how to create a fair divorce settlement

Addressing Debts and Liabilities

Understanding Debt Allocation

A crucial aspect of a fair divorce settlement is the equitable division of debts. This involves identifying all existing debts, including mortgages, loans, credit card balances, and outstanding personal loans. Thorough documentation and transparency are essential to ensure that each party understands the full extent of their financial obligations and how these will be handled in the separation. A clear understanding of the debt allocation process is critical for navigating the financial aspects of the divorce with clarity and minimizing potential future complications.

Often, debts incurred pre-marriage are considered separate property and should be the responsibility of the individual who accumulated them. However, debts accumulated during the marriage are typically considered marital debts and are subject to division, usually following the principles of equitable distribution.

Categorizing Marital and Separate Debts

Distinguishing between marital and separate debts is a fundamental step in a fair divorce settlement. Marital debts are typically those incurred during the marriage, while separate debts are those accumulated before the marriage or during the marriage by one party independently. This categorization is essential for determining responsibility and allocation in the settlement agreement. Careful documentation and evidence are key to supporting the categorization and preventing disputes later on.

Proper categorization helps ensure a fair division of financial burdens and avoids unintended consequences or future disputes over debt responsibility. This process requires a detailed review of financial records, including bank statements, credit card bills, loan documents, and any other relevant financial paperwork.

Negotiation Strategies for Debt Division

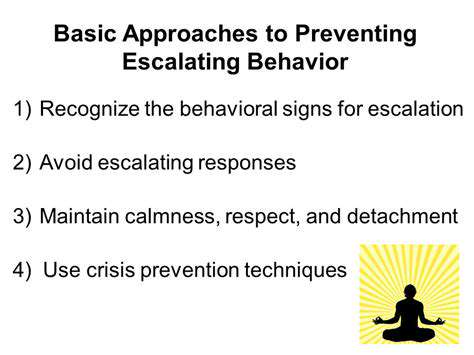

Negotiating a fair division of debts can be challenging, but effective communication and negotiation strategies can help parties reach a mutually agreeable solution. Understanding each party's financial situation, including income, assets, and existing debts, is crucial for a productive negotiation. Open communication and a willingness to compromise are vital for a smooth and equitable outcome.

Consider seeking professional guidance from a financial advisor or mediator to assist in the negotiation process. Mediation can facilitate communication and help parties arrive at a fair and sustainable resolution regarding debt allocation. This process often yields more favorable results for both parties compared to litigation.

Impact of Income Disparities on Debt Allocation

Significant income disparities between the divorcing parties can significantly impact the fair allocation of debts. If one party has a substantially higher income, they may be expected to assume a larger portion of the marital debts. Alternatively, a party with a lower income might be assigned a smaller portion of the responsibility. The division should take into account the future earning capacity of both parties and the potential impact on their respective financial well-being.

A judge will consider the parties' financial situations and the ability of each to contribute to the repayment of debts. Factors such as current income, future earning potential, and the standard of living of each party are often taken into consideration to ensure a fair outcome.

Legal Implications of Unpaid Debts

Failing to address debts in a divorce settlement can have serious legal implications for both parties. Unpaid debts can lead to collection actions, wage garnishments, and other financial repercussions. Ensuring a thorough and legally sound resolution for all debts is crucial to avoid such issues after the divorce is finalized.

Strategies for Managing Post-Divorce Debt

After the divorce settlement, effective strategies for managing post-divorce debt are essential. Developing a budget that accounts for the new financial realities is crucial. Creating a payment plan for outstanding debts and maintaining open communication with creditors are important steps in managing the financial implications of the divorce. Seeking guidance from a financial advisor can help establish a realistic and sustainable debt management plan.

Importance of Professional Guidance

Navigating the complexities of debt allocation in a divorce can be overwhelming. Seeking professional guidance from a qualified attorney and/or financial advisor is highly recommended. Their expertise can help ensure that the division of debts is fair, legally sound, and in the best interests of all parties involved. This professional assistance can significantly reduce the stress and potential complications associated with this aspect of the divorce process.

Considering Spousal Support and Child Support (If Applicable)

Understanding Spousal Support

Spousal support, also known as alimony, is financial provision made by one spouse to the other after a divorce or separation. It's designed to help the lower-earning spouse maintain a standard of living similar to what they experienced during the marriage, especially if the marriage was long-term and one spouse sacrificed career opportunities for family responsibilities. Determining the need for and amount of spousal support is crucial in a fair settlement, considering factors like the length of the marriage, the parties' earning capacity, and the contributions each made to the relationship and household.

It's important to note that spousal support isn't always awarded, and the terms of support (if awarded) can vary considerably depending on the specific circumstances. A thorough understanding of the legal framework and the potential implications of different support structures is vital to ensure a just outcome for both parties.

Factors Affecting Spousal Support Decisions

Numerous factors influence the court's decision regarding spousal support. These include the length of the marriage, the age and health of the parties, their earning capacity, and the contributions each spouse made to the marriage, both financially and in terms of homemaking and childcare. The ability of the paying spouse to support the other spouse and maintain their own standard of living is also a significant consideration. Each case is evaluated individually, with a careful examination of the unique circumstances.

The roles and responsibilities within the marriage, such as one spouse pursuing an advanced degree or career while the other manages the household, are also taken into account. The court will assess the overall fairness and equity of the situation to determine the appropriate level of support, if any, to be awarded.

Calculating Child Support Obligations

Child support calculations are often based on established guidelines and formulas, which vary by jurisdiction. These formulas typically consider the income of both parents, the number of children, and the amount of time each parent spends with the children. A thorough understanding of these guidelines is essential for both parents to ensure they are aware of the potential financial obligations.

It's crucial to understand that the goal of child support is to ensure the children's needs are met financially, providing them with the resources necessary for a stable and healthy upbringing. This includes costs for housing, food, clothing, education, and healthcare.

Establishing Fair Child Custody Arrangements

Determining fair child custody arrangements, which often intertwine with child support, is a critical aspect of any divorce or separation. The best interests of the child are paramount, and the court will consider factors like the child's wishes (where appropriate), the parents' ability to provide a stable and nurturing environment, and the child's relationship with each parent. This often involves creating schedules and arrangements for visitation and decision-making responsibilities.

Considering Asset Division in Relation to Support

Equitable division of assets is a significant component of divorce proceedings, and it's crucial to understand how this division might influence spousal and child support considerations. Assets accumulated during the marriage, such as property, investments, and retirement accounts, are typically divided in a fair and equitable manner, which can affect the need for and amount of support awarded. A thorough understanding of asset division is essential for a comprehensive understanding of the overall financial implications.

Seeking Professional Guidance

Navigating the complexities of spousal and child support, along with asset division, can be overwhelming. Seeking guidance from qualified legal professionals is highly recommended. Attorneys specializing in family law can provide expert advice tailored to your specific circumstances, ensuring your rights and interests are protected throughout the process. This includes understanding your options, the relevant laws in your jurisdiction, and the potential outcomes.

Read more about how to create a fair divorce settlement

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases