how to overcome post divorce financial stress

Understanding Your Income Sources

A thorough assessment of your financial situation begins with a clear understanding of your income streams. This includes not only your primary salary or wages but also any additional sources of income, such as rental income, investments, side hustles, or government benefits. Listing out each source and the associated amount received regularly is essential for calculating your total monthly or annual income, which forms the foundation for budgeting and financial planning.

Accurate record-keeping is crucial here. Reviewing bank statements, pay stubs, and any other relevant documents will help you to identify and quantify all of your income sources. This step is not just about accumulating numbers; it's about gaining a precise picture of your financial inflows, which is a vital component in understanding your current financial position.

Analyzing Your Expenses

Equally important to understanding your income is a detailed analysis of your expenses. This includes fixed expenses like rent or mortgage payments, utilities, and loan repayments. It also encompasses variable expenses, such as groceries, transportation, entertainment, and dining out. Categorizing these expenses will help you to identify areas where you might be overspending or areas where you can potentially cut back.

Using budgeting tools or spreadsheets to track your expenses is highly recommended. This will allow you to visualize your spending patterns and pinpoint areas where savings can be made. By meticulously documenting your expenses, you gain a clearer picture of your spending habits, allowing you to make informed decisions about your financial future.

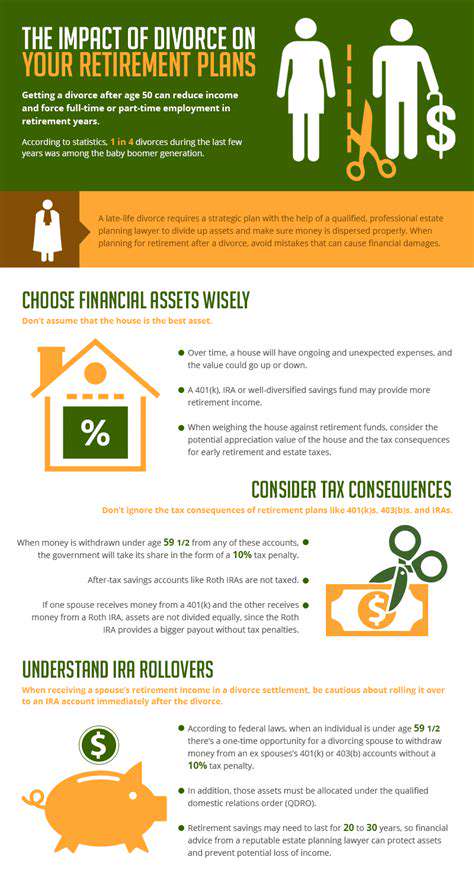

Evaluating Your Assets and Liabilities

Assessing your assets and liabilities is a critical part of understanding your overall financial health. Assets represent items of value that you own, such as cash, investments, vehicles, and property. Liabilities, conversely, are your debts, such as loans, credit card balances, and outstanding bills.

Listing out all of your assets and liabilities, providing approximate values for each, will give you a comprehensive picture of your net worth. Understanding the difference between your assets and liabilities is essential for determining your current financial position and identifying potential areas for improvement.

Identifying Your Financial Goals

Before you can develop a plan to overcome financial problems, you must first define your financial goals. These could range from short-term goals, such as paying off a credit card balance, to long-term goals, such as saving for a down payment on a house or retirement. Clearly outlining your objectives provides a roadmap for your financial decisions and motivates you to work towards a desired outcome. This is a crucial step in the process of financial planning and allows you to prioritize your efforts effectively.

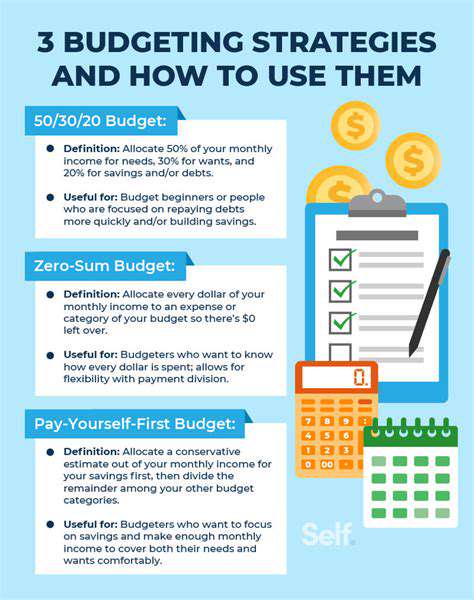

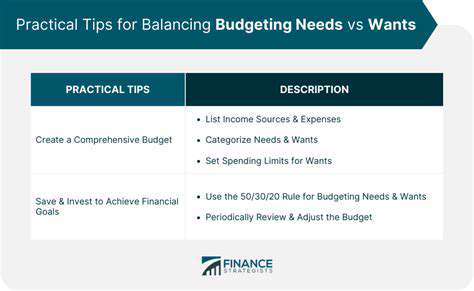

Creating a Budget and Tracking Progress

Once you've assessed your income, expenses, assets, liabilities, and goals, you can create a budget that aligns with your financial situation. A budget is a plan that outlines how you will allocate your income to cover your expenses and work towards your financial goals. Creating a realistic budget is important; it should be something you can stick to consistently. Tracking your progress against your budget is essential for ensuring you're staying on track and making necessary adjustments as needed.

Regularly reviewing and updating your budget is vital. Life changes, and your budget should adapt to these changes. Consistent monitoring and adjustments will help you stay on course toward achieving your financial goals and overcoming any existing financial challenges.

Rebuilding Credit and Establishing Financial Independence

Rebuilding Credit After a Setback

Dealing with a credit setback can be incredibly frustrating, but it's crucial to remember that Rebuilding credit is achievable. A variety of factors can contribute to credit issues, from missed payments to high debt levels. Understanding the root causes of your credit problems is the first step towards effective solutions. This understanding allows you to develop a personalized plan to tackle your financial challenges and regain control of your credit standing.

There are several strategies you can employ to begin rebuilding your credit. Prioritizing consistent and timely payments is paramount. Even small improvements in payment habits can significantly impact your credit score over time. By demonstrating financial responsibility, you'll be sending a strong message to credit bureaus and lenders that you are committed to managing your finances effectively.

Understanding Your Credit Report

A thorough understanding of your credit report is essential for effective credit rebuilding. Your credit report contains a detailed history of your credit activity, including loan applications, payment history, and outstanding debts. Reviewing this report meticulously allows you to identify any errors or inconsistencies that may be impacting your score.

Knowing what's on your credit report is crucial. Identifying areas for improvement and understanding the factors that influence your credit score empowers you to take the necessary steps to correct any inaccuracies and improve your overall standing.

Debt Management Strategies

Debt management strategies are critical in the credit rebuilding process. One effective strategy is developing a comprehensive budget. By tracking your income and expenses, you gain a clearer picture of your financial situation, allowing you to identify areas where you can cut back and allocate funds towards debt repayment.

Prioritizing high-interest debt and using debt consolidation or balance transfer options can be highly beneficial. These strategies can lower your overall interest payments and streamline your debt repayment plan. This can significantly reduce the financial strain and improve your ability to meet your obligations.

Utilizing Credit Counseling Services

Credit counseling services can provide valuable guidance and support throughout the credit rebuilding process. These services offer personalized strategies tailored to your specific financial situation. They can help you develop a budget, create a debt repayment plan, and negotiate with creditors to potentially lower interest rates or consolidate debts.

Improving Payment History

Consistently making timely payments on all your accounts is crucial for rebuilding credit. Paying your bills on time demonstrates financial responsibility and improves your creditworthiness. Small improvements in your payment history will gradually increase your credit score.

Maintaining a positive payment history is essential for demonstrating reliability to lenders. It showcases your ability to manage your finances responsibly, which significantly increases your chances of securing future loans and credit lines.

Seeking Secured Credit Options

Secured credit options can be beneficial when rebuilding credit. Securing a secured credit card or loan with a collateral can demonstrate your ability to manage credit responsibly. This can help you build a positive credit history and improve your credit score over time. This demonstrates to lenders a willingness to take on responsibility and repay debts as agreed.

Monitoring and Maintaining Credit Health

Regular monitoring of your credit report is essential for ongoing credit health management. Checking your report regularly allows you to identify any potential errors or discrepancies promptly. This proactive approach helps you maintain a positive credit history, ensuring you're aware of any changes that could impact your ability to obtain credit in the future.

Continuously monitoring your credit score and report is key to staying informed about your credit health. This ongoing awareness provides you with the data needed to adjust your financial strategies as needed and continue building credit effectively.

Read more about how to overcome post divorce financial stress

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases