How to Rebuild Wealth After Divorce

A well-defined goal gives you a target to work toward and serves as a motivation. Revisit these goals regularly to refine them as needed and track your progress.

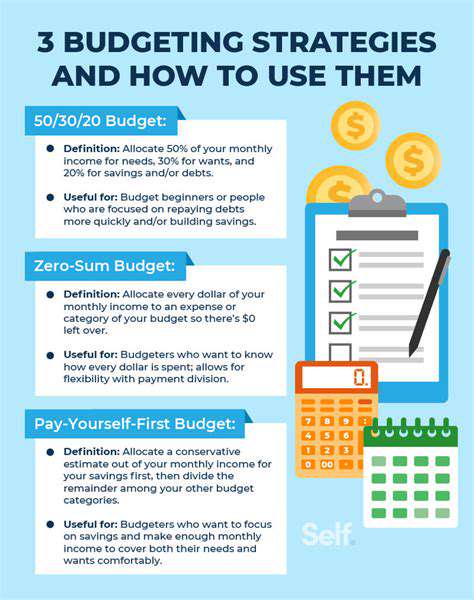

Choose Budgeting Tools and Methods

Selecting the right budgeting method can greatly enhance your financial management experience. Various approaches exist, from the traditional envelope method to digital tools like financial apps or spreadsheets. Each has its pros and cons; for instance, while apps often automate calculations and provide visual data representation, the envelope method encourages tangible spending awareness.

Experimentation is key. Try a few different methods until you find one that suits your lifestyle and preferences best.

Implement Regular Financial Reviews

Your budget should be a living document that evolves as your financial situation changes. Schedule regular reviews—monthly or quarterly—to assess your budget's effectiveness. During these reviews, compare your actual spending to your budget and adjust categories appropriately to better fit your current reality.

Using insights from these sessions can help you stay proactive. Iterate on your budget based on what works and what doesn’t, making adjustments in strategies or spending as life circumstances shift.

Consider Consulting a Financial Advisor

If you're feeling overwhelmed, consider consulting a financial advisor. An expert can provide personalized advice tailored to your unique financial situation, which is especially valuable during major life transitions like divorce. Advisors can assist in navigating complex tax implications or investment strategies, ensuring that you’re on a sustainable path to rebuild your wealth.

Investing in professional advice today can yield substantial rewards tomorrow, enabling you to make well-informed financial choices.

Educate Yourself on Financial Literacy

Embarking on the journey to financial recovery after divorce necessitates enhancing your financial literacy. Familiarize yourself with concepts related to budgeting, investing, and tax implications. Free resources abound online, from educational articles to webinars on personal finance topics.

Staying informed will empower you to take charge of your financial future. The more knowledgeable you are, the better equipped you will be to make prudent financial decisions and avoid potential pitfalls down the line.

Focus on Income Generation

Building New Income Streams

After a divorce, establishing new income streams is crucial. Start by considering your skills and interests. Are you proficient in writing, graphic design, or programming? Many professionals successfully transition to freelance work, allowing them to create a flexible income source. According to a 2023 report from Upwork, the freelance economy has grown significantly, with over 50% of freelancers achieving higher satisfaction compared to traditional employment.

Investing in your education can also pay off. Look into certifications or courses that align with high-demand fields. For example, tech-related courses have consistently shown a return on investment. The Bureau of Labor Statistics projects that job areas such as information technology will see a 13% growth by 2030. This aligns with the increasing reliance on digital skills in various industries.

Loan and Financing Opportunities

Leveraging loans or financing can be part of your wealth rebuilding strategy. If you have a solid business proposal, consider small business loans or grants targeted at individuals rebuilding after significant life changes. For instance, the U.S. Small Business Administration (SBA) offers various loan programs geared towards entrepreneurs. Just be sure to evaluate the terms carefully to avoid long-term financial stress.

Another option is peer-to-peer lending platforms, such as LendingClub, which can offer more accessible funding routes compared to traditional banks. These platforms commonly have less stringent requirements and cater to a range of personal credit situations, making them ideal for those looking to revitalize their financial standing after a divorce.

Make sure to create a detailed plan for repayment, as the obligation to repay loans can affect your financial stability. Having a clear income path will help you manage these responsibilities effectively while you rebuild wealth.

Investing for Future Growth

Once you have established a stable income, it’s time to consider investing. A diversified portfolio can help safeguard your financial future. Start with low-risk investments such as index funds, which historically deliver solid returns with lower volatility. The S&P 500 has averaged about 10% annual returns over the last century, making it a convincing option for long-term growth.

Don’t overlook the potential of real estate. Short-term rentals, for instance, have become increasingly popular and profitable through platforms like Airbnb. A study by AirDNA in 2022 indicated that the average host earns around $24,000 per year, making it an attractive avenue if you have additional space or properties available.

Networking and Professional Development

Networking is essential for career advancement and income generation. Attend industry conferences and engage in local networking events. According to a 2023 LinkedIn survey, around 70% of professionals obtain jobs through networking, highlighting its importance in rebuilding your career post-divorce. Explore online forums and social media groups relevant to your field—it’s an effective way to stay updated on industry trends, opportunities, and best practices.

Consider joining professional associations that provide access to resources like job boards, workshops, and mentorship pPrograms. Ongoing professional development can set you apart from others in your field, increasing your attractiveness to potential employers or clients.

Rebuild Your Credit Score

Understanding Credit Scores

The concept of a credit score, often seen as a mysterious figure, actually plays a vital role in financial health. Understanding its components can empower you to make informed decisions during your recovery process after divorce. A credit score typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

It is influenced by several factors, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Each of these factors carries a different weight; for instance, payment history accounts for about 35% of your total score, making it crucial to pay bills on time. This knowledge can help you formulate a strategy for improvement.

Strategies for Rebuilding Your Credit

- Review your credit report regularly.

- Make timely payments.

- Reduce outstanding debts.

- Limit new credit applications.

One effective way to rebuild your credit score is regular review of your credit report. Check for inaccuracies that could be negatively impacting your score; correcting these can result in a significant boost. By disputing errors, you can not only improve your score but also ensure that your credit history accurately reflects your financial behavior.

Moreover, paying down existing debt is another critical strategy. Focus on high-interest accounts first, as this minimizes the cost of borrowing over time. Once debts are paid, consider maintaining low credit utilization rates on revolving accounts to further enhance your score.

The Role of Credit Counseling

If the process seems overwhelming, engaging with credit counseling services can offer expert guidance tailored to your situation. These organizations can assist in budgeting and provide you with tools and resources to improve your credit. Notably, they can help with creating a personalized plan to manage your debts effectively.

Invest for the Future

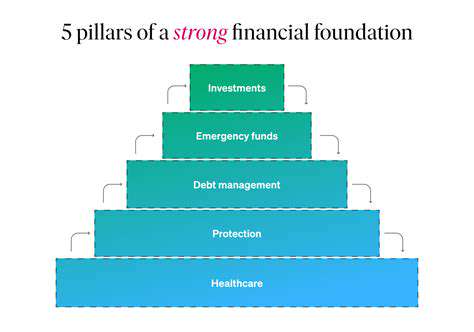

Understanding the Financial Landscape Post-Divorce

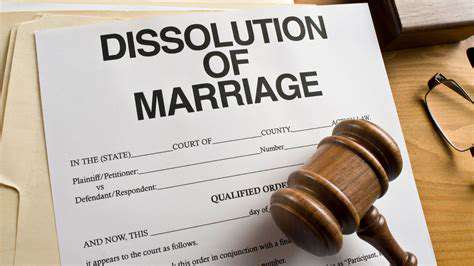

After a divorce, grasping the Financial implications is crucial for rebuilding wealth. You may find your financial situation altered due to asset division and potential alimony or child support obligations. It's essential to assess your new income and expenses holistically, as financial stability demands a clear view of your current resources.

Focusing on immediate cash flow is vital. Prioritize necessities and cut back on non-essential expenses during the transition. Creating a new budget will help you track spending and savings, allowing you to navigate this period with greater confidence and foresight.

Consulting a financial advisor who specializes in divorce can provide expert insights tailored to your unique situation. They can help you create a strategy to maximize your assets and advise on how to invest wisely for the long term.

Building a Post-Divorce Financial Plan

Drafting a financial plan after divorce sets the foundation for rebuilding wealth. This plan should include measurable savings goals, investment targets, and retirement planning to ensure you maintain a secure financial future. Think about your needs both in the short term and in the long run.

Consider using tools like budgeting apps to keep track of your finances and make informed decisions on where to allocate funds. Effective budgeting will not only provide clarity but also help build discipline in spending.

Think about setting up an emergency fund. This should cover three to six months of living expenses and can offer a safety net as you transition into this new phase of life.

Regularly review and adjust your financial plan. Life changes, and your financial strategy should be flexible to adapt to your evolving circumstances, including career changes or other personal developments.

Smart Investment Strategies for the Future

Investing wisely is key to rebuilding wealth. Start by educating yourself about investment options and products that align with your risk tolerance. Stocks, bonds, real estate, and mutual funds all have different risk factors and potential returns.

Diversifying your investments can help mitigate risks. For instance, a balanced portfolio that includes a mix of equities and fixed income securities can be less vulnerable to market volatility while optimizing growth potential over time.

Real estate may also be a prudent option for long-term investment. With appropriate research and guidance, you can identify properties that not only serve as a home but as a valuable asset that appreciates over time.

Don’t overlook retirement accounts. Contributing to a 401(k) or an IRA is a vital way to secure your future, and many employers offer matching contributions which can significantly enhance your overall savings.

Navigating Tax Implications After Divorce

Tax consequences post-divorce are often overlooked yet can dramatically influence your financial position. It's imperative to understand the tax implications of alimony, child support, and the division of assets. For instance, alimony payments may be taxable for the recipient and tax-deductible for the payer, which can affect your financial planning.

When it comes to dividing assets, remember that not all assets are taxed equally. For instance, withdrawing from retirement accounts often incurs taxes. A financial advisor can provide clarity on minimizing your tax burden over time.

Insurance and Estate Planning Considerations

Updating insurance policies and estate plans is essential after divorce. Ensure that your beneficiaries reflect your current situation, as failing to do so can lead to unintended distributions of your assets. Life insurance may also play a significant role in protecting your loved ones.

Consider creating or revising a will as well. This document should outline your wishes regarding the distribution of assets and the care of dependents. An estate planner can help you navigate this process effectively, ensuring all legal aspects are properly addressed.

Seeking Professional Guidance

Rebuilding wealth after a divorce can be complex, thus engaging with professionals such as financial advisors, divorce lawyers, and tax consultants is often beneficial. They provide insights tailored to your financial landscape and can help devise a strategy to regain control over your financial future.

Regularly attending financial workshops or support groups specific to those navigating life after divorce can also be refreshing. You’ll gain valuable perspectives, find mutual support, and share strategies with others in similar situations, which can be incredibly motivating.