divorce asset management for beginners

Pre-Nuptial Agreements and Their Importance

Pre-nuptial agreements, also known as prenuptial agreements, are legally binding contracts outlining the division of assets in the event of a divorce or separation. They are crucial for couples who wish to protect their individual financial interests and ensure that their assets are handled according to their wishes. These agreements can provide clarity and prevent future disputes. They often specify how property acquired before the marriage will be handled during and after the marriage. A well-drafted prenuptial agreement can significantly reduce the complexities and potential conflicts that might arise during a separation.

It's important to understand that a prenuptial agreement is not a guarantee of a smooth divorce. However, it can be a valuable tool in establishing clear expectations and minimizing disagreements about finances. Careful consideration and legal advice are essential to ensure the agreement is fair and legally sound. The agreement should be reviewed and understood by both parties, and it should be in compliance with the relevant laws of the jurisdiction where the marriage takes place.

Determining Community Property and Separate Property

Understanding the difference between community property and separate property is vital in asset division. Community property typically includes assets acquired during the marriage through the efforts of both spouses. This can encompass income, investments, and even gifts received during the marriage. Separate property, on the other hand, consists of assets owned by one spouse before the marriage, or assets received as gifts or inheritances during the marriage.

Distinguishing between these types of property is crucial for determining how assets should be divided in the event of a divorce. State laws vary significantly in their definitions of community property and separate property. It is essential to consult with a legal professional to accurately determine which assets fall under each category.

Valuation of Assets: A Critical Aspect

Accurately valuing assets is essential for equitable division. This process often involves professional appraisals for real estate, business interests, and other complex assets. A thorough valuation ensures that the division reflects the true worth of each asset. This is particularly important for assets that have fluctuated in value during the marriage. Neglecting proper valuation can lead to significant financial discrepancies and future disputes.

Accurate valuations are not just important for divorces; they are also important for estate planning and other legal processes. Appraisers, accountants, and other professionals are often necessary to provide accurate and unbiased assessments of assets. A clear understanding of the asset valuation process is critical for both parties involved.

Division of Marital Debts: A Complex Issue

Dividing marital debts is often a complex and contentious aspect of asset division. These debts are typically incurred during the marriage and are the responsibility of both spouses. Determining the allocation of debt can be particularly challenging and may require careful negotiation or court intervention. Debts incurred for household expenses, credit card bills, and loans are common examples of marital debts.

Understanding the legal precedents and guidelines for debt division is critical. It is essential to work closely with legal counsel to ensure that the division of debts is fair and compliant with the relevant laws. This aspect of the process often requires detailed documentation and careful consideration of each debt's origin and nature.

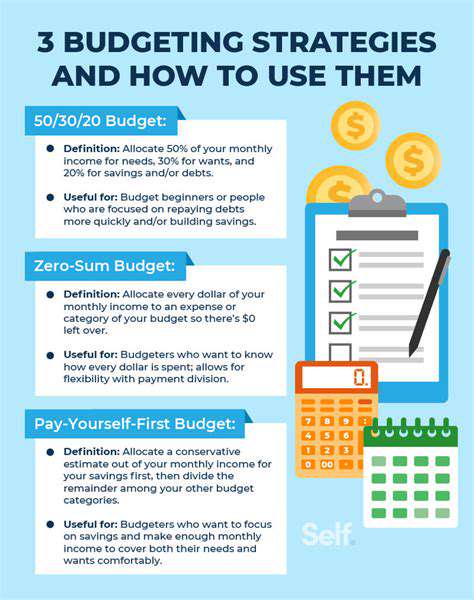

Tax Implications of Asset Division

The division of assets can have significant tax implications for both spouses. Changes in ownership and distributions of assets may trigger tax consequences. Careful consideration of tax implications is critical to avoid potential financial penalties. Understanding the tax laws related to asset division is vital for minimizing tax liabilities and ensuring financial stability.

Consultations with tax professionals are essential to fully grasp the potential tax implications of asset division. Tax laws can change, and it is important to stay up-to-date on the latest regulations. This aspect of asset division often requires expert guidance to navigate the complexities of tax codes and ensure compliance.

A strong design portfolio showcases not just aesthetic appeal but also a deep understanding of design principles. Look for projects demonstrating a range of skills, from concept development and space planning to material selection and execution. A portfolio that effectively communicates the designer's ability to translate client needs into functional and beautiful spaces is a significant indicator of their design expertise. The designer should be able to articulate their process and decision-making behind each project. This demonstrates not only technical proficiency but also their understanding of the client's perspective.

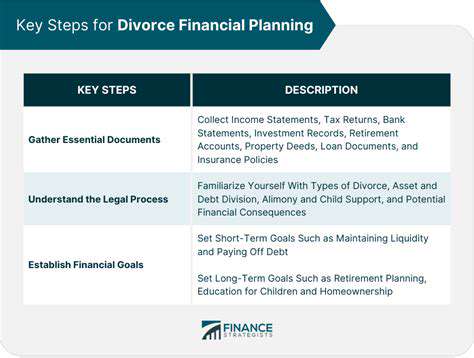

Protecting Retirement Accounts During Divorce

Protecting Retirement Accounts During Market Volatility

Market fluctuations are an inevitable part of investing, and retirement accounts are particularly vulnerable to these swings. Understanding how market volatility impacts your retirement savings and taking proactive steps to protect them is crucial for long-term financial security. This volatility can significantly impact the value of your investments, potentially delaying or even jeopardizing your retirement goals. It's essential to stay informed and adapt your strategy as needed.

Maintaining a diversified investment portfolio is one key strategy for mitigating risk during periods of market volatility. Diversification across various asset classes, such as stocks, bonds, and real estate, can help balance out potential losses in one area with gains in another. Diversification is a cornerstone of risk management in the investment world. This approach can help to soften the blow of market downturns.

Understanding Your Retirement Account Options

Different retirement accounts offer varying levels of protection and investment options. Understanding the specific features of your 401(k), IRA, or other retirement accounts is essential for making informed decisions. This includes knowing the investment options available and the associated risks.

For example, a 401(k) might offer employer matching contributions, which can significantly boost your savings. Understanding these unique features and the potential tax advantages of each account type is crucial for maximizing your retirement savings.

Assessing Your Risk Tolerance

Your risk tolerance plays a significant role in how you approach retirement account management. A high-risk tolerance might allow for a larger allocation to stocks, while a lower risk tolerance might favor a more conservative approach with a greater emphasis on bonds or other less volatile investments. It is imperative to carefully evaluate your personal financial situation and goals when determining your risk tolerance.

Understanding your individual circumstances—including your age, time horizon until retirement, and financial goals—will help you to make a rational decision about the most appropriate level of risk.

Staying Informed About Market Trends

Keeping abreast of market trends, economic forecasts, and relevant financial news is essential for making informed decisions. Regularly reviewing your investment portfolio and understanding the factors affecting it is an important part of protecting your retirement savings. Monitoring market trends can help you anticipate potential issues and adapt your strategy accordingly.

Staying current with financial news and market analysis is a proactive way to maintain control of your investments and mitigate risk. Seek out reputable sources of financial information to stay well-informed.

Reviewing and Adjusting Your Investment Strategy

Regularly reviewing your investment strategy is key to adapting to market changes and ensuring your retirement savings remain on track. This includes evaluating your asset allocation, rebalancing your portfolio, and considering any changes in your personal circumstances. Periodic reviews are essential to ensure your investments align with your long-term goals.

If market conditions change significantly, you may need to adjust your investment strategy to maintain your desired risk level. This might involve shifting your investments toward safer options or making other changes to mitigate potential losses.

Seeking Professional Advice

Consulting with a qualified financial advisor can provide valuable insights and personalized guidance. A financial advisor can help you develop a tailored investment strategy, assess your risk tolerance, and navigate complex financial decisions. Seeking professional advice is an important step to ensure you are making informed decisions about your retirement funds.

Professional financial advice can be invaluable in helping you to understand the complexities of retirement planning and make sound financial decisions. They can help you navigate the challenging aspects of market volatility and ensure your retirement funds are protected.

Read more about divorce asset management for beginners

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases