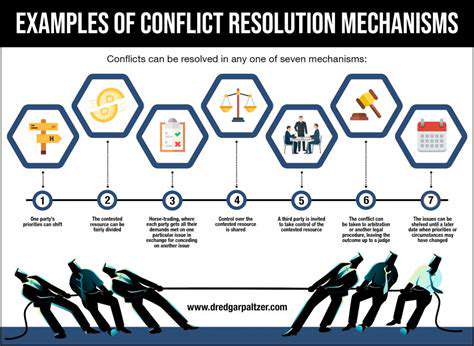

Resolving Conflicts and Reaching Agreements

Negotiation often involves addressing potential conflicts and disagreements. A crucial aspect of resolving conflicts is to identify the root cause of the issues. Understanding the underlying needs and concerns of both parties is essential for finding common ground and developing creative solutions. By focusing on shared interests, you can often find ways to address concerns and overcome obstacles. This proactive approach allows for a more constructive exchange and sets the stage for a mutually agreeable outcome.

Effective communication is vital for achieving successful resolutions. Clearly articulating your position, while actively listening to the other party's perspective, is crucial. Employing active listening techniques, such as summarizing and paraphrasing, helps ensure accurate understanding and avoids misinterpretations. This approach allows for a more productive dialogue and increases the probability of reaching a mutually beneficial agreement. Considering alternative solutions and being open to compromise are crucial steps in effectively resolving conflicts and reaching agreements.

Remember that time you traveled somewhere and suddenly saw your own culture through fresh eyes? Or when you met someone whose traditions made you question your own? These moments of friction and discovery are where cultural identity gets interesting. They force us to articulate what we've always taken for granted.

Read more about divorce asset division advice for secure settlements

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases