Pre Divorce Tips for a Smooth Transition

Understanding Your Financial Goals

Defining your financial goals is the cornerstone of any successful financial plan. Whether it's saving for a down payment on a house, funding your children's education, or ensuring a comfortable retirement, clearly outlining these objectives is crucial. This involves not only identifying the specific goals, but also quantifying them with specific amounts and timelines. For instance, instead of simply stating save for retirement, you should specify save $1 million by age 65. This level of detail provides a roadmap for your financial journey.

Considering your current financial situation is vital. Review your income, expenses, assets, and debts. This self-assessment allows you to understand your starting point and identify areas where you can improve your financial health. Recognizing your current position provides a realistic evaluation of your ability to achieve your future goals.

Assessing Your Current Financial Situation

A comprehensive review of your current financial health is a crucial step in any financial planning strategy. This includes evaluating your income streams, analyzing your spending habits, and assessing your current assets and liabilities. Thorough analysis of your income and expenses is key to identifying areas where you can reduce debt and increase savings.

Identifying your assets, such as savings accounts, investments, and property, is also important. Equally significant is the evaluation of your liabilities, including outstanding debts like mortgages, loans, and credit card balances. A clear understanding of your current financial standing is essential for creating a plan that aligns with your specific circumstances.

Creating a Budget and Tracking Expenses

A budget is a crucial tool for managing your finances effectively. It helps you allocate your income across various spending categories, enabling you to track your progress towards your financial goals. This detailed overview of your income and expenses allows you to identify areas where you might be overspending and adjust your habits accordingly. Careful tracking of expenses helps you identify patterns and understand where your money is going.

Creating a budget is not just about restricting spending; it's about understanding where your money goes. By meticulously tracking your expenses, you can pinpoint areas where you can cut back, save more, and ultimately, achieve your financial objectives faster. This detailed record-keeping is an essential part of a successful financial plan.

Developing a Savings Plan

Saving money is a cornerstone of financial security. Establishing a savings plan allows you to build an emergency fund, accumulate capital for future purchases, and invest for long-term growth. A well-defined savings plan is essential for achieving your financial goals and maintaining financial stability.

Determining the appropriate savings rate depends on your individual circumstances and goals. Consider factors like your income, expenses, and desired savings level. Setting realistic savings goals helps you stay motivated and on track to reach your financial aspirations.

Investing for the Future

Investing your savings is essential for long-term financial growth. Different investment strategies cater to varying risk tolerances and financial goals. Understanding various investment options, including stocks, bonds, and mutual funds, is critical for making informed decisions. Diversifying your investments across different asset classes is a key component of a sound investment strategy.

Consider consulting with a financial advisor to determine the most suitable investment strategy for your specific needs and risk tolerance. Properly managing your investments can lead to substantial returns over time, helping you achieve your future financial objectives.

Managing Debt and Credit

Effective debt management is crucial for maintaining financial stability. Strategies for reducing high-interest debt, such as credit card debt, can significantly improve your financial health. Understanding and managing your credit score is also vital for securing favorable loan terms and financial opportunities.

Creating a debt repayment plan, prioritizing high-interest debts, and exploring debt consolidation options are essential steps in managing your debt effectively. By implementing these strategies, you can reduce the burden of debt and improve your overall financial standing.

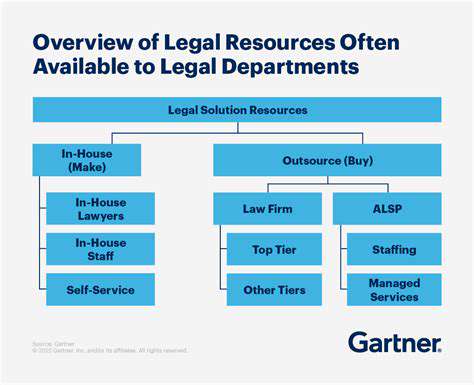

Legal Considerations and Preparation

Pre-emptive Measures

Understanding the potential legal ramifications of your actions is crucial, especially when dealing with sensitive data or transactions. Proactive legal review and consultation can significantly mitigate potential risks and ensure compliance with relevant regulations. This includes anticipating potential legal challenges and developing strategies to address them before they arise. Thorough documentation of all procedures and decisions is essential for future reference and to provide a clear audit trail should any issues arise later. This also involves establishing clear lines of communication and responsibility for handling potential legal disputes.

Furthermore, a comprehensive risk assessment is vital. Identifying potential legal pitfalls associated with specific projects or transactions is essential for implementing appropriate preventive measures. This proactive approach can help avoid costly legal battles and reputational damage. Regular legal training for personnel involved in sensitive operations can increase awareness of legal best practices and ensure compliance is prioritized.

Contractual Obligations

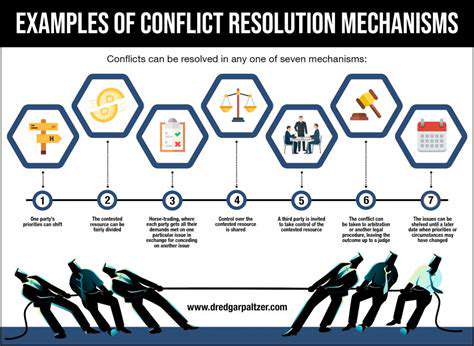

Contracts form the bedrock of many business relationships. Careful review and negotiation of contract terms is essential to ensure that all parties' interests are protected and that potential liabilities are clearly defined. Understanding the language and implications of each clause is critical to avoiding unforeseen complications or disputes down the line. This includes scrutinizing the scope of work, payment terms, termination clauses, and dispute resolution mechanisms.

Clearly defined contractual obligations can prevent misunderstandings and disagreements, fostering a more collaborative and productive working environment. Furthermore, having a robust understanding of the contract's terms will help to ensure compliance with applicable laws and regulations. This due diligence can protect both the company and its clients from potential legal issues.

Data Protection and Privacy

In today's digital age, data protection and privacy are paramount. Organizations must implement robust systems and procedures to safeguard sensitive personal information and comply with relevant data protection laws, such as GDPR or CCPA. This includes establishing secure data storage methods, implementing access controls, and developing clear data handling policies. Adherence to these principles is not only legally required but also essential for maintaining public trust and avoiding costly penalties.

Comprehensive data breach protocols are essential to mitigate the damage if a security incident occurs. This involves having a clear plan to respond to a breach, including notification procedures, investigation protocols, and measures to prevent future incidents. This demonstrates a commitment to responsible data handling and can help to limit legal repercussions.

Far from being a frivolous indulgence, self-care forms the bedrock of lasting wellness. When we consciously integrate self-care rituals into our lives, we rebuild our inner reserves and face obstacles with renewed clarity and determination. This intentional approach to nurturing our whole selves - body, mind, and spirit - serves as our best defense against exhaustion while cultivating a brighter life perspective. It's about honoring our personal requirements rather than neglecting them in life's daily shuffle.

Read more about Pre Divorce Tips for a Smooth Transition

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases