Understanding Post Divorce Property Division

Valuation of Assets

Dividing property fairly requires precise appraisals of everything from homes to stock portfolios. Specialists often assess complex assets like businesses or patents. Overlooking hidden value in pensions or intellectual property could leave one spouse at a severe disadvantage. Professional valuations prevent costly disputes later.

State Laws and Jurisdictions

Where you file for divorce dramatically impacts outcomes. Nine states enforce strict 50/50 splits (community property), while others consider fairness (equitable distribution). A house in California might divide differently than the same property in New York. Local legal advice proves indispensable.

Debts and Liabilities

Joint credit cards or mortgages don't disappear after separation. Courts typically assign responsibility based on who benefited from the debt. A spouse who secretly racked up gambling debts might bear full responsibility. Credit reports help track obligations before negotiations begin.

Contribution and Effort

Judges recognize that stay-at-home parents contribute value beyond income. Years spent raising children or supporting a partner's career can translate to larger asset shares. Documentation like emails or witness statements helps demonstrate non-financial inputs.

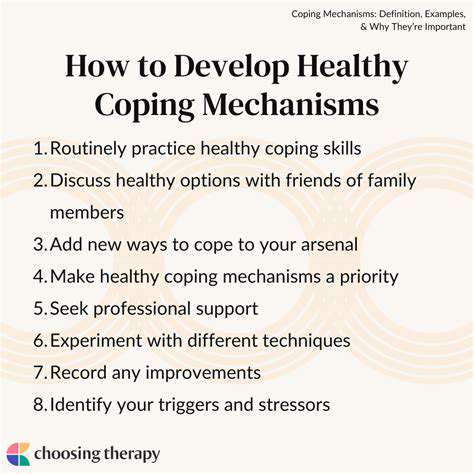

Dispute Resolution and Negotiation

Mediators help couples avoid courtroom battles by crafting customized solutions. About 80% of divorcing couples settle through negotiation, saving time and money. When compromise fails, judges impose decisions based on evidence and local statutes.

Methods of Property Division: Equitable Distribution vs. Community Property

Equitable Distribution

Equitable distribution focuses on fairness rather than strict equality. Courts examine multiple factors:

- Marriage duration

- Each spouse's earning potential

- Childcare responsibilities

Community Property

In states like Texas or California, the law presumes equal ownership of marital assets. Even if one spouse earned significantly more, assets typically divide down the middle. Exceptions exist for:

- Gifts specifically to one partner

- Inherited items kept separate

Separation Agreements

Custom contracts allow creative solutions courts can't order, like:

- Keeping the family business intact

- Phased buyouts of home equity

Division of Retirement Accounts

QDROs (Qualified Domestic Relations Orders) split pensions and 401(k)s without tax penalties. Missing deadlines for QDRO submission can forfeit rights to retirement funds. Actuaries calculate present values when dividing future benefits.

Addressing Retirement Accounts and Pensions in Divorce

Understanding the Complexity of Retirement Accounts

Retirement funds contain multiple layers:

- Employer-matched contributions

- Vested versus unvested portions

- Tax-deferred growth

Choosing the Right Account Type

Post-divorce, individuals often need to:

- Roll over 401(k) portions

- Convert traditional IRAs to Roth

Managing and Maximizing Your Contributions

Rebuilding after division requires strategy:

- Catch-up contributions after age 50

- Automatic paycheck deductions

Understanding Tax Implications and Withdrawal Strategies

Key considerations include:

- RMD (Required Minimum Distribution) schedules

- Social Security coordination