divorce financial planning after separation guide

Protecting Your Assets and Minimizing Debt

Understanding Your Financial Situation

A crucial first step in divorce financial planning after separation is a comprehensive understanding of your current financial situation. This involves meticulously reviewing all assets, including bank accounts, investment portfolios, retirement funds, real estate, and any other valuable holdings. Detailed records of income and expenses are also essential. This meticulous accounting will provide a clear picture of your current financial standing, helping you make informed decisions during the divorce process.

Equally important is understanding the debt you currently hold. Categorize and assess each debt, including mortgage loans, personal loans, credit card balances, and any outstanding student loans. Knowing the principal, interest rate, and monthly payments of each debt type is fundamental to creating a realistic and achievable financial plan.

Protecting Your Assets During the Divorce Process

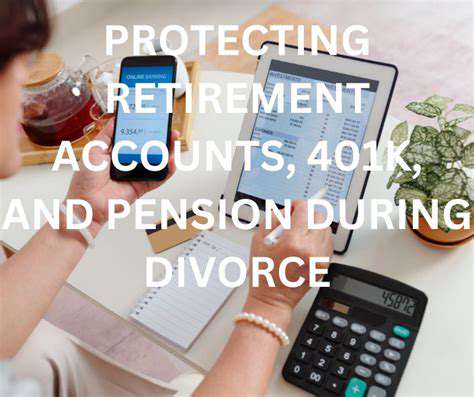

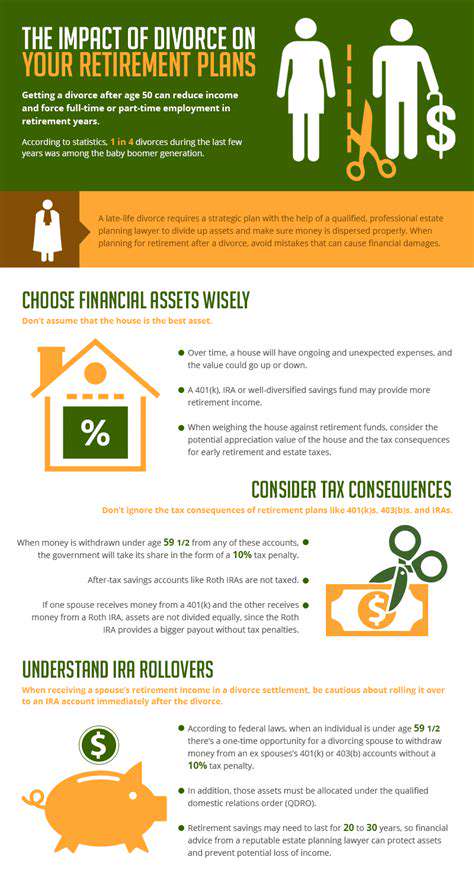

Protecting your assets during divorce is paramount. This involves taking proactive steps to safeguard your financial interests and prevent unnecessary loss. Consult with a qualified financial advisor to discuss strategies such as asset protection trusts or other legal tools to shield your assets from potential claims by your spouse. It's vital to understand the specifics of your state's laws regarding asset division.

Consider freezing any joint accounts and setting up separate accounts for your personal funds to avoid any potential misappropriation or confusion during the proceedings. This careful management of assets ensures your financial well-being throughout the divorce process.

Developing a Post-Separation Budget

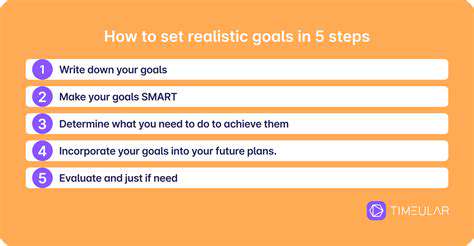

Creating a realistic post-separation budget is essential for managing your finances effectively. This involves estimating your projected income after the divorce, factoring in any potential changes in income or expenses. Identify your fixed and variable expenses, such as housing costs, utilities, groceries, transportation, and healthcare. Be extremely thorough in this process to ensure accuracy.

Developing a budget that accounts for potential changes in income and expenses is critical to maintaining financial stability. Prioritize essential expenses, and allocate funds for savings, debt repayment, and unforeseen circumstances. A well-defined budget will help you navigate the financial challenges of the separation and divorce process.

Managing and Reducing Debt

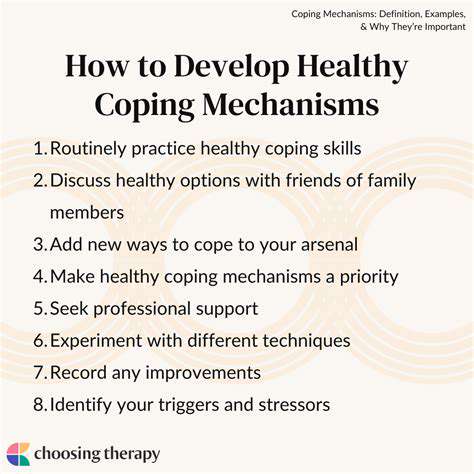

Assessing and managing your debt load is a critical component of post-separation financial planning. Develop a debt reduction strategy that considers your income, expenses, and the terms of your existing debts. Explore options like debt consolidation or balance transfer credit cards if appropriate, but be mindful of interest rates and fees.

Prioritize high-interest debt for repayment to minimize the overall cost of borrowing. Create a realistic timeline for paying off your debts, and consider seeking professional guidance from a financial advisor to develop a sustainable and effective debt management plan.

Retirement Planning After Separation

Retirement planning is a critical aspect of divorce financial planning, as it impacts your long-term financial security. Evaluate your current retirement savings and understand how the division of assets might affect your future retirement income. Consider establishing individual retirement accounts (IRAs) if necessary to maintain your retirement savings goals.

Seeking Professional Guidance

Navigating the complex financial landscape of divorce can be overwhelming. Seeking guidance from qualified professionals is crucial. Consult with a financial advisor experienced in divorce financial planning to develop a personalized strategy for managing your finances. A legal professional specializing in family law can provide essential advice regarding asset division and debt allocation.

Don't hesitate to seek legal and financial advice. This will help you make informed decisions, protect your assets, and minimize financial stress during this challenging time.

Read more about divorce financial planning after separation guide

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

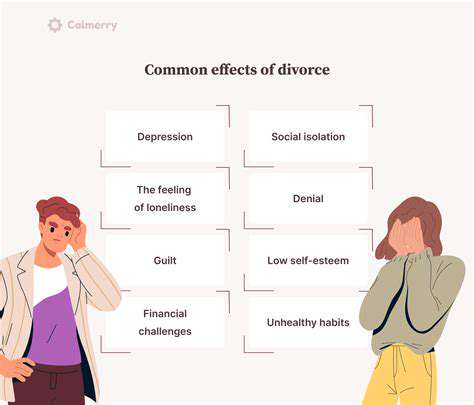

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases