Divorce and Breakup Advice for Adults

Your goals should evolve as you move through different life stages. Early career priorities might include building an emergency fund and improving credit scores, while mid-career focuses often shift toward retirement savings and college funds for children.

Evaluating Your Risk Tolerance

Investment decisions should align with your personal comfort level with risk. Some people lose sleep over minor market fluctuations, while others view downturns as buying opportunities. Your age, financial obligations, and time horizon all influence how much risk makes sense for you. A single 30-year-old can typically afford more investment risk than a 55-year-old supporting children in college.

Be honest with yourself - taking on more risk than you can handle emotionally often leads to poor decisions like selling during market lows. Many financial advisors use questionnaires to help clients understand their true risk tolerance.

Analyzing Your Income and Expenses

Detailed tracking of money coming in and going out forms the foundation of any solid financial plan. Modern budgeting apps can automate much of this process, categorizing transactions and identifying spending trends. Look for patterns - are you spending hundreds monthly on unused subscriptions? Does your grocery bill creep up when you're stressed? Awareness creates opportunities for meaningful changes.

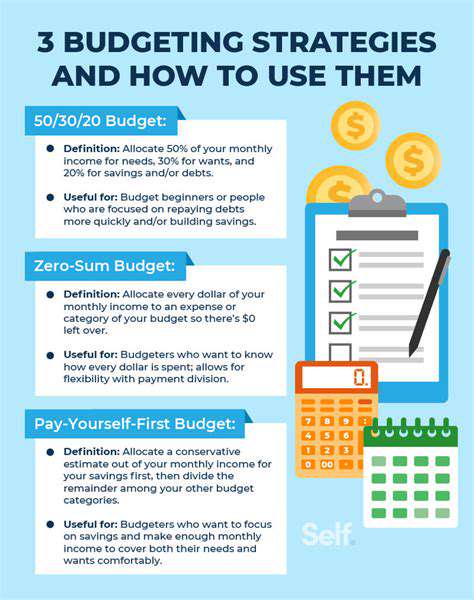

Developing a Budget

A practical budget balances necessary expenses, discretionary spending, and progress toward goals. The 50/30/20 rule provides a helpful framework: 50% for needs, 30% for wants, and 20% for savings/debt repayment. However, these percentages should adjust based on your specific circumstances and priorities. The key is creating a plan you can stick with long-term.

Creating a Savings Plan

Successful savers treat savings like any other bill - non-negotiable and paid first. Automate transfers to savings accounts right after payday so the money never hits your spending account. For big goals like home purchases, break the total into monthly amounts. Seeing $500/month rather than $60,000 feels much more achievable. Even small, consistent contributions add up significantly over time thanks to compound growth.

Considering Professional Financial Advice

A good financial advisor provides more than investment picks - they help create a comprehensive plan tailored to your unique situation. They can identify blind spots in your financial strategy, suggest tax-efficient approaches, and provide objective guidance during emotional decisions. Look for fee-only advisors who commit to acting as fiduciaries, legally obligated to put your interests first.

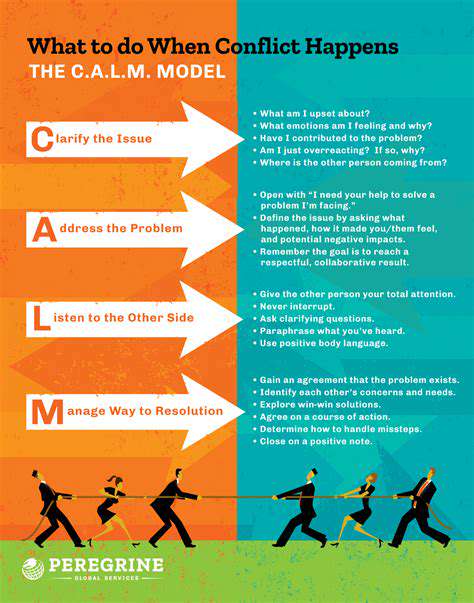

Communicating Effectively During a Difficult Time

Understanding the Emotional Landscape

Relationship endings trigger complex emotional reactions. You might cycle through anger, sadness, relief, and confusion - sometimes all in one day. These fluctuations are completely normal. Journaling can help process these emotions, as can talking with trusted friends or a therapist. Avoid judging yourself for whatever feelings arise; healing isn't linear.

Open and Honest Communication (When Possible)

Clear communication becomes both more difficult and more important during separations. Stick to I statements (I feel overwhelmed when...) rather than accusations (You always...). If tensions run high, consider writing important points in an email to allow time for thoughtful responses. Some couples find scheduling weekly business meetings to discuss practical matters helps contain conflict.

When emotions flare, call for a timeout rather than saying things you'll regret. Set a specific time to resume the conversation when everyone has cooled down.

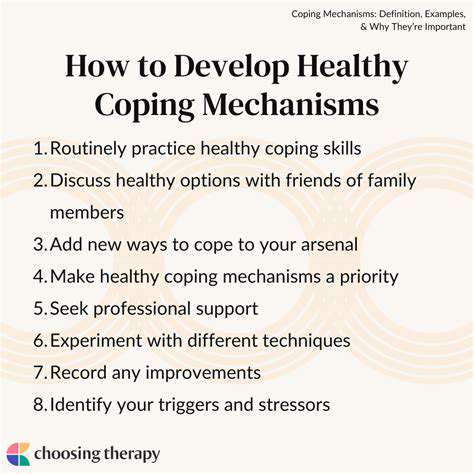

Prioritizing Self-Care

Stress takes a real physical toll during difficult transitions. Protect your health by maintaining consistent sleep schedules, eating nutritious meals, and moving your body daily - even just walking around the block helps. Many people find mindfulness practices like meditation or deep breathing provide much-needed calm amidst the chaos. Don't neglect activities that normally bring you joy, whether that's reading, gardening, or seeing friends.

Dealing with Difficult Conversations

Prepare for tough discussions by writing down your key points beforehand. Stay focused on solutions rather than rehashing past conflicts. If discussing children, keep their best interests front and center. When emotions threaten to derail the conversation, suggest taking a break and returning to the discussion later with fresh perspectives.

Seeking Professional Guidance

Therapists specializing in relationship transitions can teach invaluable coping strategies and help process complex emotions. For practical matters like asset division or parenting plans, mediators provide neutral guidance to reach fair agreements. Many people find both types of support essential for navigating this challenging life transition with their well-being intact.

Creating an elegant yet safe bathroom environment requires balancing aesthetics with functionality. Thoughtful material choices and layout planning make the difference between a beautiful showpiece and a truly livable space. Consider slip-resistant flooring that doesn't sacrifice style, and tempered glass shower enclosures for safety. Smart technology like motion-activated lighting adds convenience while reducing accident risks.

Navigating the Emotional Landscape of Separation

Understanding the Initial Shock

The early days after deciding to separate often feel surreal. You might alternate between numbness and overwhelming emotion. This disorientation typically fades as you establish new routines. Be patient with yourself - major life changes require significant psychological adjustment. Temporary difficulty concentrating or remembering details is common during this phase.

Coping with Grief and Loss

Even when a relationship needed to end, you'll likely grieve the loss of shared dreams and familiar routines. Allow yourself to feel this grief without judgment. Create new rituals to mark this transition - some people find symbolic acts like rearranging furniture or taking a solo trip help process the change. Support groups for people going through similar experiences can provide invaluable understanding.

Managing Conflict and Communication

High-conflict situations benefit from clear boundaries and structured communication. Many couples find email or co-parenting apps help keep discussions focused and documented. For in-person conversations, stick to neutral locations like coffee shops rather than emotionally charged home environments. When tensions rise, remind yourself that you only control your own responses, not the other person's behavior.

Rebuilding Your Identity and Self-Esteem

Rediscovering who you are outside the relationship takes time but offers exciting opportunities. Reconnect with old hobbies you set aside or explore new interests you couldn't pursue before. Many people emerge from this process with stronger self-awareness and clearer personal values. Consider this a chance to consciously design the life you truly want.

Navigating Financial Changes

Financial advisors specializing in divorce can help untangle joint accounts and plan for your new financial reality. Update all beneficiary designations and passwords. Build your own credit history if you previously relied on joint accounts. Creating a realistic post-divorce budget often provides reassuring clarity during this uncertain time.

Addressing the Impact on Children (if applicable)

Children thrive on stability - maintain consistent routines across households when possible. Answer their questions honestly but age-appropriately, reassuring them that both parents love them regardless of the relationship changes. Avoid putting children in the middle or speaking negatively about the other parent in their presence. Family therapists can provide valuable guidance tailored to your children's specific needs.

Moving Towards a New Beginning

With time, what initially felt like an ending can transform into an opportunity for growth. Many people discover strengths they didn't know they had during this challenging transition. As the intense emotions subside, you'll gain perspective on both the relationship and yourself. This hard-won wisdom often becomes the foundation for healthier future relationships and greater personal fulfillment.