how to draft clear divorce legal documents

Precise wording becomes especially critical when dealing with emotionally charged legal documents like divorce agreements. Ambiguous phrasing in custody arrangements or asset division can lead to years of costly litigation and family conflict. Many couples discover too late that vague terms like reasonable visitation or shared expenses create more problems than they solve.

Legal professionals emphasize drafting agreements with concrete examples and measurable terms. Instead of the father will have regular parenting time, specify the father will have the children every Thursday evening from 5-8pm and alternating weekends from Friday 6pm to Sunday 6pm. This level of detail prevents future disagreements about interpretation.

Impact on Compliance and Enforcement

Well-drafted agreements with unambiguous language tend to have higher compliance rates. When both parties clearly understand their obligations, they're more likely to follow through without court intervention. Family court judges frequently see cases where poorly worded agreements lead to repeated violations and contempt hearings.

The enforcement process becomes significantly easier when agreements contain specific benchmarks. For example, child support payments of $1,200 monthly, due by the 5th of each month via direct deposit to account XXXX leaves no room for misunderstanding. Precision in financial terms prevents accidental underpayment or late payments that strain co-parenting relationships.

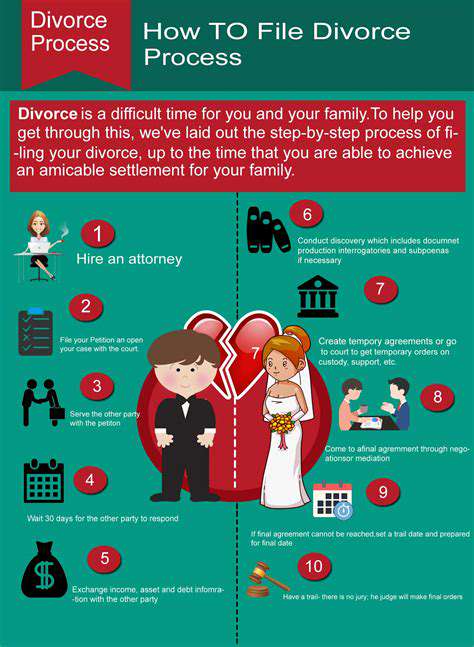

Practical Applications in Divorce Proceedings

Experienced divorce attorneys recommend including definitions sections for key terms. What constitutes an educational expense? Does it include summer camps, tutoring, or school trips? Defining these upfront saves countless headaches later. Smart couples even attach sample calculations for complex financial arrangements.

For business owners, valuation methodologies should be exhaustively detailed. Rather than the business will be appraised, specify the business will be valued by a CPA using the discounted cash flow method with these specific assumptions... This prevents $50,000 appraisal disputes down the road.

Defining Assets and Liabilities with Surgical Precision

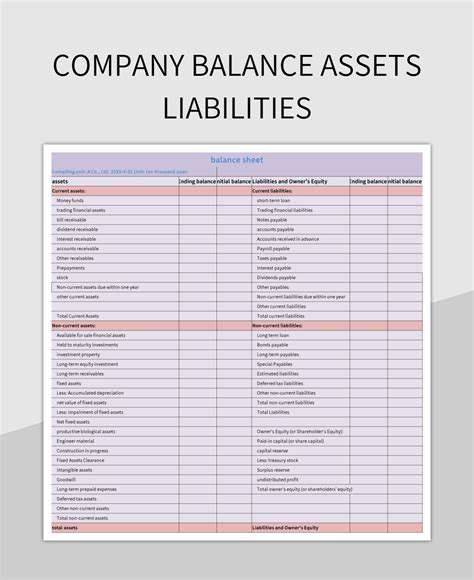

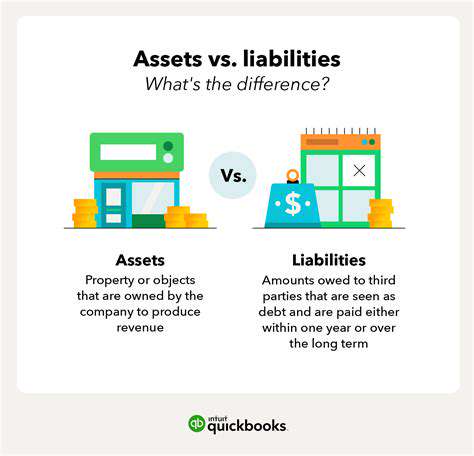

The Devil in the Details: Asset Classification

Divorcing couples often make the critical mistake of treating all assets equally. A sophisticated asset division plan distinguishes between liquid assets (cash, stocks) and illiquid assets (real estate, private business interests). Each category requires different handling in terms of valuation timing, transfer mechanisms, and tax implications.

Even retirement accounts demand careful parsing. The difference between a 401(k) and IRA can mean thousands in early withdrawal penalties if not properly addressed in the agreement. Seasoned divorce attorneys always specify whether QDROs (Qualified Domestic Relations Orders) will be required for division.

Hidden Liabilities: The Silent Marriage Killer

Many spouses discover undisclosed debts after divorce finalization. A thorough liability audit should examine credit reports, business guarantees, and even potential lawsuits that could materialize later. Smart agreements include indemnification clauses protecting each party from the other's undisclosed obligations.

Tax liabilities require special attention. Who claims the children as dependents in which years? How will capital gains from the home sale be allocated? These decisions impact both parties' financial futures significantly.

Child-Centered Custody Agreements That Actually Work

Beyond Legal Minimums: Creating Living Documents

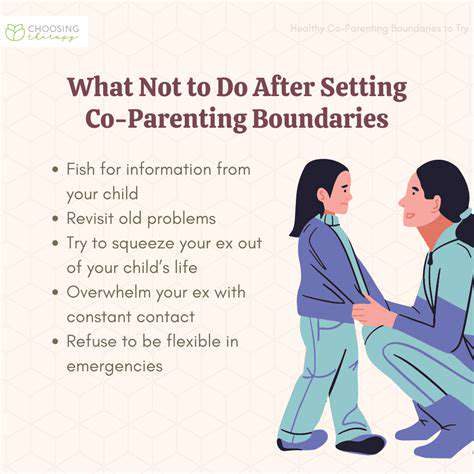

The best custody agreements evolve with children's developmental stages. Infant care schedules differ dramatically from teenage visitation needs, yet most agreements fail to address these transitions. Forward-thinking parents build in automatic schedule modifications triggered by school transitions or developmental milestones.

Successful co-parents also codify communication protocols. Will updates go through a shared parenting app? How quickly must responses be given for medical decisions? These operational details determine whether the agreement functions smoothly in daily life.

The Support Calculation Trap

State child support formulas often miss real-world complexities. Agreements should account for private school costs, special needs therapies, and activity fees that standard calculations ignore. Detailed provisions for handling these extras prevent constant return trips to court.

Income fluctuations also require planning. Commission-based earners might need support tied to quarterly financial statements rather than fixed monthly amounts. These nuances separate workable agreements from problematic ones.

Property Division That Stands the Test of Time

The Title Transfer Timeline

Too many agreements vaguely state the house will be sold without critical details. Who selects the realtor? What's the minimum listing price? Who pays for repairs before sale? These unanswered questions lead to properties languishing on the market for years.

For buyout situations, the appraisal process needs exact specifications. Will both parties approve the appraiser? What happens if valuations differ by more than 5%? Anticipating these scenarios saves months of deadlock.

The Digital Asset Blindspot

Modern divorce agreements must address digital property often overlooked. Who retains control of family photos in cloud storage? What happens to cryptocurrency wallets? Domain names and social media accounts have real value. Tech-savvy couples inventory these assets with the same rigor as physical property.

Even streaming service logins and airline miles require consideration. While seemingly trivial, their cumulative value can be substantial, especially for frequent travelers.