effective divorce asset division advice

Understanding Different Asset Types and Division Strategies

Understanding Liquid Assets

Liquid assets are those that can be readily converted into cash with minimal loss of value. These are crucial in a divorce settlement as they provide immediate resources for both parties. Examples include bank accounts, savings accounts, money market accounts, and readily-marketable securities such as stocks and bonds. Proper identification and valuation of these assets are essential for equitable distribution.

Accurate records and documentation of liquid assets are critical. This includes account statements, investment records, and any other supporting documentation. This meticulous process ensures transparency and avoids disputes during the division process.

Real Estate Division

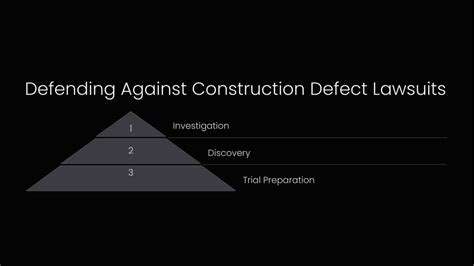

Real estate, often the most significant asset, requires careful consideration during a divorce. Determining the fair market value and the appropriate method of division is paramount. This could involve selling the property and dividing the proceeds, or one party retaining ownership with a corresponding financial settlement to the other. Navigating the complexities of real estate division often necessitates professional appraisals and legal counsel.

Considering factors like mortgage obligations, property taxes, and maintenance costs is essential to arrive at a fair and equitable solution. This process can be complex and requires careful attention to detail.

Personal Property Valuation

Personal property, encompassing items like furniture, vehicles, jewelry, and collectibles, needs to be meticulously valued. Determining the fair market value of these items is often subjective and may require expert appraisals, especially for high-value items. Disputes frequently arise over the valuation of personal property, making a detailed inventory and clear documentation crucial.

Business Interests and Valuation

If one or both parties are involved in a business, a thorough valuation of the business interest is essential. The value of a business can be complex and may involve professional business appraisers. This often involves considering factors such as the business's profitability, assets, liabilities, and market value. This can be a particularly complex area requiring expert legal and financial guidance.

Retirement Accounts and Pension Plans

Retirement accounts and pension plans often represent a significant portion of a couple's assets. Understanding the rules and regulations surrounding these accounts is crucial for a fair division. Spousal support, division of retirement benefits, and the potential tax implications of these divisions need careful consideration. This aspect of the divorce often requires consultation with financial advisors and legal professionals.

Intellectual Property and Goodwill

Intellectual property, such as patents, copyrights, and trademarks, presents unique challenges in a divorce. Determining the value of these assets often requires expert legal counsel. The division of goodwill, especially in the context of a business, also needs careful consideration. The value and division of intellectual property requires significant legal expertise and a detailed understanding of the relevant laws and regulations.

Debts and Liabilities

Dividing assets is not the only consideration; debts and liabilities also need equitable distribution. This includes credit card debt, mortgages, and other outstanding financial obligations. Identifying all debts and liabilities is crucial for a fair and comprehensive settlement. Understanding how these debts will be divided is as important as understanding the division of assets.

Protecting Your Interests Through Legal Representation

Protecting Your Financial Well-being

Financial security is a cornerstone of a comfortable and fulfilling life. Understanding and proactively managing your finances is crucial for achieving your goals, whether it's saving for retirement, purchasing a home, or simply ensuring you can cover your everyday expenses. Taking control of your finances empowers you to make informed decisions and build a strong foundation for the future.

A well-defined financial plan acts as a roadmap, guiding you towards your objectives and helping you navigate potential challenges. Creating a budget, tracking your income and expenses, and establishing savings goals are essential steps in this process. These foundational steps allow you to understand where your money is going and make necessary adjustments to align your spending with your priorities.

Ensuring Legal Protection

Legal protection is paramount to safeguarding your interests and ensuring peace of mind. This encompasses a broad spectrum of considerations, from protecting your personal information to ensuring your rights are upheld in legal proceedings. Diligence in understanding your rights and responsibilities is vital for navigating the complexities of the legal landscape.

Understanding and adhering to relevant laws and regulations is key to avoiding potential legal pitfalls. Thorough research and seeking professional advice when needed can prevent costly mistakes and protect your interests. This proactive approach can save you time, money, and stress in the long run.

Safeguarding Your Assets

Protecting your assets is crucial for maintaining financial stability and ensuring a secure future. This encompasses a range of strategies, from diversifying your investments to implementing robust security measures to safeguard your property. Proper asset protection strategies can safeguard your hard-earned wealth and provide a safety net during challenging times.

A well-structured asset protection plan is designed to mitigate risks and safeguard your investments. Strategies like establishing trusts or utilizing insurance policies can provide a layered defense against unforeseen circumstances. Implementing these measures can offer peace of mind and provide greater security for your financial future.

Maintaining Your Health and Well-being

Prioritizing your health and well-being is an integral part of protecting your interests. A healthy body and mind are essential for achieving your goals and maintaining a fulfilling life. Engaging in regular physical activity, maintaining a balanced diet, and practicing stress-reduction techniques can significantly impact your overall well-being.

Taking proactive steps to maintain physical and mental health directly contributes to your ability to pursue your interests and goals. Seeking professional guidance from healthcare providers, when necessary, is crucial for addressing any concerns or potential health issues. Prioritizing your health is a fundamental aspect of protecting your interests.

Read more about effective divorce asset division advice

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases