expert divorce legal consultation guide

Understanding Your Current Financial Health

Every solid financial journey begins with an honest look at where you stand today. Take stock of all money coming in—not just your paycheck but also side gigs, rental income, or dividends. Then, track every dollar going out, from mortgage payments to that daily coffee habit. This financial mirror won't lie—it shows exactly where your money habits need improvement. You'll spot leaks in your budget you never noticed and find surprising opportunities to save.

But numbers only tell part of the story. What debts keep you up at night? Which savings accounts gather dust? Are there loans hanging over your head? Facing these financial realities head-on transforms them from obstacles into stepping stones. This stage isn't about judgment—it's about empowerment through awareness.

Identifying Your Financial Goals

Picture your ideal financial future in vivid detail. Maybe it's being debt-free by next summer or sending your kids to college without loans. Perhaps it's retiring early to travel the world. These dreams become your financial North Star, guiding every money decision you make. The clearer your vision, the more motivated you'll stay when temptation strikes.

Think beyond generic goals like save more. Imagine exactly what you want your life to look like in five years. That mental image will help you say no to impulse buys and yes to smart investments. Your future self will thank you for today's disciplined choices.

Evaluating Your Risk Tolerance

Investing isn't one-size-fits-all. Some people thrive on the adrenaline of volatile markets, while others lose sleep over minor fluctuations. Knowing where you fall on this spectrum prevents costly emotional decisions when markets dip. There's no right answer—only what lets you sleep peacefully at night while growing your wealth.

As life changes, so might your comfort with risk. The single 30-year-old might embrace aggressive growth funds, while new parents often shift toward stability. Regular check-ins ensure your investments always match your current life chapter.

Analyzing Your Resources and Constraints

Take a clear-eyed look at your financial toolbox—what assets can you leverage? What limitations must you work around? This isn't about lack but about making the most of what you have. Maybe that means delaying gratification now for greater rewards later or finding creative ways to grow your nest egg despite current constraints.

External factors—from economic downturns to unexpected medical bills—will test even the best-laid plans. Building flexibility into your strategy turns potential crises into manageable bumps in the road. The most successful financial plans aren't rigid—they're resilient.

Defining Your Goals and Expectations: What You Want to Achieve

Understanding Your Desired Outcomes

When navigating major life transitions like divorce proceedings, clarity about your non-negotiables is crucial. Beyond legal jargon, focus on the life you're building afterward. Is preserving the family home essential? Does maintaining your children's routine outweigh other considerations? These priorities will shape every negotiation.

Balance idealism with practicality—the perfect outcome rarely exists. Maybe you accept slightly less alimony to keep cherished assets, or compromise on visitation to ensure long-term stability. The art lies in knowing which concessions serve your bigger picture.

Evaluating Your Resources and Limitations

Divorce drains more than bank accounts—it taxes emotional reserves too. Take stock of your support systems before decisions must be made under stress. Who can provide childcare during meetings? Which friend offers clear-headed advice? Recognizing your limits prevents burnout when you need clarity most.

Financial realities often dictate strategy. That dream litigation might deplete college funds, while mediation could preserve resources for fresh starts. Sometimes the bravest choice is pragmatic compromise.

Setting Realistic Expectations for the Legal Process

The courtroom isn't Hollywood—resolution takes months, not montages. Paperwork multiplies, dates get postponed, and emotions run high. Mentally preparing for this marathon prevents frustration when progress feels slow.

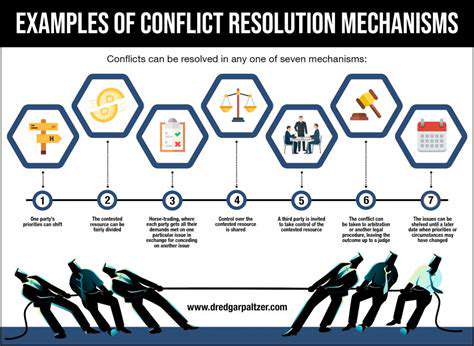

View negotiations as collaborative problem-solving, not battles to win. The healthiest resolutions often leave both parties slightly dissatisfied—a sign of fair compromise. Flexibility becomes your greatest asset when unexpected twists arise.

Whether designing study routines or tailoring learning plans, success starts with self-awareness. Night owls forcing dawn study sessions sabotage their own efforts, while morning people wasting peak hours struggle unnecessarily. Work with your natural rhythms, not against them, and watch productivity soar.

Read more about expert divorce legal consultation guide

Hot Recommendations

- divorce asset division legal checklist

- how to overcome breakup shock step by step

- divorce self growth strategies for single parents

- how to overcome divorce trauma quickly

- emotional recovery tips for breakup survivors

- divorce breakup coping strategies for adults

- how to find effective divorce counseling online

- divorce custody battle resolution strategies

- how to find affordable breakup counseling services

- best co parenting solutions for divorce cases