how to recover financially after divorce settlement

Assessing Assets and Liabilities

This financial inventory goes beyond spreadsheets. Photograph valuables, scan sentimental items with monetary value, and document digital assets often overlooked. One divorcee discovered her ex's cryptocurrency wallet was community property—leading to a six-figure settlement. Simultaneously, list every debt with interest rates; some may be negotiable post-divorce when creditors want to retain business.

Building a Resilient Financial Plan

Traditional budgeting fails many divorcees because it ignores emotional spending triggers. Instead, design a financial first aid kit with three tiers: 1) 30-day crisis cash, 2) 90-day stabilization fund, 3) long-term rebuilding. Mark, a recent divorcee, automated transfers to these buckets right after payday—his pay myself first strategy prevented emotional splurges. Review this system quarterly as your new normal emerges.

Navigating Financial Assistance Programs

Many qualify for help but don't apply due to pride or misinformation. Local legal aid societies often know about obscure programs—like Denver's mortgage assistance for single parents or Austin's utility bill relief. A teacher I advised received $3,000 in emergency housing grants by simply asking the right questions at her child's school PTA meeting. Bring divorce paperwork when applying—many programs prioritize post-marital transitions.

Partnering With Financial Professionals

Seek a Certified Divorce Financial Analyst (CDFA)—they understand nuances like QDROs and tax implications of asset splits. My colleague helped a client preserve $120,000 in retirement funds by structuring withdrawals strategically over seven years. Fee-only advisors often provide free initial consultations; bring your financial inventory to maximize this meeting.

The recent social media frenzy surrounding mysterious disappearances mirrors how divorce can make financial assets vanish—if you're not vigilant. One reddit thread's theory about historical artifacts applies equally to finances: What you don't document, you can't protect.

Seeking Professional Guidance and Support

The Power of Expert Perspectives

After my divorce, I resisted therapy until realizing my financial advisor was essentially a money therapist. Specialized professionals provide more than advice—they offer cognitive frameworks. My CDFA's financial triage system helped prioritize which fires to extinguish first when everything felt urgent. This structured approach prevented costly emotional decisions.

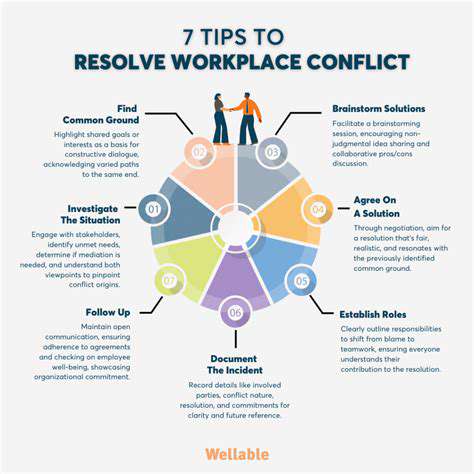

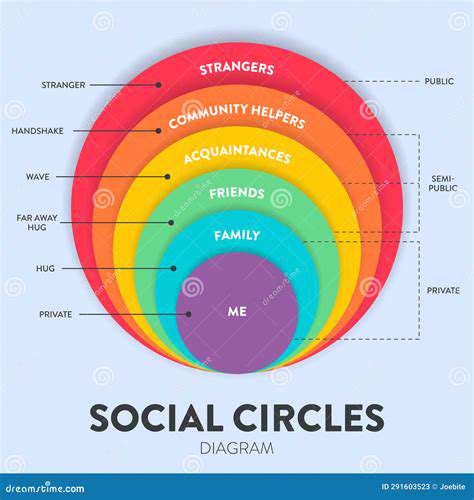

Matching Specialists to Your Needs

Not all help is equal. A bankruptcy attorney differs from a divorce attorney as a cardiologist differs from a podiatrist. I guide clients to create a support dream team—perhaps a therapist for grief, forensic accountant for hidden assets, and career coach for reinvention. Pro tip: Many professionals offer sliding scales—my therapist adjusted fees during my financial rebuilding phase.

Clarifying Your Objectives

Before consulting professionals, journal for a week about financial pain points. This creates an issues inventory far more useful than vague complaints. One client's journal revealed 73% of her financial stress came from one vexing custody-related expense—solving that transformed everything else. Bring this documentation to initial consultations.

Creative Support Solutions

Beyond traditional therapy, consider divorce financial workshops at community colleges or church-based support groups. The most impactful guidance I received came from a divorced small business owner at a Chamber of Commerce mixer—she shared vendor discount programs I'd never find online. Sometimes wisdom wears jeans, not suits.

The Trust Imperative

Vet professionals like you're choosing a heart surgeon. Ask for client references (I provide three upon request) and watch how they explain complex concepts. My rule: If they can't describe QDROs using a pizza analogy, keep looking. Trust builds when they acknowledge what they don't know—no professional has all answers.

Sustaining the Journey

Post-divorce financial recovery isn't linear. I schedule financial checkups every six months—like dental cleanings for my wallet. A client who maintained this practice caught a credit report error that would've sabotaged her mortgage approval two years later. Consistent small actions compound into security.