How to Handle Taxes After Divorce

If you have dependents, the Head of Household status may provide a larger standard deduction, which could be beneficial for single parents. Additionally, the choice between filing separately or together may influence eligibility for certain tax credits. A consultation with a tax professional can provide tailored advice based on individual circumstances.

Navigating Deductions and Credits

Divorce may alter your eligibility for various deductions and credits, such as the Child Tax Credit and various education tax benefits. If you have dependents, consider who will claim them on their taxes. Generally, the parent with primary custody takes this credit, unless otherwise agreed upon. Understanding these nuances can help Maximize Your Refunds. For instance, two parents cannot claim the same child, so clear agreements are essential.

- Review who can claim dependents based on custody arrangements.

- Evaluate available tax credits to ensure maximum benefits.

- Consult with a tax advisor regarding future financial decisions and implications.

Additionally, some deductions related to divorce-related expenses may still apply, like legal fees or costs associated with selling a home. Keeping detailed records will aid in ensuring that you optimize your post-divorce tax situation.

Child Support and Alimony Tax Implications

Understanding Child Support Payments

Child Support Payments are designed to provide financial assistance to the custodial parent in raising the child. In the United States, these payments are calculated based on both parents' incomes, with varying state guidelines impacting the final amount. Understanding these calculations is crucial for ensuring that both parents comply with their financial obligations.

Additionally, child support payments can significantly affect tax situations. While payments made are not tax-deductible for the payer, they are also not taxable income for the receiver. This creates a situation where the custodial parent isn't taxed on the funds that are essential for their child's livelihood.

Tax Implications of Alimony

Unlike child support, alimony (or spousal support) has different Tax Implications. For divorcés divorced before the end of 2018, alimony payments are tax-deductible for the payer and taxable for the recipient. This can dramatically influence the overall tax burden for both parties involved.

- Divorce settlements before 2019 allow for taxable alimony.

- Post-2018 agreements typically do not allow for tax deductions on alimony payments.

- Individuals should consider these variations when negotiating divorce settlements.

For those navigating post-divorce tax landscapes, understanding whether the alimony can be claimed as a deduction can help in planning future finances more effectively. This understanding is essential for effectively managing one's tax liabilities and ensuring compliance with IRS regulations.

Adjusting Withholding and Estimated Payments

After a divorce, it's vital to reassess your tax withholding status. Changes in financial situations may require adjustments to avoid underpayment penalties or excessive withholding. Communicating with a tax advisor can help you determine whether to increase or decrease your tax withholdings immediately following a divorce.

This proactive step can prevent unpleasant surprises come tax season. Making informed decisions regarding estimated tax payments can improve financial viability throughout the year, ultimately leading to easier tax filing processes.

Documentation and Record Keeping

Keeping thorough records of child support and alimony payments is essential for tax filing. Documents such as wage stubs, bank statements, and signed agreements serve as proof of payments made and received. This clarity can be invaluable in the event of disputes or audits.

Additionally, maintaining records of associated expenses, such as children's health care costs, can provide deductions or credits that might affect your tax situation positively. Thus, staying organized can lead to more favorable tax outcomes in the long run.

State-Specific Tax Regulations

Different states have varying laws concerning the taxation of child support and alimony. Researching your specific state's regulations can uncover unique tax benefits or obligations pertinent to your circumstances. Every divorce is different, and understanding local laws can make a significant difference in overall tax liability.

It is advisable to consult with a tax professional who is familiar with state laws to help navigate this complex area. They can offer insights into potential deductions or credits that could effectively lower your tax burden post-divorce.

Seeking Professional Help

Navigating the intricacies of child support and alimony tax implications can be daunting, making it essential to seek assistance when needed. Tax professionals specializing in divorce-related issues are invaluable resources. They can help clarify what you can expect for tax purposes based on the details of your situation.

Additionally, utilizing services offered by divorce attorneys who understand tax implications can further enhance your understanding and preparation. Their expertise can ensure that you not only comply with state and federal laws but also maximize your financial benefits during this transitional phase.

Asset Division and Tax Consequences

Understanding Asset Division Mechanics

When a couple decides to divorce, Asset Division is a critical aspect that must be navigated carefully. It's essential to understand whether the state operates under community property or equitable distribution laws. Community property states typically split all marital assets 50/50, while equitable distribution states take into account various factors to determine a fair allocation.

During this process, factors such as the duration of the marriage, the economic circumstances of each spouse, and contributions made to the household can influence the allocation. This will impact not only the division of assets but also how certain assets are treated for tax purposes in the event of a sale or transfer.

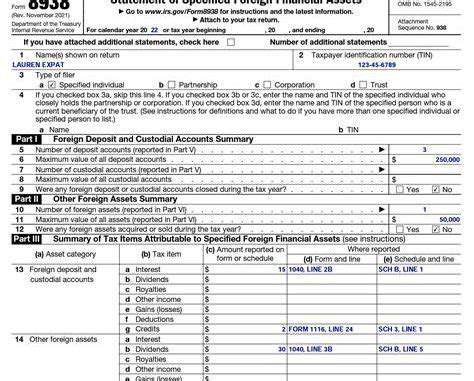

Tax Implications of Asset Transfers

Transferring assets between spouses during a divorce can have significant tax implications. For instance, property transfers that occur as part of a divorce settlement typically do not incur capital gains taxes, a benefit meant to facilitate the transition. However, once the divorce is finalized, selling these assets may trigger taxable events, depending on their appreciated value over time.

Furthermore, understanding the tax basis of transferred assets is vital. Each asset retains its original cost basis, which affects future tax obligations when it is sold. It’s advisable to work closely with a tax professional to evaluate these factors to avoid unexpected tax burdens in the future.

Seeking Expert Guidance

The process of asset division can be complicated, and consulting professionals can provide clarity. Tax advisors and legal experts can offer insights that pertain not only to asset division but also to ongoing income tax responsibilities following a divorce. Having experienced guidance can ensure that both parties are making informed decisions, minimizing potential losses.

- Tax advisors can explain liabilities associated with different asset types.

- Lawyers can clarify divorce laws affecting asset division.

- Accountants can assist with evaluating asset appreciation over time.

Impact of Divorce on Filing Status

Your filing status can significantly change following a divorce, with implications for tax liabilities. For instance, while married, couples may file jointly, taking advantage of various tax breaks. After separation, however, individuals typically need to file as single or head of household, which can affect tax rates and available deductions.

This change often leads to higher tax bills if adequate adjustments aren’t made, especially for those who were previously benefiting from joint filings. Consider consulting tax software or professionals to understand the nuances and make the most beneficial filing choices post-divorce.

Changes in Property Ownership and Taxes

The transfer of property ownership during a divorce can also lead to tax consequences. If one spouse retains the marital home, they might need to refinance the mortgage, which can trigger additional costs. When selling property, capital gains taxes may apply if the asset appreciates significantly and the exemption rules aren’t adequately considered.

It’s important to weigh these potential tax impacts against the benefits of property retention or division. Ensuring that both parties understand these changes can facilitate smoother transactions and prevent future disputes over financial obligations.

Child Support and Tax Consequences

Child support payments are not tax-deductible for the payer nor taxable for the recipient, which can sometimes lead to confusion. However, it’s important to note how these payments impact the overall financial situation of both parties. The custodial parent, for instance, may qualify for certain tax credits that support their economic stability. Understanding these implications helps in planning post-divorce finances effectively.

Using Mediation for Financial Clarity

Mediation can be a constructive method for couples to navigate asset division and clarify any tax implications. By working together, you can identify mutually agreeable solutions while gaining insights into the tax consequences of various options. This often results in a more amicable divorce process and can reduce the time and financial strain of divorce litigation.

Moreover, engaging a mediator who specializes in family law and taxes can yield significant benefits—allowing both parties to emerge from the divorce with a greater understanding of their financial futures.

Tax Credits and Deductions

Understanding Tax Credits

Tax credits directly reduce your tax liability and can play a crucial role in financial planning post-divorce. For example, the Child Tax Credit can provide families with a significant reduction in taxes owed, depending on the number of qualifying children. As of 2023, the maximum credit is $2,000 per qualifying child, which can considerably ease the tax burden.

Other credits to consider include the Earned Income Tax Credit (EITC), a program designed to assist low-to-moderate income earners. If you meet the income thresholds, you could receive a substantial credit that boosts your refund and supports your financial recovery after a divorce.

Key Deductions to Consider

Deductions lower your taxable income, which can ultimately reduce the amount of tax owed. After a divorce, the ability to claim deductions such as the mortgage interest deduction may still be available, depending on your financial and property situation. It's essential to analyze your mortgage contract and the overall asset division documented during your divorce finalization.

Don’t overlook deductions for job-related expenses, particularly if you’re transitioning back into the workforce. Certain costs, like uniform purchases or continuing education, may be deductible if they directly relate to your new position.

The Impact of Filing Status

Your Filing Status Impacts which credits and deductions you can take advantage of during tax season. After a divorce, you may have the option to file as Single or, if eligible, Head of Household, which usually offers better tax benefits. For example, the Head of Household status can provide a higher standard deduction and lower tax brackets than filing as Single.

It's vital to assess your filing options yearly to determine what status maximizes your overall return, especially as your financial situation may change following a divorce.

Child Custody and Tax Benefits

Child custody arrangements can significantly affect tax benefits. Typically, the custodial parent is entitled to claim tax credits related to the child, such as the Child Tax Credit. However, this can be negotiated, and in some cases, non-custodial parents may still claim certain benefits if the custodial parent agrees, which should be documented in your divorce decree.

Additionally, understanding the implications of your custody agreement on tax benefits is crucial for financial planning. Consult a tax professional to ensure you're optimizing these benefits correctly.

Documenting Deductions Carefully

Thorough documentation is vital when claiming deductions and credits on your tax return post-divorce. Keep records of all relevant documents, such as divorce settlements, legal fees, and proof of any child expenses. According to the IRS guidelines, maintaining detailed records for at least three to seven years is advisable in case of audits.

Utilizing technology, like expense tracking apps, can ease the process of documentation. This way, you can systematically record and categorize all relevant expenses, making tax season much less daunting.

Consulting Tax Professionals

Navigating tax issues after a divorce can be complex, making it wise to consult a tax professional. They can provide insights into your rights and obligations, helping you avoid costly mistakes. A qualified tax advisor will offer tailored strategies that take into account your unique financial circumstances and the latest tax laws.

Consider seeking advice specifically from accountants who have experience with divorce-related tax issues. Their expertise can guide you through specific credits and deductions relevant to your situation, ensuring you maximize your tax benefits during this transitional phase of life.

Consulting a Tax Professional

Understanding Your Tax Situation Post-Divorce

After a divorce, your tax position can change significantly. It's important to grasp how income, deductions, and potential liabilities may shift. For instance, if your income has decreased due to alimony payments or single-income status, this will directly affect your tax bracket. Understanding these changes is essential in making informed financial decisions moving forward.

Additionally, the manner in which assets are divided can lead to varying tax implications. Property transfers, retirement account distributions, and the ownership structure can alter your tax responsibilities. Consulting with a tax professional will provide clarity on what these implications could look like in your specific situation.

Filing Status and Its Importance

Your filing status can significantly impact your tax obligations and opportunities for deductions. After a divorce, most individuals will file either as single or head of household. The latter can sometimes offer more favorable tax rates and additional benefits, such as higher standard deductions. Consulting a professional can help clarify the most advantageous filing status for your situation.

In cases where children are involved, the ability to claim them as dependents can also influence your filing options. Discussing these nuances with a tax advisor could help you maximize your tax benefits related to child support or custody arrangements.

Alimony Payments and Tax Deductions

Understanding the Tax Implications Surrounding Alimony payments is critical for both parties in a divorce. For divorces finalized before 2019, alimony payments were tax-deductible for the payer and considered taxable income for the recipient. However, following the Tax Cuts and Jobs Act of 2017, this law changed for divorces finalized after December 31, 2018. It's crucial to consult a tax professional to navigate these changes effectively.

Child Support vs. Tax Deductions

Many individuals mistakenly assume that child support payments are tax-deductible. Unlike alimony, child support is not deductible for the paying parent nor taxable income for the receiving parent. Understanding these distinctions helps in planning your financial outlook post-divorce.

A tax professional can also provide insights related to tax credits associated with child expenses, further assisting in maximizing your overall tax position. This can be particularly beneficial in budgeting for future expenses like education and healthcare.

Retirement Accounts and Their Tax Implications

Dividing retirement accounts during a divorce can have significant tax ramifications. Depending on the type of account, withdrawals may incur taxes and penalties that can affect the bottom line. It's essential to speak with a tax advisor before making any decisions regarding these assets.

For instance, a Qualified Domestic Relations Order (QDRO) may be required to divide a 401(k) without tax penalties. A tax professional can help ensure compliance with all regulations and assist in understanding the tax consequences associated with any distributions.

After a divorce, reevaluating your retirement strategy is prudent. Changes in financial status may mean you need to adjust your contributions or investment strategies. A tax expert can guide you in making informed choices reflecting your new financial reality.

Seeking Professional Guidance

Consulting A Tax Professional is invaluable when navigating the complexities of taxes after divorce. They can assist in identifying opportunities to minimize tax liabilities and ensure compliance with tax laws. A proficient tax advisor will dissect your specific situation, addressing all unique elements that come into play post-divorce.

Moreover, establishing a relationship with a professional who understands your individual circumstances can lead to long-term financial strategies beyond immediate tax considerations. As tax laws change, ongoing advisory support helps you stay informed and prepared.